Australian shares hit three-month low as Federal Reserve cautions on interest rate cuts

Australia’s major banks have emerged the losers in more drama today, with Commonwealth Bank leading the charge with an almighty tumble.

Commonwealth Bank has clearly been on Santa’s naughty list — as the nation’s biggest bank was hammered on the Aussie stock market on Friday.

It was the second straight day of major losses on the ASX — with a combined total of $42 billion wiped off its value on one of the last trading days before Christmas.

CBA copped it hard, losing whopping 3.6 per cent, as global markets deal with a wave of uncertainty.

Global uncertainty triggered by US move

It all appears to have been trigged by a call from the US Federal Reserve which appears to have concerns about Donald Trump’s imminent return to the White House and his policy proposals.

Fed chair Jerome Powell acknowledged on Wednesday that Mr Trump’s economic platform, which includes the threat of major tariff hikes, the extension of tax cuts, and mass deportation, had been a consideration when members of the rate-setting committee met to consider the number of interest rate cuts they expect next year.

“Some did identify policy uncertainty as one of the reasons for their writing down more uncertainty around inflation,” Mr Powell said after the Fed announced it was cutting rates by a quarter point and signalled just two cuts in 2025 — a call which sent shockwaves around global markets on Thursday. Australian stocks for example lost $50 billion.

“We don’t know what’ll be tariffed from what countries, for how long, and what size,” Mr Powell said. “We don’t know whether there will be retaliatory tariffs, we don’t know what the transmission of any of that will be into consumer prices.”

Previously, Mr Powell had refused to comment on how the Fed was thinking about the potential impact of the next administration’s economic policies.

Mr Trump has continued to insist that, “properly used,” tariffs would be positive for the US economy.

“Our country right now loses to everybody,” he told reporters at his Florida residence earlier this week. “Tariffs will make our country rich.”

Given the uncertainty over Mr Trump’s plans, the decision by many policymakers to pencil so few cuts may have been a signal that they are willing to keep rates higher if the new administration puts forward policies that are inflationary, Steve Englander, head of G10 FX Research at Standard Chartered bank, told AFP.

“There are reasons not to be that pessimistic, and yet they chose to be that pessimistic,” he said. “So it’s hard to sort of avoid the signal that maybe they wanted to send a message.”

The US central bank has a dual mandate from Congress to act independently to tackle inflation and unemployment. But it must still consider how the economy could be affected by government policies.

Australia cops huge hit

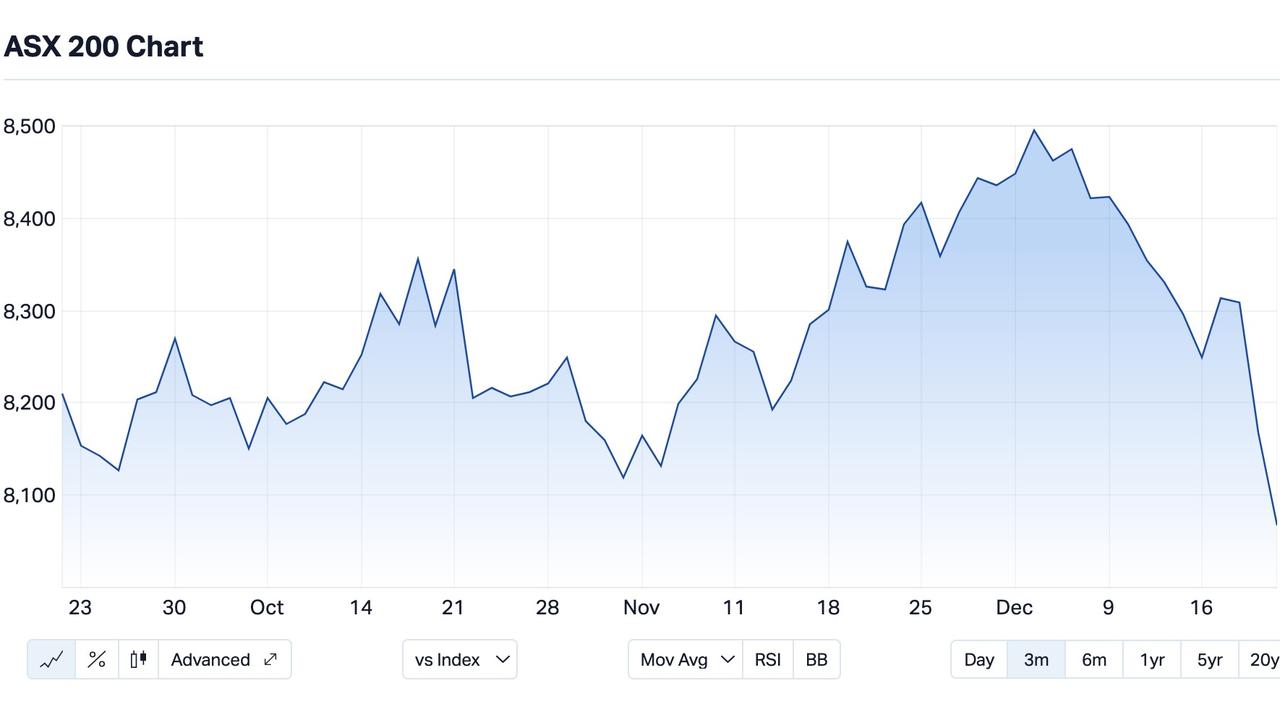

All this has resulted in Australian shares sliding to a three-month low on Friday, with traders continuing to react to the Federal Reserve’s decision to reduce its projections for interest rate cuts in 2025.

The ASX closed the day down 1.29 per cent, settling at 8067.70, marking its lowest level since September.

Over the course of the week, the index shed nearly 3 per cent, driven by a broad sell-off, particularly in banking and consumer discretionary stocks.

The downturn follows the Fed’s revised stance, with its outlook on interest rate cuts in 2025 now reduced from three to two.

Mr Powell also issued a warning about the ongoing risks of reinflation, signalling a more cautious approach moving forward.

The impact was felt across global markets, with New York traders initially reacting with a sell-off, although they staged a recovery overnight on Thursday.

However, in Australia, the prevailing sentiment remained decidedly risk-averse.

The biggest losers on the ASX were the major banks, with Commonwealth Bank leading the charge with a 3.4 per cent tumble.

NAB declined 2 per cent, and Westpac dropped 1.3 per cent. Bellevue Gold was another major drag on the index, tumbling 5 per cent as a lower gold price hit local producers.

In biotech, Mesoblast saw a sharp 21.5 per cent decline after US regulators gave approval to a competitor’s groundbreaking cell therapy, prompting a wave of profit-taking.

Meanwhile, HMC Capital rose 3.2 per cent following a sell-off earlier in the week, sparked by the lacklustre IPO performance of DigiCo, a company in which HMC is a major investor.

Meanwhile, Integral Diagnostics rose one per cent after completing a merger with Capitol Health, and Ventia gained 3 per cent after announcing a five-year deal with Telstra, though Telstra’s shares remained flat.

Wesfarmers fell 3.7 per cent, following the announcement of the sale of its Coregas business for $770 million. De Grey Mining climbed 1.4 per cent on positive news regarding its Hemi Gold project, while Woodside rose 1.3 per cent, despite Citi analysts issuing a sell rating on the stock after the company’s recent asset swap deal with Chevron involving a $34 billion LNG venture.