APRA savages IOOF chief Kelaher at royal commission

APRA has launched a scathing attack on the fitness of IOOF chief executive Chris Kelaher to lead the company.

The prudential regulator has launched a scathing attack on the fitness of IOOF chief executive Chris Kelaher to lead the company, throwing fresh doubts over its billion-dollar takeover of ANZ’s wealth management business.

In a submission to the financial services royal commission, the Australian Prudential Regulation Authority heaped pressure on Mr Kelaher to stand down, telling the banking royal commission he did not understand superannuation law or the obligations of a trustee and made an important “untrue” statement in a letter to it.

MORE FROM THE ROYAL COMMISSION

APRA said it had launched fresh investigations into IOOF and two other big financial institutions tarred in last month’s round of commission hearings into super, CBA and Suncorp.

In a series of submissions to Kenneth Hayne’s year-long inquiry yesterday, NAB, CBA and AMP attempted to argue their way out of recommendations that the royal commission find the retail fund providers breached serious criminal laws.

APRA’s move on IOOF came after sister regulator, the Australian Securities & Investments Commission, last month said it was keeping a close eye on the transaction after Labor senator Deborah O’Neill raised concerns about whether it would be in the interests of ANZ clients to be transferred to IOOF, under a previously announced sale.

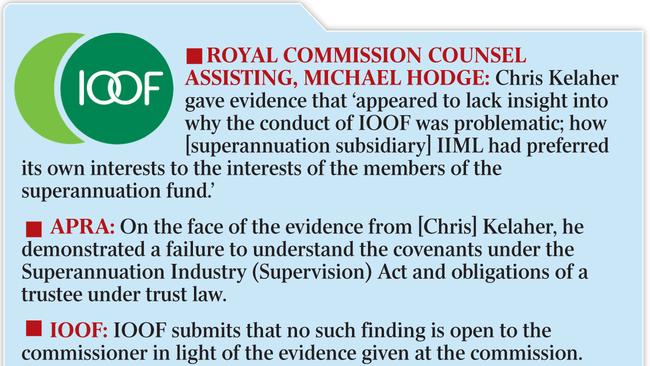

It follows evidence given to the royal commission by Mr Kelaher that triggered a sharp fall in IOOF’s share price and led counsel assisting the royal commission, Michael Hodge QC, to accuse him of failing to understand the company’s obligations under the law.

Mr Kelaher and chairman George Venardos did not respond to calls and text messages yesterday, and IOOF spokeswoman Rachel Scully declined to comment, as did an ANZ spokesman.

IOOF’s already-pressured share price touched a year low of $8.32 before closing the day down 0.71 per cent at $8.36.

The company has this year lost almost a quarter of its market value, with yesterday’s fall bringing the total loss to date to 22 per cent. IOOF has direct funds under management of $21 billion, but its adviser network oversees an additional $100 billion.

Fund manager Legg Mason, which owns 7.5 per cent of IOOF, has consistently declined to comment on Mr Kelaher’s future or its view of his conduct.

“We do not tend to comment on stock positions,” Legg Mason head of marketing Felicity Nicholson said. In 2013, IOOF awarded Legg Mason $100m in tailored equity manager mandates.

Last week, Mr Venardos told The Australian IOOF would hold a board meeting where it would discuss the royal commission and its response. “We’re still considering it. We will respond in due course,” he said at the time.

Counsel for APRA, Robert Dick SC, told the royal commission it agreed with allegations raised against Mr Kelaher that Mr Hodge made in his closing submissions for the super round.

“APRA agrees that on the face of the evidence from Mr Kelaher, he demonstrated a failure to understand the covenants under the SIS [Superannuation Industry Supervision] Act and obligations of a trustee under trust law,” he said. Mr Dick also attacked a letter Mr Kelaher sent APRA last year in which the IOOF chief executive said a plan to remediate an overpayment to a super fund by clawing back distributions made to members “passed the pub test”.

In the letter, Mr Kelaher said an IOOF rectification committee had been offered two options to deal with the overpayment — claw it back immediately or do so over time.

However, in his closing submissions for this round, Mr Hodge said that “this statement to APRA was untrue”. Mr Dick agreed.

“It also appears on the evidence before the commission that an important statement made in a letter to APRA dated 19 April 2017 was untrue,” he said.

In its submission, IOOF said this finding was not open to commissioner Kenneth Hayne.

“The absence of documents recording these matters cannot support a conclusion that the statement in the letter was untrue,” the company said.

It said there was “no basis” to find the company did not understand its duties under the SIS Act or as a trustee.

ASIC last month told parliament it was watching the ANZ transaction, which is due to complete next year.

If completed, it would more than double IOOF’s existing client base of about 500,000 by adding fresh clients from ANZ’s wealth business, OnePath, totalling about 770,000. It would also almost double IOOF revenue to more than $900 million.

During oversight hearings, Senator O’Neill challenged ASIC commissioner John Price on whether it was “in the best interests of ANZ customers to be sold to IOOF”. “That’s actually quite an important legal question that the trustee of the ANZ funds will need to come to a conclusion about before the transfer can occur,” Mr Price said.

He said ASIC was “absolutely” keeping a close eye on the issue.

“If your question is: is that a matter where ASIC may also have a strong interest in understanding the reasons why … Then the answer is yes.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout