Banking royal commission live: superannuation hearings 15 August

Millions flowed out of Catholic fund’s coffers as conflict of interest went unchecked for years.

- IOOF issues

- ANZ OnePath’s Victoria Weekes appears

- Conflict of interest

- Catholic Super’s Peter Haysey appears

- Mystery shopper findings

- 30 per cent fee

- Colonial’s Peter Chun appears

- Comyn’s call

- CFS’ dealings on insurance

- Arm’s length negotiations

- Trailing commissions on cash

- Inadequate systems

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is conducting the second week of its fifth round of hearings, focused on superannuation, in Melbourne. Follow the proceedings with us live.

4.59pm: Hearing adjourned

Mr Hodge asks commissioner Hayne if they should call a halt for the day. the commissioner concurs and the session concludes for the day.

Thanks for following along with us today. You can jump back to some of the days hightlights using the links on the left of the page.

We’ll be back following the royal commission live tomorrow morning from 9.30am. Join us then.

4.39pm: ANZ’s Mark Pankhurst appears

The last witness of the day, Mark Pankhurst, takes the stand. He is the head of superannuation for ANZ Wealth.

Mr Hodge begins by asking Mr Pankhurst about payments made by responsible entities of managed investment schemes to the ANZ Group.

In his statement, Mr Pankhurst said OnePath and Oasis had not formally considered these type of payments. He says such payments are a major consideration by management in determining the pricing of fees.

Has this position changed in the respect that the board of OnePath custodians and Oasis has recently turned its mind to what is going on in relation to these payments, Mr Hodge asks. Mr Pankhurst admits he was only made aware of that this afternoon.

Mr Hodge brings up the draft minutes that he had just discussed with Ms Weekes. One of the items refers to “shelf-space fees”. These are the responsible entity payments.

The document suggests that management’s understanding is that shelf-space fees are factored into the calculation of fees by OnePath Life, Mr Hodge says. Mr Pankhurst isn’t sure. He is shown a flow chart of the fees and he says he believes it to be incorrect.

Mr Hodge brings up one of the master distribution agreements that ANZ has with an investment manager. It shows the agreement was made in 2011, pre-FoFA. The parties to the agreement include OnePath Custodians, OnePath management and OnePath Life.

The payments don’t go back to the trustee, OnePath Custodians, Mr Pankhurst confirms.

Under a clause for the shelf-space fee, the issuer agrees to pay OnePath the fee in respect of each of the schemes listed. OnePath’s obligations in the document say it needs to comply with the law but makes no mention of services to the issuer. We see a scheme of the issuer, which will be available through a number of OnePath products. In exchange for being available to be invested in the products the issuer pays a percentage per annum of the funds under management to OnePath.

So if an investor invests their super through the Retirement Portfolio Service they have a range of schemes they can invest in. Whichever they invest in they pay the rack rate fee for that scheme and the rebate then goes back to OnePath. Mr Pankhurst isn’t sure. It’s not part of his portfolio, he says.

Is this a flaw with Pankhurst’s analogy of how it negotiates a wholesale rate for members, Mr Hodge asks. Because the member pays the rack rate and the investment manager then pays OnePath the difference between retail and wholesale, but that’s not passed on to the member in pre-FoFA arrangements. That money that is not passed on is an input into the pricing model, Mr Pankhurst says.

4.25pm IOOF issues

Mr Hodge moves on to ask Ms Weekes about a meeting from last March. It shows that OnePath was seeking a presentation from IOOF to confirm that members’ best interests would be met. There has been no presentation so far, Ms Weekes confirms.

Strategically it may be in members’ best interests to address other issues first, so that it’s very clear about what it’s seeking from IOOF when it meets with the group, she adds. “It is a complex process,” she says. As the transaction has progressed, OnePath’s thinking has matured, she adds. And the board may not meet with IOOF, but rather have discussions with the group about the transfer.

Would it be possible for the board to approve the successor fund transfer without being satisfied that upon the sale of OnePath to IOOF the members’ best interests would be served by remaining within an entity controlled by IOOF, Mr Hodge asks. Ms Weekes thinks not.

Is it necessary for the board to take into account at all what’s happening with IOOF, he continues. Absolutely it is, Ms Weekes replies.

OnePath has been reviewing media articles on IOOF, Ms Weekes confirms in response to a question from Mr Hodge. It will continue to monitor information on IOOF, she confirms.

In doing that, is it your view that the trustee acting in the best interest of the members must take all of that information into account informing a view as to whether putting those members within the control of the IOOF group is in their best interests, Mr Hodge asks.

Yes, Ms Weekes says, saying she wouldn’t reply on media reports, but it assisted OnePath in identifying issues of concern and some of the options before it to address those concerns.

Mr Hodge has no further questions and Ms Weekes is excused.

4.07pm: Project Edison

Mr Hodge brings up a management presentation in relation to “Project Edison”, the project title given to the transfer.

It says that OnePath Life pays commissions to advisers. The current assumption in the paper is that commissions will continue to be grandfathered. Ms Weekes clarifies that both she and others on the board queried the proposition that it was concerned about grandfathering. She’s awaiting legal advice on the issue.

So essentially the view of management is different to Ms Weekes’ view. Unlike management, she doesn’t view the retention of commissions as important for the successor transfer to go through.

Mr Hodge asks if Ms Weekes can see how cutting off all commissions via the fund tranfer would be in the interest of all members.

“It might be, but the first position the board would take is what is the actual effect rather than forming a view of what we would like the effect of the transfer to be on commissions. Second, on the position of grandfathered commissions, understanding how our obligations as trustee interact in terms of Choice members and members who have chosen a product versus the fund as a whole.”

“Has the trustee considered previously why it’s in the best interest of members to continue paying commissions?” No, not in that specific manner, Ms Weekes says.

The trustee will now consider whether it’s ever in members’ best interests to retain grandfathered commissions, she adds.

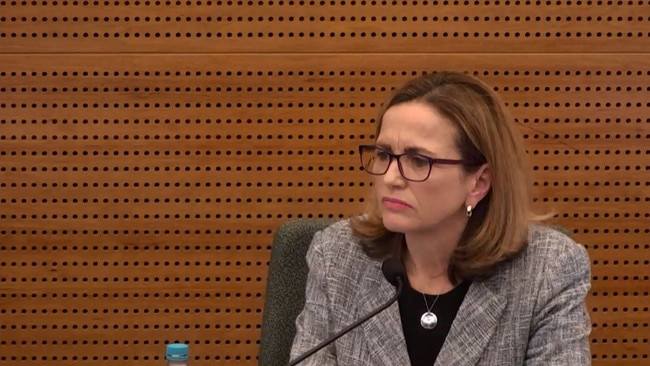

3.53pm: ANZ OnePath’s Victoria Weekes appears

After a short break, the chairman of OnePath Custodians, Victoria Weekes, takes the stand.

Senior counsel assisting Michael Hodge QC begins by outlining to Ms Weekes that he wants to explore the decision the trustee will have to make in relation to ANZ’s move to sell its wealth business to IOOF.

Mr Hodge brings up a briefing paper that explains the proposed successor fund transfer. Presently, OnePath is the trustee of two super funds: OnePath Master Fund and the Retirement Portfolio Service, a super wrap platform.

The Master Fund contains an employer MySuper product and the Smart Choice life stage fund.

The investments of the Master Fund are made into insurance policies issued by a related party life insurer? “Yes,” Ms Weekes confirms. OnePath Life then in turn invests in the underlying product.

ANZ is also selling the insurance business, but not to IOOF. It’s being sold to Zurich. The consequence is the OnePath Master Fund will need to unwind its investments in the life insurance policies, the commission hears.

The current proposal is that the redemption of the investment-linked life policies occur by way of successor fund transfer from OnePath Master Fund into the Retirement Portfolio Service. One of the benefits of that is it avoids a capital gains tax event, such that there’s essentially no “event” that affects the members of the fund, Ms Weekes says.

Once that fund transfer happens, there will only be the one super fund operated by OnePath Custodians.

Mr Hodge wants to understand the issue of grandfathered commissions.

He says if one of the things important to the trustee is for the members’ best interests to be met, it will have to be with the assistance of IOOF.

Mr Hodge brings up a section of the document that details the risk overview of the proposals. One of the risks is “adviser loss of revenue”. The risk flows if the successor fund transfer disturbs the grandfathering commission arrangements, we hear.

3.35pm: Family ties

An email from 2010 is shown to the commission. Paul Clancy writes to brother Robert. He says he suggests CSF continues its sponsorship of Australian Family.

Robert replies and asks if his brother is suggesting $30,000 or $40,000 per year.

Has Mr Pegan ever raised an issue that Mr Clancy may have a conflict that hasn’t been disclosed, Mr Dinelli asks.

The control put in place was that only Mr Pegan would have a relationship with Australian Family, Mr Haysey says. So the board was of the mind that Mr Pegan had managed the relationship because of the conflict, he says.

He adds that he is not satisfied that that was the case and he has seen numerous examples that breach the fund’s conflict policy.

Mr Dinelli lists the monies paid to Australian Family since 2013: they amount to $1.5 million along with $500,000 in sponsorship expenses. So $2 million in total.

Was that an appropriate amount to spend on services, Mr Dinelli asks. That’s the subject of an independent review, Mr Haysey reveals.

Australian Family was then paid by CSF for doing the branding exercise it had recommended to the fund.

Mr Pegan assured the fund in 2015 that he would manage relationship between the Clancys. “Since that time that situation has not been managed that way,” Mr Haysey says.

The fund is currently investigating the matters and Robert Clancy has been placed on leave, Mr Haysey tells Commissioner Hayne.

We learn that Robert Clancy approved payments to Australian Family on three occasions. Mr Haysey isn’t aware of any other payments but it is part of the investigation underway.

Robert Clancy also racked up personal expenses of more than $46,000 in his time at the fund, Mr Dinelli says. That’s correct, Mr Haysey confirms. The money was repaid, he adds.

15.10pm: Conflicts of interest

Mr Dinelli now goes on to the management of conflicts by a trustee and the obligations of the trustee.

There is a conflict management policy within CFS, and Mr Dinelli brings it up. It’s been broadly the same since 2012.

It says a failure by a person to disclose a personal conflict is considered a serious disciplinary matter and corrective action will be determined by the board. It lists the relevant conflicts.

At the start of his testimony, Mr Haysey raised a possible issue between CSF and Australian Family. Australian Family is a marketing a communications organisation that provides support in the education and care sector. It is also responsible for sponsoring the early education and care awards and provides marketing and communications services, Mr Haysey says.

Australian Family is constituted by Family Pack Services Pty Ltd and Paul Clancy Consulting. They’re all related parties. CSF has used their services since 2010.

Paul Clancy provided services to CSF on the strategy of growing the member numbers for the fund.

How was it that Australian Family was chosen to provide services to CSF, Mr Dinelli asks.

Mr Haysey doesn’t know the beginnings of the relationship.

But CFS had identified that the early education space would be a potential growth area for the fund in order to achieve scale and the CEO commissioned research that took place in 2011 and 2012 to confirm the prospects of that approach, Mr Haysey tells the court.

Mr Dinelli reveals to the court that CSF head of institutional relations Robert Clancy’s wife was a shareholder in Australian Family Pack Services and that she was an editor of the magazine.

That was disclosed only in 2015, Mr Haysey says. So from 2010 to 2015 that conflict was not disclosed.

Were you aware that extensive amounts of money had been paid to the organisation before that time, Mr Dinelli asks. Yes, Mr Haysey replies.

Paul Clancy is the head of Australian Family network and the sole director of Paul Clancy Consulting.

That’s never been disclosed on to the register, Mr Dinelli says.

It turns out Paul and Robert are brothers.

The conflict was put on the register in July 2018, Mr Haysey says, upon his insistence.

2.53pm: What did it matter?

By October 2017, a response was sent from Mr Haddock to Mr Bugden. He says there were a number of elements that required further discussion including the appointment of CEO and chair.

He puts forward a proposal that the board implement the merger on the basis that six directors from each fund comprise the new board; the new board would select a new chair thorugh a market search process; CSFs CEO would be the ongoing CEO; a merger of equals that brings together the best elements of both funds.

Mr Bugden on the same day sent an email to Mr Haddock and Mr Cantor. It says “Thank you for your response. We are disappointed that you were not able to accept our offer and I wish you well”.

So the position was CSF wasn’t able to pursue the merger at the time.

We could not continue the arrangements without having clarity around critical issues in the best interests of our members, Mr Haysey says.

Commissioner Hayne interjects: “There was no agreement. If you were asked why did this fall over, what’s your answer?”

Mr Haysey says the best interests of the members would have been served by CSF being the successor fund.

So which fund dominates, Mr Hayne says in answer to his own question. That’s always the case, Mr Haysey replies.

There was no dispute that the board would be a “six plus six”, Mr Hayne continues.

Mr Haysey says it accepted “six plus six” but it wanted an independent chairman.

So if there was no dispute on the governance of the fund, what does it matter which fund merges into which, the commissioner asks.

“We felt that to protect our members’ interests... it wouldn’t be in their interests for their retirement savings to be put at risk given that the policies and procedures in place to achieve those returns might not be able to be guaranteed going forward,” Mr Haysey responds.

Those policies are set by the board, Mr Hayne says. Mr Haysey agrees.

The new chairs of both funds have recommenced discussions, Mr Haysey says. It’s the hope of both funds that that merger will still occur, he adds.

2.41pm: Chair manouvres

A further letter was sent by CSF to Australian Catholic Super. Mr Bugden says in the letter that an impasse has been reached. It says the CSF board had determined that a new independent chair is essential. So that was a change in CSF’s position at the time? Yes, Mr Haysey agrees.

The proposal then is that both chairs stand aside and “entrust the merger to new leadership”.

How was it intended that the board of CSF would be chaired after a memorandum was signed, Mr Dinelli asks.

The current chair would remain in place until a new chair was appointed, Mr Haysey says.

What did it matter which would be the successor fund and who would be the merging fund, Commissioner Hayne asks.

The paramount interest was that it was in the benefits of its members, Mr Haysey says.

There were also structural differences, he says. CSF, the trustee, was a master trust and Catholic Super was a master trust. There was another division and a banking licence as well as a financial planning service. So it’s not just the CEO of one of the best super funds in the industry.

“But does it follow from the considerations you have mentioned that the only way of achieving scale would be from takeover, as distinct from merger,” Mr Hayne asks.

Mr Haysey says there’s no doubt the best interests of the fund’s members would not be served if the arrangements had been different to what CSF wanted.

Eventually Australian Super accepted CSF’s request for Mr Pegan to be CEO.

Mr Dinelli moves on to an email from Mr Bugden to Mr Haddock a few months down the track. It says both ACS and CSF have agreed to all but one point. Mr Bugden says CSF wanted to appoint a Mr Casey to the role of chair.

Mr Haysey clarifies that the appointment was just “a preference”. He had been employed by CSF as a consultant and they thought he was best placed to suit the interests of both funds.

Did the other fund know Mr Casey had been assisting CSF?

Mr Haysey doesn’t know.

2.27pm: Board battle

We’re back after lunch and counsel assisting Albert Dinelli resumes his questioning of Catholic Super deputy chair Peter Haysey.

Mr Dinelli brings up a board note from a 2017 meeting that references the challenges facing both Catholic Super and Australian Catholic Super as well as the synergies for a merger of the two funds.

Mr Dinelli brings up two statements prepared by the trustee of Australian Catholic Super, SCS. Richard Haddock was chair of the trustee at the time.

An email from Mr Haddock to members of his board and other executives of SCS. He refers to a meeting between Australian Catholic Super CEO Greg Cantor, the chair of Catholic Super Peter Bugden and the CEO of Catholic Super, Frank Pegan. It says initial discussions found a merger made sense.

Was that a view shared by CSF, Mr Dinelli asks. It was in the best interest of both funds, Mr Haysey says.

The note also says ACS wanted it to be a merger of equals. Pegan accepted that but only on the basis that the CEO and chair of the new fund come from Catholic Super. Was that the position of the fund, Mr Dinelli asks. “That’s certainly not the case, no,” Mr Haysey says.

Mr Haysey’s recollection is that one position would rest with one fund and the other with the second fund.

Mr Dinelli takes us to another document: it says CSF board remains unanimous that a merger would be in the best interests of its members and that the board consented to the ACSF chair be invited to be the chair of the new entity and the CSF chair would be invited to be the deputy chair. CEO and CIO of the merged entity would be from CSF. CSF would be the successor fund and operations of the fund would be harmonised over two years.

Mr Dinelli brings up a letter from Mr Haddock to Mr Budgen. It says the board noted the earlier request that the CEO, CIO and deputy chair come from CSF. “The ACSRF board believes that the identification of these roles and the candidates to fill them should be based on merit and should be undertaken as part of the assessment of the needs of the combined fund.”

That seems like a reasonable position, Mr Dinelli suggests.

“Our view was that the nature of our fund and the performance of our fund was such that the CEO of the continuing fund should have come from CSF,” Mr Haysey says.

The note then goes on to say it accepts CFS’ proposal but that after two years the chair, deputy chair and CEO should be determined by the new board.

2.15pm: In depth

As this week’s hearings reach their mid-point, The Australian’s Anthony Klan and Richard Gluyas have taken a step back to assess some of the wider implications of what we’ve heard.

Kelly O’Dwyer’s prediction of a royal commission reckoning for the $600 billion industry super funds sector looks to have fizzled, Richard Gluyas says. We’ve heard from AustralianSuper’s Ian Silk and Hostplus’ David Elia, but “the truth is that Hayne has barely laid a glove on the industry funds,” he says.

The banks have had it far tougher.

“There is nothing special about super — it’s just money invested in markets,” as Anthony Klan tells us.

But it has some specific tax breaks, and you can’t touch it until you retire.

“It’s this last point that has allowed retail funds to unashamedly fleece their members over the past two-and-a-half decades.

“The public isn’t looking, and it trusts their bank will do the right thing with their retirement savings,” he says.

Instead, the fleecing of the nation’s super will be revealed as one of, if not the biggest, scams in the nation’s history.

1.25pm: Catholic Super’s Peter Haysey appears

Catholic Super deputy chair Peter Haysey takes the stand.

Counsel assisting Albert Dinelli begins his questioning by asking Mr Haysey about his role at Catholic Super and if he’s aware of his obligations to act in the best interests of members in his role as trustee.

Mr Dinelli asks if in preparing his statement if there were any areas of concern.

Yes, there were some potential conflicts of interests in respect to an arrangement with a service provider and an employee.

Mr Dinelli asks about the fund. it has funds under management of $9.3 billion and it has 75,000 members. The average balance is $115,000. While the fund has increased in size, it has been considering a merger.

“The benefits of a merger to members are the benefits of scale,” Mr Haysey says. It would decrease the costs per member, he adds. There have been negotiations with the Australian Catholic Super Retirement Fund, we hear.

In 2016, the fund’s CEO presented to the board on the benefits of a merger. It had engaged Rice Warner to assess the benefits. Rice Warner had said that the super industry was going through a lot of changes and there would be a smaller number of large funds over time.

We break for lunch and Mr Haysey will return at 2pm.

1.15pm: Mystery shopper findings

Mr Hodge brings up a presentation that Mr Chun gave to ASIC about the product. Why did he do this, Mr Hodge asks.

mr Chun says he recognised the risks of a blurring into personal advice and it was also a major project for CBA, so it felt as a trustee it would be best to consult with the regulator on it.

CFS walked ASIC through all the scripting of the product to get clarity and input from the regulator.

The product was made available from July 2013. Shortly afterwards KPMG conducted a mystery shopping exercise on behalf of CFS.

KPMG found that there were a high volume of compliance exceptions:

- 85 per cent of shoppers were not provided with a financial services guide,

- 40 per cent weren’t provided with a product disclosure statement (PDS)

- 85 per cent of shoppers were not provided with a general advice warning

CFS did not provide the results to ASIC until 2014.

CFS continued to do mystery shopping - one round in December 2013 and another in September 2014. There was some, but not a lot, of improvement, Mr Hodge says. Mr Chun thinks there was improvement.

In August ASIC issued a notice to CFS. It was seeking information on the product and its implementation. It became concerned with the financial health check being linked to the super fund from 2015-16.

What happened in relation to the enforecable undertaking, Mr Hodge asks. Mr Chun wasn’t directly involved in those negotiations.

Mr Hodge asks why Mr Chun thinks it’s okay for a fund to pay 30 per cent of revenue to a bank to recommend that fund? Mr Chun clarifies that it was on the basis of costs incurred.

Mr Hodge doesn’t accept that: “It’s a revenue-sharing arrangement.”

Mr Chun argues that it was set up that way because it was a new distribution model.

Mr Hodge has no further questions for Mr Chun and he is excused.

12.54pm: 30 per cent fee

Has the adviser complained about being suspended, Mr Hodge asks. Mr Chun isn’t aware of any feedback. The suspension action was only taken this week.

Is CFS contemplating consequences for its own management having misled members in the exact same way that this adviser did, Mr Hodge asks.

Mr Chun doesn’t accept that suggestion.

There’s been no internal review within CFS of the manner in which it communicated with members on ADAs, Mr Hodge says. Mr Chun says he has reviewed the communications and believes they were fair and balanced. This appears to conflict with what Ms Elkins said in her testimony.

Mr Hodge moves on to the selling of Commonwealth Essential Super in CBA bank branches.

The agreement between CBA and CFS is that CBA will provide services to CFS and CFS will establish a super fund that includes CES.

The services include that CES would be sold through CBA branches. This was the original target market, Mr Chun says. Under the fee it says the bank will earn 30 per cent of the total net revenue of the fund. Is that high, Mr Hodge asks. Mr Chun can’t comment on that. But he says the fee was agreed based on the costs the bank incurred to sell the product.

Was there any internal analysis that showed that this product would perform better or be lower cost for members than other products on the market, Mr Hodge asks. Mr Chun says it wanted to ensure it was priced very competitively. It has exceeded its investment objective since launch, he adds.

Mr Hodge points out that every MySuper fund has outperformed its investment objective since launch.

12.39pm: Colonial’s Peter Chun appears

We’re back after a short break and CFS general manager of distribution Peter Chun takes the stand.

Senior counsel assisting Michael Hodge QC begins questioning Mr Chun on intra-fund advice.

There’s an agreement between CFS Investments Ltd and Financial Wisdom for the provision of intrafund advice. CFS is the trustee for the super trust and Financial Wisdom is an advice licensee owned by CBA. Financial Wisdom provides intrafund advice, not personal financial advice. It could a bit beyond general advice but CFS has limited it to general advice and factual information, Mr Chun explains.

When a member asks about insurance, investment options or contributions to their super fund, that it classed as intrafund advice.

Mr Hodge wants to discuss a specific adviser that was retained by Financial Wisdom to provide intrafund advice to some members of the First Choice Employer Super fund.

This adviser was receiving trail commissions from some of the members. It arose from the employer plan, we hear, for members in the product before the FoFA changes came into effect.

The trail commissions was one arrangement and the intrafund advice was a separate arrangement.

But the only members the adviser was giving intrafund advice to were the ones paying the trail, Mr Hodge suggests. “There’s no direct relationship in that way,” Mr Chun clarifies.

This adviser - we don’t know his name - sent letters to the members he was getting trail from matters relating to the ADA transfer. It could be classed as intrafund advice, Chun says.

CFS provided advisers with a template to communicate to members, Mr Chun says. Ths letter does not conform with the template, Mr Chun says.

The issue, Mr Hodge says, is that it says “if you don’t actively make an investment choice the government will make a choice for you”. It says the government will put members in MySuper products, which may not be suitable for them.

We know that CFS views these kind of statements as misleading, he tells Mr Chun.

In the case of this adviser, between 2013 and 2017, 1380 of this adviser’s clients gave an investment direction rather than being transferred to MySuper. That was around 25 per cent of his clients, Mr Hodge says.

The concern, Mr Hodge says, is the communication is not balanced and it doesn’t disclose the potential conflict of interest on his part. It’s also drafted in a way to make the member fearful. Mr Chun agrees with all of this.

This adviser was initially identified by ASIC last year, and a notice was sent about him in February this year. Mr Chun doesn’t know what has happened since.

In July, CFS took steps to seek information from Financial Wisdom in relation to the adviser and on August 10th Financial Wisdom provided information. In recent days CFS has decided to suspend the adviser.

What is the connection to intrafund advice, Mr Hodge asks.

“In the contract there’s a need to ensure this type of advice is balanced and not misleading. We decided to take action and suspend him going forward,” Mr Chun replies.

CFS considers that its own conduct may have fallen below community expectations and standards in respect of this adviser, we hear. So CFS didn’t tell advisers to disclose their conflicts of interest and should have, Mr Chun says.

CFS also considers that its delay in investigating the adviser fell below community expectations and standards.

12.14pm: ‘Don’t think I’ve got much to lose’

On another chain of CBA emails, from October 2017, which Mr Comyn was included on, it says a view has been put to Mr Mullaly at ASIC that ASIC should wait until the Westpac proceedings are determined before taking CBA’s proceedings any further.

“We were trying to understand to what extent the BT case would inform these areas which were very grey,” Ms Elkins says.

The suggestion in the email is that this position taken by CBA was not acceptable to Mr Mullally. It also says to Mr Comyn: ‘I don’t think there’s any need for you to meet with Mr Kell this Friday unless you would like to have a further go at pursuing this.”

Mr Comyn’s response in the email is: “I think we should keep trying. I don’t think it will achieve much but don’t think I’ve got much to lose either.”

Mr Elkins wasn’t on this chain but she says she was aware of the discussions taking place.

The EU were given just weeks ago, in July.

Does Ms Elkins know what happened in the intervening nine months? It’s just the normal course of negotiating EUs, she says.

Mr Hodge has no further questions and Elkins is excused.

12.07pm: What was going on with ANZ?

Mr Hodge wants Ms Elkins to explain the strategy of having Mr Comyn call Mr Kell to see if he will override Tim Mulally’s decision. Mr Elkins doesn’t agree that that was the strategy.

Mr Comyn did speak to Mr Kell, Ms Elkins thinks.

On August 10th Comyn says he left a voicemail for Ms Kell and would “revert with a response”.

We know that CBA and ASIC agreed on an EU, so Mr Kell didn’t go for the idea of a media release.

One of the ongoing matters was what was going on with ANZ, Mr Hodge says. Ms Elkins doesn’t think that was discussed much but CBA was aware of it.

Mr Hodge brings up the chain of emails again, internal emails within CBA. It asks “Do we have an update on ANZ’s position?”. In the emails, Ms Elkins is asked if she knows.

Why would Ms Elkins have intel on ANZ, Mr Hodge asks. “Because I am the superannuation leader in CBA so whatever was happening with ANZ, I was the one likely to know.”

“Was there some communication between CBA and ANZ as to what positions they were each taking with ASIC?” Mr Hodge asks.

“There was certainly a lot of discussion around general advice and what the problem was and we were both aware that we were negotiating EUs,” Ms Elkins says.

Mr Hodge asks if Ms Elkins knows how it was that CBA knew ANZ was willing to accept an EU but only on a particular basis? She doesn’t know.

11.54am: Comyn’s call

Mr Hodge has one more topic to discuss with Ms Elkins: the selling of Commonwealth Essential Super (“CES”) in CBA branches and the related enforceable undertaking agreed with ASIC.

As the EU was being negotiated, Ms Elkins was copied on a number of emails, which Mr Hodge brings up.

As background, in 2012, CFS and CBA developed a program whereby CFS would establish a super fund, CES, and CBA would sell it in its branches.

By the end of 2014, it had become apparent that there were issues with how it was being sold. It later became apparent that it was looking a lot like personal financial advice.

Toward the end of 2016, ASIC suggested it was going to commence court proceedings. CFS and CBA took the view that ASIC should put out a media release instead of going to court.

“Ultimately you met somewhere in the middle. No doubt ASIC put out a media release but you also entered into an EU [enforeceable undertakng],” Mr Hodge says. “Well, CBA did,” Ms Elkins replies.

Mr Hodge brings up a letter from ASIC. It proposes for the matter to be resolved on the basis of an EU. It also says ASIC remains open to resolving the matter outside of court.

An internal CBA email was sent to a number of people including Ms Elkins and CBA CEO Matt Comyn, who was then group executive for the retail division of the bank.. It says that CBA would prefer to resolve the matter without an EU and subject to a media release. And it wanted to negotiate the EU to ensure it could move forward with “Project Everest”. This project was to look at how it could respond to ASIC’s concerns and ensure if CES was put back into branches it was under the general advice model, Ms Elkins explains.

The steps proposed are that Matt Comyn will call ASIC’s Peter Kell in the coming days to confirm willingness to engage on a no-EU basis. Again, Mr Comyn wasn’t CEO at this stage.

“If Kell indicates willingness to entertain no-EU approach then ring Tim Mullally to agree way forward,” the email says. “If not write to ASIC on 18 August accepting EU but seeking to discuss specific terms.”

Under the heading “no EU position” it says “on balance it is unlikely ASIC will want to resolve this matter other than by EU”.

Mr Hodge wants to know how CBA negotiates with ASIC.

CBA knows ASIC intends to proceed with an EU to resolve the issue. “Rather than moving forward with that, what’s being suggested is Mr Comyn will call up Mr Kell to see whether maybe we can still get a deal done on the basis of a media release rather than an EU,” Mr Hodge says.

11.33am: Grandfathered commission review

If a member dies, they may have trailing commissions paid to an adviser on investments, Mr Hodge asks. Yes, Elkins replies.

And because of FoFA, if there’s no reversionary beneficiary, then the grandfathered commission will have to cease. But if the reversionary beneficiary was nominated before the FoFA changes, then the grandfathered commission will continue.

Has CFS given consideration to stopping this practice? It would be in the overall review talready mentioned, Ms Elkins says.

11.31am: Relationship with advisers

Mr Hodge brings up a CFS presentation from November 2016 on adviser service fees, in which it explains CFS’ approach to the fees.

It says “we do not require licensees to provide positive confirmation of ongoing services”.

“Well that’s just incorrect,” Ms Elkins says.

She then changes her response slightly, saying that an adviser has to notify them if it fails to provide confirmation.

The presentation appears to show that adviser service fees are a CFS expense that it can deduct from member accounts. Ms Elkins isn’t sure that’s the case. “The fees are agreed between the adviser and the member and then the member authorises us to deduct the fee,” she adds.

It shows that fees are not removed if a member complains about them. This has now changed, Ms Elkins says.

“It would presumably affect your relationship with your advisers if you require them to submit attestations (of ongoing service)?” “So be it,” Ms Elkins replies

11.18am: More fees for the dead

Once again we’re hearing of fees charged to dead people.

Mr Hodge asks if Ms Elkins is a director of AIL. Yes, she is.

AIL recently gave notice of a breach to ASIC and APRA over it charging adviser service fees to members who had died.

There was an issue that arose in the second round of hearings concerning fees being charged to people who had passed away, mr Hodge says. “As a result of that, did CBA and CFS put in place a program of work to check whether that was happening in other areas?”

“To check whether it was happening at all, yes,” Ms Elkins replies.

The issue in round two was that certain advisers were charging fees to dead clients. The issue identified by AIL was that where it had been notified that a member had died it continued to do so.

This was first discovered in 2015 and AIL thought it should add in the PDS that it would continue to charge adviser fees after the member has died. But it never did that and so it formed the view when reviewing the issue this year that if it wasn’t telling this to members that it shouldn’t have charged them fees after they died.

“That was in 2015. On this review the conclusion we made was the practice should cease and should never have occured,” Ms Elkins replies.

Why was this not the view taken in 2015? Ms Elkins doesn’t know.

Was it only AIL that has this problem? Yes.

11.08am: Would CFS ever drop CommInsure?

Mr Hodge moves on to CFS’ dealings on insurance. CFS uses CommInsure as the provider of group insurance.

Is there a negotiation that occurs between CFS and CommInsure in regards to insurance premiums? There’s an annual review, we hear. It’s a holistic review of the insurer, Ms Elkins says.

Are most members of Commonwealth Essential Super blue collar or white collar workers, Mr Hodge asks. Ms Elkins doesn’t know.

Mr Hodge goes to the pricing part of the review.

Under “death only” it says CES is competitive for blue collar workers and smokers of some ages. So CommInsure isn’t charging different premiums depending on whether the worker is blue collar or a smoker. It also says the product is uncompetitive for white collar workers, especially women between the ages of 30 and 50.

CES is cheaper for blue collar workers, it says, but white collar workers and non-smokers are disadvantaged.

The suggestion is it’s competitive in terms of features rather than pricing, Mr Hodge says. Ms Elkins doesn’t know.

In a ranking list where nine is classed as the worst, we hear that there are only a few occasions that CommInsure ranks better than five and just one occasion in which it’s the least expensive premium: a female, blue collar worker age 20-25.

For death and TPD cover CES’ performance is still very poor for white collar workers, Mr Hodge says. Ms Elkins agrees. And it’s in the middle or toward the top end for blue collar workers.

But another table shows how the premiums compare to the median. The best comparison shows the CES premium for one group is 29 per cent under the median. The worst is that it is 132 per cent above the median. It is much worse for white collar workers and better for female blue collar smokers.

Do you think there are any conclusions the commission can draw based on that report as to the adequacy of the supposedly arms length negotiations that take place between CFS and CommInsure, Mr Hodge asks.

“Not necessarily. The role of the product manager is to do the benchmarking, do the annual reviews. That’s overseen by the office of the trustee aswell. Then to come to a conclusion as to whether or not we’re better off. So are we better off to negotiate with the insurer or change insurer. The decision was made to negotiate with the insurer,” Ms Elkins replies.

Mr Hodge asks the obvious question: Has CFS ever discussed changing insurer from CommInsure.

“Yes, that has been discussed... on and off on different occasions,” Ms Elkins says. The sale to AIA also informed CFS’ view, she adds.

10.51am: Arm’s length negotiations

Mr Hodge moves to dealings with related parties and how CBA negotiates its investment management fees.

He brings up minutes from a February 2017 CFS board meeting. It shows a fee review with CFS Asset Management. As background, CFS as trustee invests money into a managed investment scheme of which CFS is the responsible entity. Those assets are then invested by CFS Asset Management, a subsidiary of CBA. It manages the assets by investing in other managed investment schemes. When a negotiation on fees occurs it takes place between the two business teams: CFS and CFS Asset Management, Ms Elkins says.

Mr Hodge brings up a paper reporting to the board on the fee negotiations. The board doesn’t need to sign off on the agreement, it’s just being told what happened. There’s a reference to engage Chant West to provide a benchmark report.

Looking at the funds it details, in one column, the investment management fee, and then in another, the proposed investment management fee. The first is just the fee but the second, the proposed fee, includes “distribution and marketing”.

The Chant West benchmark range for nearly every CFS product shows the old investment management fee was outside the benchmark range and depending on what value is ascribed to distribution and marketing it may now move within the range.

Mr Hodge wonders: If the fees before the change were all outside of the benchmark range does that suggest anything to Ms Elkins about supposedly arms length negotiations within two CBA teams?

“It shows that the negotiations needed to happen,” Ms Elkins says.

10.33am: Watching CBA’s position

Mr Hodge asks about the ‘product governance forum’. It reports to Ms Elkins, she says.

The minutes of a product governance forum meeting from June 2018 are brought up. This was the first meeting. It’s a forum of people who report to Ms Elkins, people from the customer advocate and risk and legal.

The decision sought is to endorse removing contribution fees “in a phased approach”.

Mr Hodge asks what this is.

“There are some legacy products that have a fee deducted when contributions come in,” Ms Elkins says. So 4 or 5 per cent may be deducted and paid as commission to the adviser. Is it deducted whether or not there is a linked adviser? Ms Elkins isn’t sure.

When that fee is paid, does any of it flow to CBA or CFS? Ms Elkins doesn’t know.

So the forum is endorsing the recommendation to remove fees? Has the board in its capacity ever considered removing fees? Ms Elkins doesn’t think so.

“Off the back of this recommendation we are investigating moving forward with this and we are seeking legal advice.”

There’s also a recommendation to remove the fees on “nil entry fee products”.

Mr Hodge asks ms Elkins to explain that. Is it that you have lower management fees for entry fee products than you do for nil entry fee products and you’re considering reducing them, he asks. Ms Elkins says Colonial is looking at reducing fees across the board.

It also mentions that CBA will need to look at the impact of removing trail commissions on aligned dealer groups.

It suggests that the decision on whether or not to remove trail commissions depends on CBA as to the strategic position it wants to take. Ms Elkins doesn’t think it depends on it.

Mr Hodge: “Is there any sensible possibility that CFS, as trustee, would decide to remove trail commissions without its owner, CBA, having made a strategic decision to give up trail commissions?”

Elkins: “I don’t think I can answer that.”

Hodge pushes, repeating the question. “That could definitely happen.”

Mr Hodge: Has it come up before now?

No. But it’s possible, Ms Elkins says.

Mr Hodge: Is CFS waiting to hear from CBA on what CBA’s position is on trail commission?

Ms Elkins: “No, we’re aware that they’re considering that.

Mr Hodge: And you’re waiting for CBA to tell you what their position is?

Ms Elkins: “I would expect they would, yes”

Mr Hodge: And then CFS will do whatever follows from that position?

Ms Elkins: “There are things happening in parallel, we’re seeking legal advice.”

The forum occured on June 21 and on June 25 CBA announced it would spin off its wealth business.

10.17am: Trailing commissions on cash

Mr Hodge moves on to cash returns.

In June there was an article published in The Australian by Anthony Klan concerning cash returns. That raised questions as to why returns at certain bank-linked retail funds were so low. That prompted internal communication between CFS and CBA, Mr Hodge says. Is it fair to say CFS and CBA were unhappy with the article? “Yes,” Elkins says.

One of the points made about CBA super’s cash returns was the difference in the returns between various cash options. The internal analysis from CBA is that the entire explanation for the variance was to do with fees, Ms Elkins confirms.

For CFS cash option the 12-month return was 1.19 per cent, for the wholesale cash option the return was 1.9 per cent and for Group super the return was 2.01 per cent.

The 1.14 per cent fee charged on the cash option in First Choice includes a trailing commission of 60 basis points. Is that the reason for the lower performance, Mr Hodge asks. “Yes, I believe so”.

And once this was identified, did that prompt Ms Elkins to ask why are we paying a trailing commission on cash, Mr Hodge asks. “As I said yesterday, all of our arrangements are under review.”

10.11am ‘That was a purpose’

Mr Hodge goes to board meeting minutes from June 2014. It gives a 29WA compensation update and a paper presented to the board.

The board notes that it may not be in the interest of members with ADAs to transfer them to Commonwealth Essential Super (the MySuper product).

“It would seem what happened in June 2014 was that management told the board that APRA had requested CFS accelerate the transition; that bringing forward the transition had significant business implications; management didn’t propose an amended transition plan; the board noted that it may not be in members’ interests to transfer over to MySuper at that time; and finally the board said it would stick with management’s plan,” Mr Hodge says.

Why would it not be in their best interests to transfer them in 2014?

ms Elkins cites operational risks and that CFS needed to contact clients to make sure they were aware of the insurance changes.

Was ms Elkins aware that if there was an immediate move from ADAs over to MySuper it would affect CFS’ relationship with advisers, Mr Hodge asks. Yes.

mr Hodge: And was that a matter of concern to management? “We were aware of it,” Ms Elkins says.

The active steps being taken by CFS at the time was to obtain investment directions from clients to benefit advisers, Mr Hodge states. “That wasn’t the purpose,” Ms Elkins says. “That was a purpose,” Mr Hodge presses. A pause from Ms Elkins before a reluctant “Yes”.

10.01am: No ‘better off’ test

Mr Hodge suggests to Elkins that if CFS has not identified the ADAs in First Choice Personal Super by January 1, 2014, there was no prospect of it being able to comply with section 29WA for new contributions. “I think that follows,” Ms Elkins replies.

Assets were allocated as ADAs if a member hadn’t made an investment direction. So any new contributions needed to be paid into MySuper. So CFS hadn’t identified there were ADAs so it couldn’t know there was an investment direction.

The problem was CBA hadn’t put in adequte systems to be able to comply with the law, Hodge says. “Well, yes,” Ms Elkins replies.

And for the first half of 2014 the intention was that it would eventually move the ADAs toward the end of the transition period in 2017, Hodge says. “We didn’t have an intention to leave it to the last minute,” Ms Elkins says.

Mr Hodge brings up the 2014 transition plan. The issues related to the breaches had been identified by this stage and a decision made that where an offence occurs and CFS hasn’t identified an investment direction it will move members over to MySuper but otherwise it’s not going to accelerate the rest of the members’ move over to MySuper.

The project timeline shows that apart from the 29WA members, the strategy is to transfer members in tranches from July 2016 onward.

Was any consideration given to whether it was in members’ best interests to be in MySuper rather than the product they were in? “We were thinking about the systems build and how we would prioritise each tranche,” Elkins says.

For ADAs in First Choice Employer Super the analysis was only 9 per cent would be worse off moving to MySuper, Mr Hodge says.

“So when you as a trustee are making a decision to approve the transition of members how do you set in place a timeline in 2014 without first analysing whether members will be better off if they move to MySuper”.

It was a holistic approach, Ms Elkins says, there were a lot of factors that CFS was looking at. It had to obtain a MySuper licence, build the products.

So it was going to take two and a half years to complete the transition - except for members for which it was in breach.

9.53am: Inadequate systems

Senior counsel assisting Michael Hodge QC begins the morning session by asking Colonial First State’s executive general manager Linda Elkins about a letter CFS sent to its super members in 2016, asking them to make an ‘investment decision’ which would mean they would not be transferred to the low-fee MySuper product.

In the letter, CFS told members that fees and insurance premiums may increase with the change to MySuper. A table from an example letter shows that this specific member had opted out of insurance in their original super product and that they would pay an insurance in MySuper unless they opted out of it. The letter also says the present annual fee was $155 in First Choice and the equivalent fees in the MySuper product would be $128 (these are the fees for this specific member).

Mr Hodge asks Ms Elkins about the explanation she gave yesterday as to why CFS was not in a position, from January 2014, to pay member contributions into a MySuper product, per the legislation that came into effect at the time.

“As I remember it, these are people in First Choice personal were thought by us to be ‘Choice’ customers and therefore not identified by us as needing to be moved to a MySuper product,” she says. So CFS thought these 15,000 members had made an investment decision and weren’t needing to be moved to MySuper. They later discovered that not to be the case.

Mr Hodge shows the court a chain of internal CBA emails. It deals with First Choice Personal Super. It says that an issue had been lodged with CBA’s risk department in relation to the ADA calculation and that there had been a delay in calculating and providing the information prior to the cut off of January 2014. It says there was a plan for a project for ADAs to be moved across to a MySuper product in 2017.

An email to Peter Chun, who will give evidence later today and at the time was responsible for product development, says risk had identified an issue with the ADAs for First Choice Personal Super.

Mr Hodge asks Ms Elkins if CFS had not put in place adequate systems to identify ADA members in First Choice. She recalls there was an issue, yes.

9.15am: Preview

Good morning and welcome to another day of the superannuation round at the financial services royal commission.

Colonial First State’s Linda Elkins is back on the stand this morning and is set to face another grilling from senior counsel assisting Michael Hodge QC. Yesterday we heard CBA’s wealth management arm admit it had committed more than 15,000 criminal offences by failing to move super members from a high-fee-paying accounts to commission-free MySuper accounts.

And in another twist, we learned that APRA knew of the breaches but didn’t take any action to prosecute.

Just before yesterday’s session finished, we heard that CFS had lobbied Treasury to retain commissions on super funds ahead of the FoFA changes. We’re likely to hear more on that this morning.

Once Mr Hodge is finished with Ms Elkins, Colonial’s general manager for distribution, Peter Chun, is set to make an appearance.

Join us live from 9.30am

Tuesday 14 August: Colonial’s ‘different hats’

Monday 13 August: NAB’s Hagger hammered

Banking royal commission: full coverage