‘Shocked gasps’ at Donald Trump’s new threat

The US President has warned business and political leaders from every world nation that they will pay dearly for not playing by his rules.

The US President has warned business and political leaders from every world nation that they will pay dearly for not playing by his rules.

Millions of Aussies are confronting a stark budget black hole, with an economic update exposing a serious $217bn breakdown in one state’s finances.

Donald Trump has refused to rule out using the United States military to seize control of the Panama Canal and Greenland.

Experts have warned that the Australian dollar could continue to plummet even further after falling sharply to a near-five-year low.

Greenland’s PM has raised eyebrows with a new push for the island’s future, as President-elect Donald Trump seeks a US takeover.

From ramen noodles to online gambling, Australia’s $225bn Future Fund has some pretty wild investments on its books. Here are our top 10 wildest bets.

The ASX 200 finished the week strongly off the back of surging commodity stocks and an unexpected business partnership

Donald Trump has been warned by a former Aussie Prime Minister that any plans to impose tariffs on Australia could be illegal.

Experts have offered their outlooks for the economy in 2025, and while there’s some good news, there will be continued pain to come for many.

Denmark has made a shift in Greenland after Donald Trump said he wished to obtain the island to strengthen the United States.

A new outlook has forecast the Australian economy is on a “narrow path to a soft landing” and is tipped to improve next year – but there’s a major catch.

The ASX has surged back and broken a days-long losing streak – after better than expected inflationary data out of the US sent markets higher around the world.

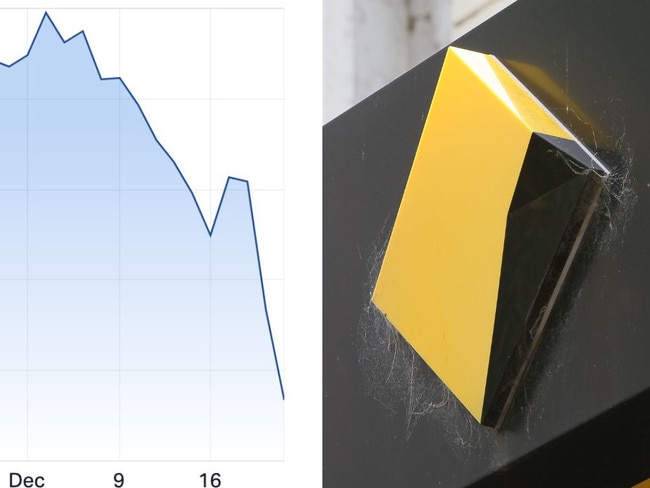

Australia’s major banks have emerged the losers in more drama today, with Commonwealth Bank leading the charge with an almighty tumble.

The ASX has tumbled to a new low after markets continued to sell off, with investors factoring in a less-than-favourable decision in the US.

The incoming US president has said making a country with the world’s 10th biggest economy the next state is a “great idea”.

The ASX 200 traded slightly down ahead of a major decision by the US Federal Reserve, just after the market hit a four-day high.

The incoming president hails massive investment by a Japanese holding company, which is set to create thousands of jobs.

The Reserve Bank has made a major call on the potential impact of Donald Trump’s second presidency on the Australian economy.

A sharp sell-off in banking and tech stocks pushed the Australian sharemarket into the red on Tuesday, even as the heavyweight mining sector soared.

Experts have unveiled a groundbreaking new innovation in China and it could be absolutely devastating for Australia.

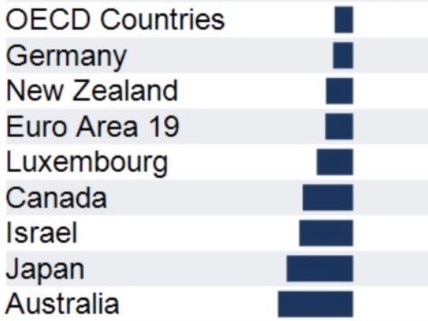

Australians are getting poorer and a leading economist has produced a simple chart that shows why.

It’s been a wild 2024 at the Aussie box office, but cinema operators say a new dawn is rising for the beleaguered movie business.

Australia’s sharemarket cracked a fresh record high on Tuesday, on the back of renewed economic confidence.

Australia’s sharemarket has started the last month of the year with a strong day of trading, as new retail data was surprisingly good.

The world’s richest man and SpaceX CEO has issued a grim forecast for America’s economy.

The Australian sharemarket cracked a fresh record high on Thursday on the back of a surge in the big banks and healthcare stocks.

An iconic actor has made a brutal call on a government that is facing a massive rebellion just months after a landslide victory.

Donald Trump has revealed huge tariffs for three nations and it has had an immediate effect on Australia.

Australia’s grim economic outlook has been revealed, with the federal budget tipped to have its sharpest retraction since covid.

Australia could be on the verge of becoming a “loser” if a trade war was to break out between America and China following the election of Donald Trump.

Original URL: https://www.news.com.au/finance/economy/world-economy/page/5