BHP mulls WA nickel’s long-term future if mothballed

Nickel West faces an uncertain future as mining giant BHP says a dismal market may persist for years to come.

Nickel West faces an uncertain future as mining giant BHP says a dismal market may persist for years to come.

Nickel has become the thorn in BHP’s side, but the company’s ever-reliable iron ore division has again delivered a bumper profit.

Jayne Hrdlicka leaving Virgin before IPO. RBA considered Feb rate hike. Suncorp up after ANZ deal green light. Sims, KMD, Baby Bunting drop. Bravura soars. ARB, HMC gain.

Far from creating jobs, we’re facing the loss of our nickel industry with the announcement that BHP may mothball its entire Nickel West operations.

The $7bn listed coal miner Whitehaven Coal is believed to be on the cusp of a deal to sell down part of its Blackwater coal mine.

The local sharemarket will take cues from corporate results, with big names including BHP, Rio Tinto, Qantas and Woolworths highlighting a busy week in reporting season.

The road hasn’t necessarily ended for Australian nickel and one good discovery by a junior explorer could still change everything, says industry veteran Chris Cairns.

Resources Minister Madeleine King will ramp up talks to establish a new premium market for ‘cleaner’ nickel to try and save the local industry.

WA premier Roger Cook has flagged the state could provide royalty relief in an effort to keep the remaining nickel mines in production.

High costs, then heavy losses and now mothballing. It’s all just delaying the mining giant’s inevitable exit from the heavy metal.

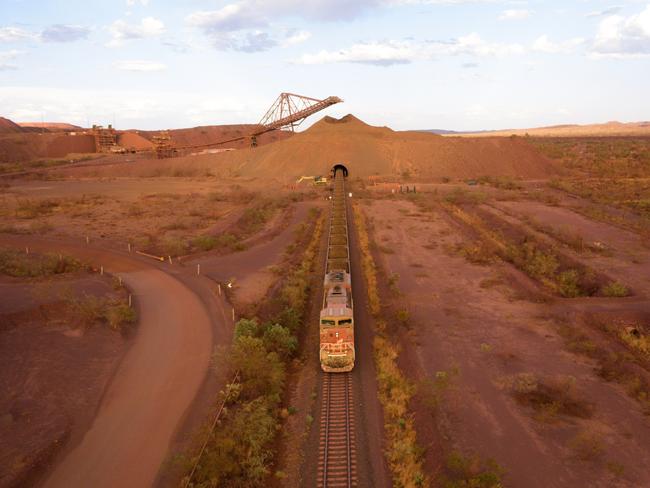

The annual salary of the iron ore drivers will jump from $240,000 to $292,000 over the life of the four year agreement.

BHP’s ‘future-facing’ ambitions have now been shredded, and dumped into the dustbin of history, thanks to brutal contemporary reality.

The mining major says a steep first term slide in profit does not undermine its long-term faith in its $6.4bn deal to buy two giant Queensland mines from BHP.

About 3000 jobs are at risk as the mining giant signals it is considering mothballing the entire West Australian nickel division due to a flood of cheap nickel from Indonesia.

Share market rebounds in line with Wall Street’s recovery. Slowing labour market “not bad enough” to justify rate cut. BHP’s nickel woes, Telstra’s tighter earnings weigh. Altium rockets on $9bn takeover. CBA fined

Big banks and miners weigh on bourse. CBA shares fall on ‘vanilla’ result, lack of guidance. AMP up despite profit fall, chair exit. Seven ups guidance on Boral boost. Fletcher CEO and chair to leave.

Train drivers at BHP’s iron ore division in Western Australia are threatening the sector’s first 24-hour strike in the Pilbara for 15 years.

BHP will look to cut costs at its West Australian nickel business as an ongoing crisis threatens the future of a raft of major mines in the state.

BlueScope has joined Rio and BHP to consider establishing a test electric smelter furnace plant, so what does that mean for Australia’s technological leadership?

Australia’s two largest iron ore producers and our biggest steelmaker have joined forces in a bid to cut greenhouse gas emissions by investigating the development of the country’s first ironmaking electric smelting furnace pilot plant.

Original URL: https://www.theaustralian.com.au/topics/bhp-group-limited/page/12