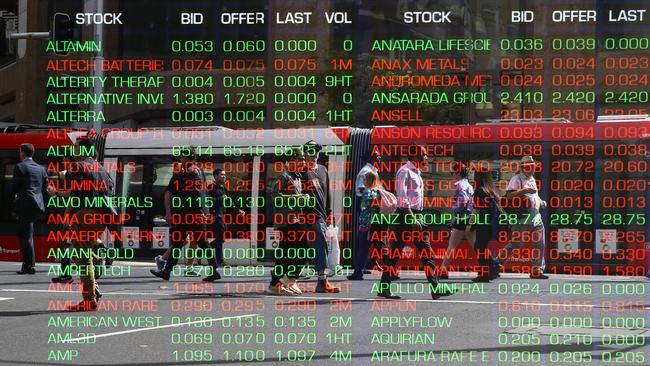

Why 2024 is shaping up like 2023 for stocks and bonds; ASX 200 rebounds

For stocks and bonds, 2024 is in some ways shaping up like 2023, which begs the question: has the market stopped listening to Fed chair Jerome Powell?

Welcome to the Trading Day blog for Thursday, April 18. The ASX 200 index closed 0.5 per cent higher at 7642.10 points, ending a five-day losing streak. For stocks and bonds, 2024 is in some ways shaping up like 2023, which begs the question: has the market stopped listening to Fed chair Jerome Powell?

The Aussie dollar is near US64.51c.

More Coverage

Join the conversation

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout