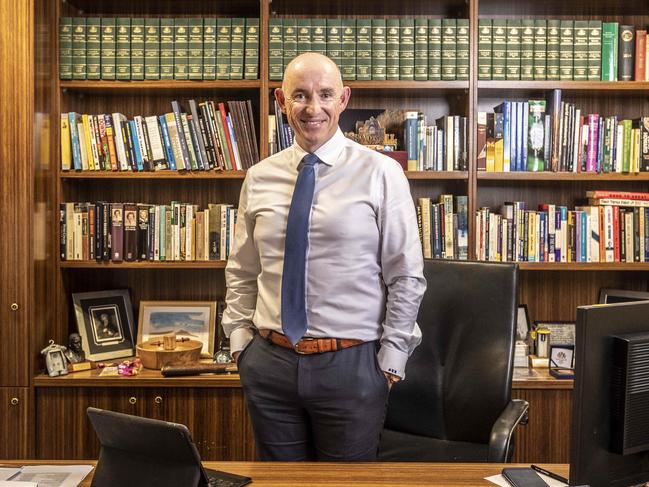

Watchdog savages IOOF chief

APRA has launched a scathing attack on the fitness of IOOF chief executive Chris Kelaher to lead the company.

APRA has launched a scathing attack on the fitness of IOOF chief executive Chris Kelaher to lead the company.

The banks have pushed back against serious breach allegations as APRA unloads on IOOF’s boss in super round submissions.

Australia’s infrastructure binge is based on the false assumption that population growth will inevitably continue to climb sharply.

Other banks may not rush to copy Westpac’s rate rises because of lower funding pressures and inquiry revelations, says an analyst.

A New Zealand government minister says its banking rules need a review to keep its Australian-owned banks in line.

Westpac’s ‘courageous’ decision to lift mortgage interest rates could spark government action, analysts warn.

Competing AMP class action lawyers will be forced into a NSW Supreme Court “beauty parade”.

Credit will be tighter and advice more expensive after the bank inquiry, says Peter Costello, who also blames regulators.

Incoming assistant treasurer Stuart Robert warns future scandals are “inevitable”, vowing to resist pressure for heavy regulation.

NAB has taken a moumental bank inquiry beating but will strongly contest assertions made in last week’s closing submission.

Billionaire investor Kerr Neilson says the royal commission could help level the playing field for fund managers.

A crunch in profit margins has sparked a fall in Westpac shares, as pressure mounts on big banks to hike mortgage rates.

ANZ chief executive Shayne Elliott has no regrets in calling for the establishment of the financial services royal commission.

AMP’s newly-appointed CEO stands to make a small fortune if he can turn the embattled company around.

In a bid to stave off new professional standards, financial advisers are planning to join forces with the union movement.

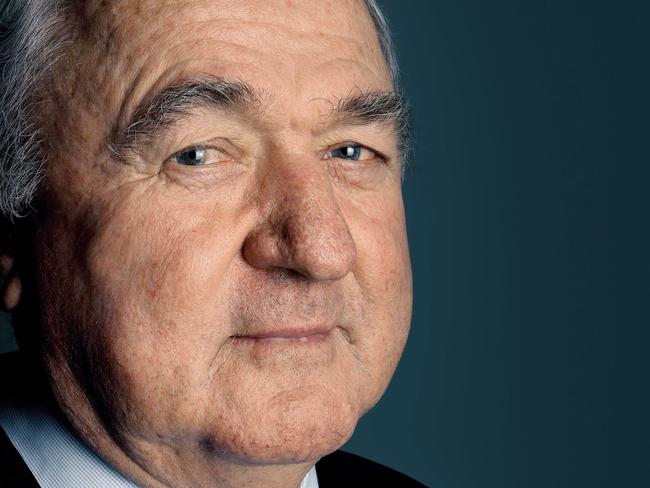

Banking industry elder Don Argus has turned his attention to the likely winners and losers of industry disruption.

More regulations won’t help. Banks must go back to the basic tenets of honesty, integrity and accountability.

The head of the RBA says he is ‘appalled’ by behaviour unveiled by bank inquiry as he flags ‘problematic’ US policy.

AMP kept the trustee of its super business in the dark on a plan to drag out the required MySuper transition.

For Andrew Thorburn, it may have been a challenging meeting to be seated with ASIC officials.

AMP kept the trustee of its super business out of the loop on a plan to drag out the required MySuper transition, inquiry hears.

It could take more than five years for AMP’s super trustee board to learn of poorly performing products, inquiry hears.

Royal commission | “I’m just trying to understand … how this could possibly make sense.”

The deputy chairs of the prudential and market conduct regulators can expect a thorough grilling.

Over five long days, Kenneth Hayne’s royal commission applied the blowtorch to NAB’s superannuation business.

Catholic Super deputy chairman Peter Haysey has defended his $9.3 billion fund’s spurning of a potential merger.

ANZ’s $1 billion sale of its OnePath superannuation business to wealth manager IOOF has come under a cloud.

CBA CEO Matt Comyn lobbied ASIC’s deputy chairman to overrule the corporate regulator’s head of enforcement.

Must you place your superannuation at the mercy of big institutions? The short answer is no.

Documents accusing NAB of criminal offences relating to its fee-for-no-service saga have been aired by the inquiry.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/13