US election 2024: Dollar down as investors exit “Trump trade” positions

Recent polls have hit the stock market in the US as traders rethink their predictions of a Donald Trump victory.

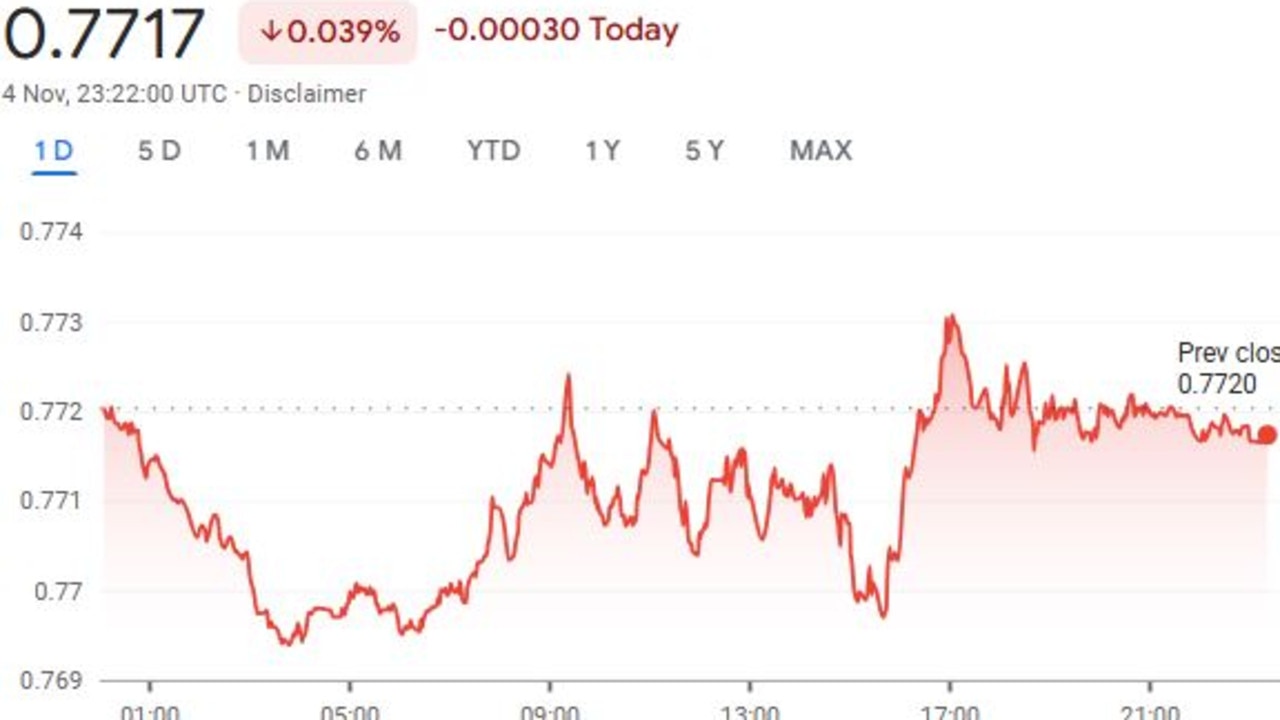

The US dollar dropped to its lowest point in weeks overnight as a ‘Trump trade’ that had driven higher values cooled on the last day before the country’s election.

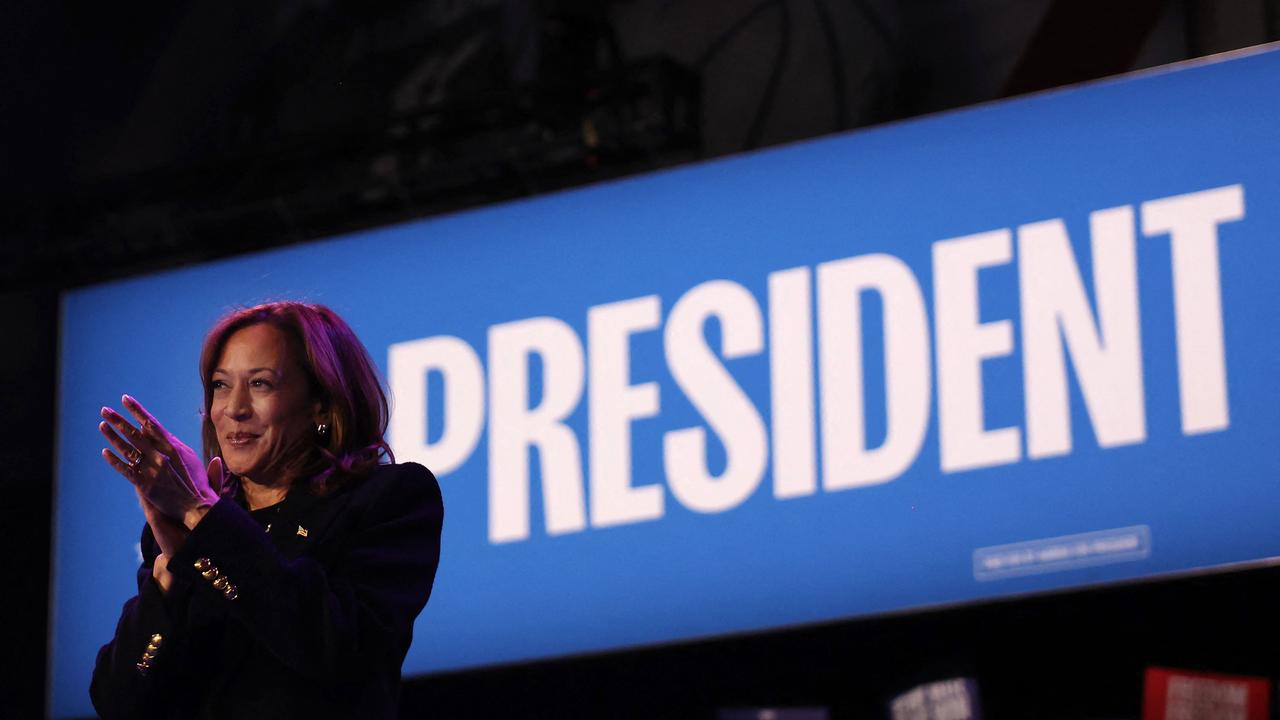

It followed a poll showing Democrat nominee Vice President Kamala Harris ahead in the Midwest state of Iowa – an unexpected result which has analysts rethinking their predictions.

Wall St traders had been betting on a Donald Trump victory raising the price of the dollar, with some of his key policie – such as tariffs and tax cuts – expected by those in the finance world to drive up inflation.

“We think that Trump’s emphasis on a lower tax economy could lead to higher disposable incomes and greater consumer spending in the near-term,” Matthew Ryan of foreign exchange company Ebury told The Guardian.

“On balance, we think that a Trump election win would be bullish for the US dollar.”

The bullish outlook on the green back has been based on a trend of changing governments boosting values, which happened in both 2016 and 2020.

A win for Ms Harris, who is a prominent part of President Joe Biden’s administration, is seen as less likely to dramatically change market conditions.

“A Trump victory is likely to lead to a rather stronger dollar and higher government bond yields because his plans to raise tariffs sharply would boost inflation and reduce the willingness of the Fed to reduce rates,” Iboss chief economist Rupert Thompson said.

The 0.6 per cent fall in early trading on Monday, US time, also coincided with the Federal Reserve in America being poised to cut interest rates on November 7.

Kenneth Broux, head of corporate research FX and rates at Societe Generale, told Reuters some traders had been cashing in after seeing the recent polls.

“The polls suggesting that Harris may have her nose in front in couple of swing states is causing a bit of profit-taking in the Trump trade,” he said.

“Markets are very stretched … into the vote tomorrow so it’s only natural we are adjusting some of that positioning.”

The Pound rose 0.4 per cent against the USD while the Euro rose an even greater 0.7 per cent on Monday, local time.

USD started slightly up on the Australian dollar when trading began at 10am on Tuesday.

A spokesperson for Australian trading platform CommSec said: “The US dollar (USD) slipped on Monday as investors exited from positions that have benefited from speculation Republican former President Donald Trump is more likely to win the presidential election on Tuesday.”

More Coverage

CommSec analyst Tom Piotrowski said it appeared the “Trump trade ascension” had been hit by a more pensive outlook so close to election day.

“What we have seen in the last 24 hours is something of an unwinding of the Trump trade.” he said.

“I suppose you could say the conviction for that trade waned a little bit as far as the most recent session is concerned.”