Anglo American rejects BHP takeover bid

Anglo American has sent BHP back to the drawing board over its ‘opportunistic’ lowball offer for the mining giant.

Anglo American has sent BHP back to the drawing board over its ‘opportunistic’ lowball offer for the mining giant.

Australia’s largest mining company is swooping in on a rival coal and copper giant in a transformative $60bn takeover bid.

The local sharemarket closed down 1.4 per cent on Friday. Anglo American rejected BHP’s takeover bid. Scott Farquhar stepping down as Atlassian co-CEO. Super Retail Group faces $30m-$50m workplace claim.

Albanese government has shown itself willing to interfere in markets.

There’s no doubt BHP’s move on Anglo American is focused on long-term copper demand, but it would be a mistake to think there’s nothing else of value in Anglo’s portfolio.

BHP’s surprise bid for global mining giant Anglo American will evoke memories of its bold move 23 years ago to merge with another London-based mining major.

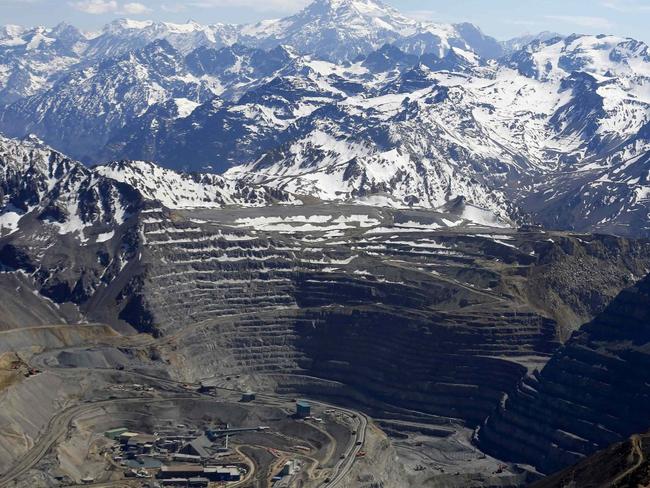

BHP’s takeover bid for Anglo American, which could be the biggest global resources deal this year, may bring some prized assets into its fold.

Big firms like BHP often share their investment banking work around the market. This time, UBS and Barclays got lucky.

BHP would be getting a copper portfolio worth $US25.4bn and a South American iron ore operation worth $US8.4bn if it buys Anglo American.

This is one of the biggest deals in the mining sector that Wall Street has seen for years, and it’s only going to lead to more big resource transactions, experts say.

In making the high-risk $60bn mega-deal, BHP’s boss Mike Henry needs to prove the miner is not slipping back to its destructive old habits.

Whitehaven Coal has ditched its autonomous truck trial at Maules Creek mine in NSW, but says the innovation will continue elsewhere as it faces the pinch from rising wages.

The nickel price has recovered, but it still may not save 3000 jobs as BHP sets a date to decide the future of its struggling WA division.

For stocks and bonds, 2024 is in some ways shaping up like 2023, which begs the question: has the market stopped listening to Fed chair Jerome Powell?

Collins St Asset Management says a valuation gap with gold miners is set to close rapidly, potentially within months. Also today: EY prepares to announce layoffs. RBNZ holds rates. Dubber sacks CEO.

Company bosses should not be distracted by woke social agendas.

ASX 200 falls 1.6 per cent this week. Iron ore futures fall. GQG rises as funds soar. APM extends trading halt ahead of new bid. Magellan’s outflows up. Oil above $US90 as geopolitical tensions rise.

Australia’s Anti-Dumping Commission has accused Chinese steelmakers of dumping rail wheels, defying protests from China and mining giants BHP and Rio Tinto as the agency asserts its independence.

Beach Energy flags post-Easter reset with most of the current leadership team leaving. Excluding Swift effect, underlying February retail sales flat. Ramelius ends takeover talks, shares rise.

Mike Henry has defended the pace of China’s timelines for cutting steel emissions, saying the country should be viewed differently to Europe.

Original URL: https://www.theaustralian.com.au/topics/bhp-group-limited/page/10