Exposing banks’ super rip-off

Evidence to the royal commission has again highlighted the scandal of bank fee gouging of super savers.

Evidence to the royal commission has again highlighted the scandal of bank fee gouging of super savers.

Predictions of a royal commission reckoning for the $600bn industry super fund sector appear to have fizzled.

CBA’s Matt Comyn lobbied ASIC to accept a media release rather than impose an enforceable undertaking for super breaches.

Millions flowed out of Catholic fund’s coffers as conflict of interest went unchecked for years.

The leading industry super fund spent $260,000 of its members’ money wining and dining associates at the Australian Open.

For Commonwealth Bank executives, it was the “Hotel California”: the continued flow of lucrative trailing commissions.

Colonial First State committed more than 15,000 criminal offences on super, the royal commission has heard.

Day after day senior executives tell the bank inquiry key issues are outside their responsibility. So let’s bring in the CEOs.

CBA’s wealth management arm has conceded more than 15,000 criminal breaches occurred amid delays in shifting super funds.

Industry super fund Hostplus says it needs to spend members’ money wining and dining bosses so it doesn’t lose contracts.

Bendigo and Adelaide Bank expects benefits to flow from the financial services royal commission.

NAB has been accused of keeping ASIC in the dark about extra compensation for ripped-off super clients.

There is deep value in the stock because the business can be turned around.

The lack of penalties against superannuation trustees who fail to act in clients’ best interests has been described as ‘astounding’.

The clear intention was to blow Andrew Hagger’s credibility apart, and expose the bank’s claims as a sham.

NAB failed to tell ASIC of boost to victims’ compensation for a fee scandal, amid concerns about media reaction, inquiry told.

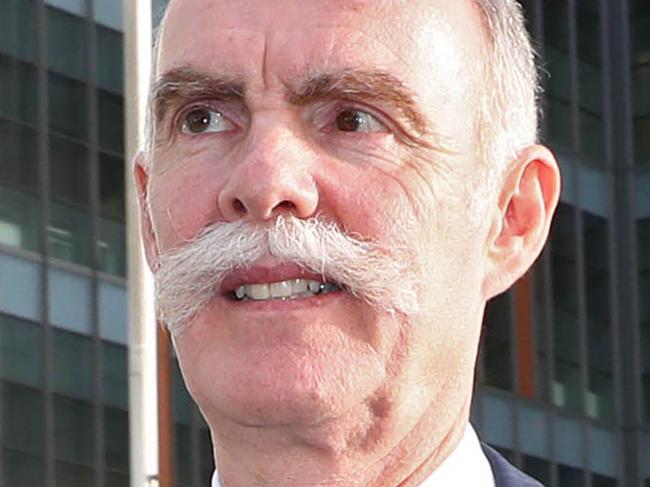

NAB’s Andrew Hagger endured a heavy round of questioning from Michael Hodge QC.

When did Australian businesses and governments start getting it so wrong?

Its CEO dismissed the regulator’s concerns about conflicts of interest at the wealth manager’s super trustee company.

A cascade of revelations has left the lender reeling.

Interests of unions and super members’ interests ‘so aligned as to be indistinguishable’, commission hears.

A fund merger derailed by disputes over union representation cost super holders dearly, the royal commission heard.

Andrew Thorburn’s direct report will be grilled by royal commissioner Kenneth Hayne on Monday.

NAB should realise you can’t look after other people’s money if you’re in the habit of continued “minor” breaches of the law.

IOOF has handed over handwritten notes on scraps of paper after Hayne’s inquiry requests board documents.

Two major hazards could damage the self-managed super fund movement — scam property funds and the Labor Party.

Since the establishment of the inquiry, the Coalition has been waiting to see strips torn off some of the largest industry funds.

AustralianSuper’s chief executive, Ian Silk, finally got his turn in the financial services royal commission hot seat yesterday.

NAB chief executive Andrew Thorburn has strongly rejected allegations the bank might have engaged in criminal behaviour.

NAB has no plans to refund customers it has stung with a so-called ‘adviser contribution fee’.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/14