MLC not so super, NAB execs admit

Over five long days, Kenneth Hayne’s royal commission applied the blowtorch to NAB’s superannuation business.

And the pain continues.

Margin Call has found a damning 30-page report in the mountain of documents handed over to the Hayne Show that reveal the board and executive team overseeing Andrew Thorburn’s pinstriped superannuation business MLC were well aware of its many governance problems.

The report — marked “draft & confidential” — was given to Nicole Smith, the then chair of MLC’s corporate trustee NULIS in April, three months before she stepped down from the $280,000-a-year gig, overseeing NAB’s super business, which has $75 billion under management.

The report was done by boutique management consultancy firm Blackhall & Pearl, an outfit that is a bit of a safety house for former NAB executives, including Harry Toukalas, Niki Short and Steven Munchenberg.

Smith, her MLC and NULIS boardmates (who include Richmond football club president Peggy O’Neal), MLC CEO Matthew Lawrance and his executive team were interviewed for the report, which was compiled by Andrea Durrant, a rare Blackhall managing partner who is not a former NAB executive.

The interviewees were self-critical in their anonymous interviews.

“The last three years have been a difficult period for the board,” said one.

“The board doesn’t seem to always operate as a well-oiled machine,” said another.

Asked what problems they identified for the business, boardmates pointed to their overlords at Thorburn’s NAB, who were blamed for “resourcing and hiring freezes”.

Another confessed: “We have little authority and are mainly rubber-stamping.”

Not inspiring stuff.

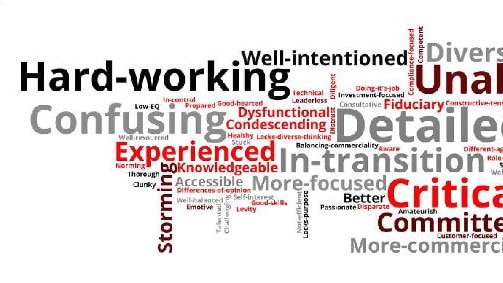

A word-cloud of general descriptions of the NULIS board was probably Margin Call’s favourite of the 30 pages. Words include: “Unaligned … Confusing … Critical … Dysfunctional …. Clunky ...”

All up, the interviewees gave the board a “6 out of 10” for their performance over the last year.

Based on his almost week-long interrogation of the fund’s apparent fees-for-no-service scandal, it’s unlikely counsel assisting Michael “Babyface” Hodge would be so generous.

Within three months of the draft report being handed over, Smith resigned as chairman.

That Smith’s end came weeks before her appearance at the royal commission was a coincidence. She had reached her 12-year maximum tenure.

Never previously explained was the June departure of ex-Macquarie and Deutsche banker Evelyn Horton from the board.

Horton exited in June, after four years as a director.

Based on the unhappy culture documented in the Blackhall report, it’s a wonder she lasted so long.

Fairwater for rent

It doesn’t matter how rich you are, smart investors like to sweat their assets.

The late Lady Mary Fairfax, whose estate is worth north of $600 million, was certainly of that mind when she penned her last will and testament back in July 1999.

Lady Mary, who passed away aged 95 in September last year, has cleared the way for her trustees, including her long-standing personal secretary Lee Thomas, 67, to extract maximum value from her historic Fairwater estate in Point Piper.

Should the trustees see fit, Lady Mary’s will — published exclusively by Margin Call — reveals they have the authority to “rent” out the 8000sq m property, said to be worth more than $100m (which would easily make it the most expensive property sale in Australia), to folks they consider “to be of excellent character to occupy or reside in Fairwater”.

The also allows for Thomas to continue living in the stunning Point Piper mansion, so any rental schemes will have to work around that.

There would be a few international squillionaires who might want to take advantage of the opportunity on a short stay in Sydney.

Meghan and Harry, who are here in October for the Invictus Games and are reportedly scouting for high-end digs, surely pass the character test — whatever the princess’s dad might say to the contrary.

It’s a bit rich

You win some, you lose some.

Such was the case on the sharemarket yesterday for two of Melbourne’s richest investors, shopping centre billionaire John Gandel and packaging billionaire Raphael Geminder.

For Gandel, 83, the cash registers were ringing at Melbourne’s mega Chadstone Shopping Centre, which he owns with the $10.5bn listed Vicinity Centres, now under the direction of new boss Grant Kelley.

Gandel, worth $6.45bn at last local count, owns 17 per cent of Vicinity (worth $1.8bn), and thanks to the 8.2c dividend declared by chairman Peter Hay, the rarely-seen Gandel will be sent a $53m dividend cheque at the end of the month.

Not a bad day at the office.

Things were less happy for fellow southern rich-lister Raphael “Ruffy” Geminder, whose Pact Group had a shocker yesterday thanks to investor fury over an 18 per

cent plummet in profit for the year. Geminder and his wife Fiona, daughter of late box billionaire Richard Pratt, own 38 per cent of packaging group Pact via their private

Kin Group family vehicle.

Ruffy is the listed company’s chairman.

The Geminders were last valued at $1.4bn. That took a $133m hit yesterday as Pact’s share price fell a painful 22 per cent to close at $4.17.

Even for a rich-lister, that has gotta hurt.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout