Industry funds emerge from Hayne’s hot seat unharmed

Predictions of a royal commission reckoning for the $600bn industry super fund sector appear to have fizzled.

The word on the street is that O’Dwyer prophesied a day of reckoning for the industry funds, with shocking revelations about systemic misuse of member funds to create a compliance nightmare for the $600 billion not-for-profit sector.

O’Dwyer denies saying this publicly or privately.

A spokesman said she never prophesied anything, apart from disclosure of some appalling practices industry-wide.

“When it comes to the superannuation industry, there needs to be reform across the board,” a spokesman said.

In an April speech, however, O’Dwyer — an industry fund member herself — referred to money in the super industry that’s “sloshing around for other cultural practices”.

She said members had to “stand by and watch” as their retirement savings are spent on “straight out political advertising”.

Funds were also spent on dubious sponsorships of union congresses. Or on super liaison officers who “are in fact union officials being out of super funds”. Or on a lobbying effort whose main achievement was to “stand in the way of the regulator, APRA, getting important new powers to protect members’ money”.

Correct us if we’re wrong, but we’re struggling to recall similar allegations made against the retail funds.

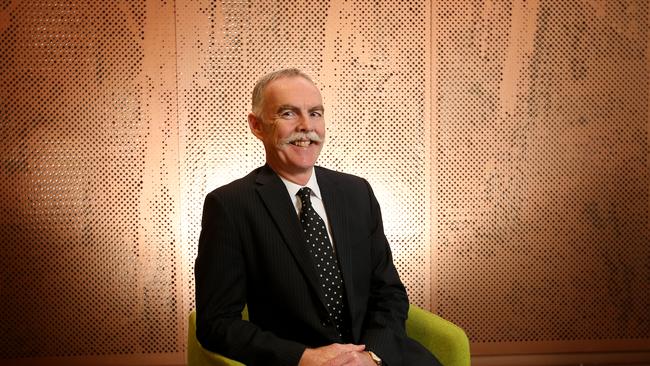

Last Thursday, the superbly moustachioed AustralianSuper chief executive Ian Silk, one of only two witnesses (along with senior National Australia Bank executive Andrew Hagger) to be summonsed by name so far, was probed by the royal commission about the “fox and henhouse” advertisement, and the online media venture The New Daily, among other things.

But on the royal commission’s pain-o-meter, sponsored by NAB and its wealth unit MLC, the damage sustained by the $140bn behemoth barely registered.

The sponsor’s three witnesses — Hagger, Nicole Smith and Paul Carter — spent a gruelling five days in the witness box.

Silk struggled to clock up two hours.

On Tuesday, the onus was David Elia, chief executive of the top-performing industry fund Hostplus, to provide the fodder for the Armageddon scenario for industry funds.

Elia had more to work with — $260,000 spent on wining and dining 120 chief executives and employer representatives at the Australian Open tennis tournament this year, $40,000 laid out on tickets at Etihad Stadium in Melbourne in April, and a staff lunch at the city’s top-end Chinese restaurant, the Flower Drum.

However, instead of Elia wilting, it was Hayne who raised the white flag in surrender, exhausted by the Hostplus chief’s relentless spruiking of the importance of relationships in super to build scale and lower fees.

Overriding that was the need to retain default-fund status so that compulsory super deductions keep flowing in.

The truth is that Hayne has barely laid a glove on the industry funds.

Meanwhile, in the for-profit sector, the commissioner has floated potential criminal charges against NAB in relation to fees-for-no-service, with Commonwealth Bank committing 15,000 offences by failing to move super customers into lower-fee accounts.

Even the regulators are facing a tougher time than the industry funds — the CBA offences are punishable today by a fine of almost $160 million.

Tomorrow, Hayne will probe the effectiveness of APRA and ASIC.

APRA will represented by deputy chair Helen Rowell, who has primary responsibility for super, while deputy chair Pete Kell will step up for ASIC.

Email: gluyasr@theaustralian.com.au

Twitter: @Gluyasr

As the curtain call looms for Ken Hayne’s inquisition of the superannuation industry, bankers around the country have been wistfully recalling that time of sweet innocence when Financial Services Minister Kelly O’Dwyer came to visit.