Vinyl Group CEO Josh Simons’s bid to dominate music industry, reach 1 billion fans

Australia’s only ASX-listed music company holds plenty of ambition, taking on every element of the lucrative industry in a bid to reach 1 billion fans.

Vinyl Group CEO Josh Simons holds vast ambitions for his growing ASX-listed music-technology company.

He wants to connect a thousand of the leading brands in the world with 100 million creators and a billion fans in a mutually reinforcing creator and fan ecosystem.

“Everything we’re doing is about trying to either increase the chances of someone making it or giving them wider exposure,” Mr Simons told NewsWire in a wide-ranging interview this week.

He started off in music like thousands of other song-obsessed youngsters across the country, scuffling to tour and record albums while working odd jobs to pay the bills.

“I was that young Aussie musician who was cleaning toilets and mowing lawns to pay for studio time to make an album, to then promote on the road,” he said.

“How tough that experience was is exactly why I made Vampr because I didn’t like you had to be in these big populous cities that cost so much money to live in and you can barely pay your rent and then somehow you’re pulling together money on top of that to pay for your career.

“I thought a way you could simplify that or make it easier to afford is by speeding up the networking process because a lot of the early years of trying to break into the industry are spent just hoping you’ll meet the right people.

“And that’s the job of technology … speeding up something that used to be slower.”

Vampr, a social networking app for musicians, forms one part of a growing stable of assets within Vinyl Group, which currently boasts a market capitalisation of some $150m.

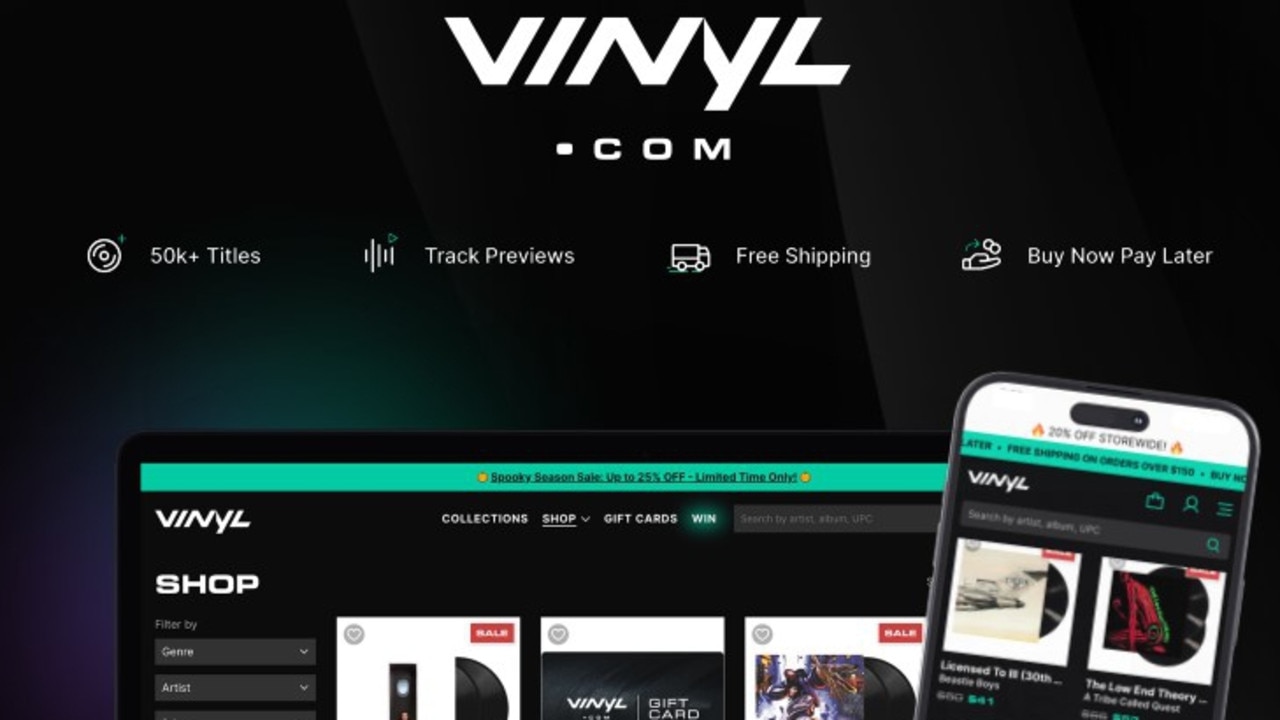

After a concentrated sweep of acquisitions, the company now holds a media division, consisting of youth publisher Brag Media, Funkified and trade publication Mediaweek, eCommerce platform vinyl.com and tech platforms Vampr and Jaxsta, which is a music directory database, similar to IMDB for film and TV.

It also owns Serenade, which makes physical and digital collectibles and merges them together.

“The plan post integration is to sell additional items on checkout,” Mr Simons said about Serenade.

“Say you buy a Taylor Swift album through vinyl.com, and we have an exclusive Taylor Swift collectable that we have been able to design with her team, obviously this is all hypothetical, we would want to sell that on checkout or offer it as a stand-alone product.”

And this week, the company announced an agreement with US-based business-to-business music licensing platform Songtradr to manage and sell advertising across Songtradr’s portfolio of digital properties.

“In a nutshell, what we really exist to do is enhance the fan and creator experience,” Mr Simons said.

“If you don’t have a robust fan ecosystem, and you don’t have a robust creator ecosystem, you actually don’t have a music industry.

In one example of Vampr’s networking power, emerging Aussie indie duo ALIBII connected with ARIA award-winning producer Adrian Breakspear through the app.

ALIBII pair Courtney Egginton and Will Cumberlege uploaded their “demos” to Vampr and Mr Breakspear soon reached out.

“I made an account on Vampr to try and make some connections that could help promote and market a single that we were willing to release, as I had no clue what was involved at the time,” ALIBII told The Music Network in June.

“A few weeks went by and Adrian reached out. We had a Zoom call about the track and he ended up mixing it and helped us promote and release the single correctly.”

A majority of Vinyl Group’s assets derive most of their revenue from the US and the company holds extensive international ambitions.

On Wednesday it announced a move into the UK market for vinyl.com.

“We have American roots in many respects and the UK was always the next biggest market,” Mr Simons said.

The company, which counts WiseTech billionaire Richard White as a major shareholder, will look to enter Europe next.

Vinyl Group’s revenues for the 2024 financial year hit $4.95m, a dramatic lift from the $582,208 it booked in FY23, with most of the money coming from its newly-acquired media assets.

But net losses reached $16.9m, with an operating loss of $6.6m.

The company’s annual report, published on October 1, warns “there is a material uncertainty as to whether the Group can continue as a going concern” given the net loss for the year, net operating cash outflows and the deficiency in working capital as at 30 June 2024.

But the company’s directors have emphasised a set of events they believe will keep Vinyl Group trading, including the acquisition of Mediaweek, the purchase of Funkified and Serenade, the continued evolution of vinyl.com to expand its product offering and geographical reach, the continued integration of the firm’s different platforms and the media business and a possible capital or debt raise to meet cash liquidity requirements if needed.

“The directors believe that the (company) is a going concern and that the above events will eventuate in the short term and accordingly the financial statements have been prepared on a going concern basis,” the report states.

“In the event that the above assumptions do not eventuate, there are material uncertainties that cast significant doubt over the ability of the Group to continue as a going concern.”

The company targets to be cash flow positive in the first half of FY26 and Mr Simons said the company was on track to meet the goal.

“We provided conservative guidance in that area,” he said.

“The statements in the annual report are pretty generic statements that any auditor is going to put into a company that is posting a loss.

“A big part of that loss is attributable to the valuation of convertible notes which we hope to wipe off the balance sheet this financial year.

“And as a result of wiping that note off, there will be some options that are vested, then those options should fund the company to such a time we do hit that (cash flow positive) goal.”

The company pursued the publishing assets to help prop up and extend its larger tech ambitions, Mr Simons said.

“The media arm of the company is definitely the current profit engine and it is paying for the growing tech side,” Mr Simons said.

“The tech side is growing faster, but it also has a higher fixed cost base. As we try and outgrow that fixed cost base, we expect that pendulum to swing the other way.”

For the next six to 12 months, he said the company would “button down” and make sense of how its assets tie together.

“I get to work in an industry that has given me everything I’ve ever had,” Mr Simons said when asked what he loved most about working with Vinyl Group.

“I love it”.