Banking royal commission: APRA ups pressure on IOOF boss, banks deny serious breaches

The banks have pushed back against serious breach allegations as APRA unloads on IOOF’s boss in super round submissions.

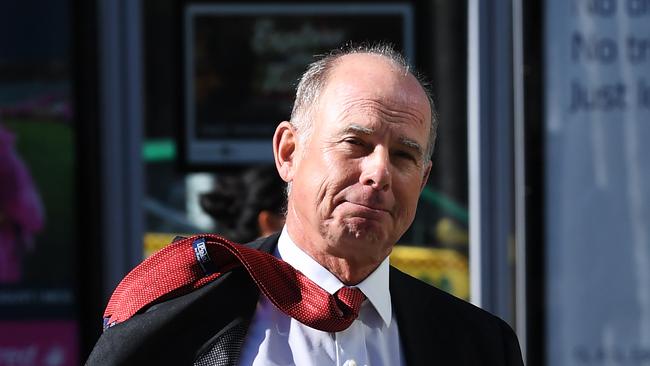

The prudential regulator has raised questions about IOOF boss Chris Kelaher’s suitability to run a fund, telling the banking royal commission he does not understand his obligations as a superannuation trustee and he made an important “untrue” statement in a letter to it.

In a submission to the commission, the Australian Prudential Regulation Authority also said it would re-open investigations into IOOF, CBA subsidiary Colonial First State and Suncorp because of evidence at the inquiry’s most recent round of hearings, into superannuation.

Meanwhile, AMP and NAB have denied serious breaches of the law, including crimes, while CBA emphasised it had made a “genuine misunderstanding” of its obligations under the Corporations Act, in their submissions to the commission, released today.

“APRA agrees that on the face of the evidence from Mr Kelaher, he demonstrated a failure to understand the covenants under the SIS [Superannuation Industry Supervision] Act and obligations of a trustee under trust law,” the regulator’s counsel, Robert Dick SC, told the commission.

Mr Dick also attacked a letter Mr Kelaher sent APRA last year in which the IOOF chief executive said a plan to remediate an overpayment to a super fund by clawing back distributions made to members “passed the pub test”.

In the letter, Mr Kelaher said an IOOF rectification committee had been offered two options to deal with the overpayment — claw it back immediately or do so over time.

However, in his closing submissions for this round, counsel assisting the commission, Michael Hodge, QC, said that “this statement to APRA was untrue”.

Mr Dick agreed.

“It also appears on the evidence before the Commission that an important statement made in a letter to APRA dated 19 April 2017 was untrue,” he said.

Mr Dick said APRA was actively considering litigating against IOOF.

He said that in the cases of IOOF and CFS, the hearings “brought additional information to light, some of which appears inconsistent with information previously provided to APRA”.

“APRA is examining these issues further to consider whether additional action is necessary.”

IOOF denied any wrongdoing by it and denied Mr Kelaher misled APRA in the letter.

“The absence of documents recording these matters cannot support a conclusion that the statement in the letter was untrue,” it said in an unsigned submission.

“Far more would be required by way of evidence, particularly given the evidence of Mr Kelaher which was to the same effect as the relevant statements in the letter to APRA.”

In the case of Suncorp, APRA said it was investigating revelations the company paid itself tax refunds reaped by a super fund.

“APRA is considering this material further,” he said.

“Based on the facts presented, APRA’s prima facie view is that aspects of the arrangement referred to may not be consistent with the requirements of Prudential Standard SPS 231 7 Outsourcing.”

Suncorp denied breaking the law, saying the decision was “a proper exercise of a trustee’s right of indemnity by way of exoneration in respect of properly-incurred expenses”.

NAB

NAB, which dominated the hearings last month, admitted to misconduct and conduct falling below community expectations, saying “mistakes have been made” in fee-for-no-service scandals exposed by the commission, but denied the most serious breaches of the law alleged by Mr Hodge and defended head of wealth Andrew Hagger against accusations he misled the corporate regulator.

It also denied committing a crime by failing to report a serious breach of its license within 10 days, as required by the Corporations Act.

“ NAB strongly refutes any suggestion that it, or any of its officers and employees, have displayed disrespect or disregard for the law, the regulator or members [of super funds],” counsel for the bank, Neil Young QC, said.

Mr Young accepted NAB breached provisions of the Corporations Act requiring it to offer financial services efficiently, fairly and honestly by charging fees for financial advice to fund members who had no financial adviser.

But he denied the bank breached similar laws covering superannuation, saying the Superannuation Industry Supervision Act did not impose an “absolute standard” that trustee companies made sure members actually got the services they paid for and it would be impractical to do so given the fund had 1.2 million members.

The bank denied its super trustee, NULIS, failed to act in the best interests of members, saying the duty to do so was “not absolute” and denied NAB sought to minimise how much compensation was to be paid to members ripped off in the fee-for-no-service scandal.

“In reality, the above evidence reveals an unexceptional engagement between an entity and a regulator concerning remediation,” Mr Young said.

However, he accepted that NAB “may” have engaged in misleading and deceptive conduct in communications with members by not telling some a fee would still be charged even though they had no financial adviser and failing to tell others they could opt out of a fee.

“NULIS acknowledges that communications to members could have been clearer,” he said.

He denied NAB committed a crime by not reporting a breach it knew about since 2013 until Christmas Eve, 2015.

He said the company only realised it was a serious breach the day before.

“NAB and NULIS accept that breach reporting was an area which needed improvement (which has now occurred),” he said.

“However, there is no evidence at all before the Commission of any intentional failure to report breaches to ASIC.”

And he staunchly defended Mr Hagger over an episode in which the executive did not mention NAB’s fee-for-no-service bill was about to soar to ASIC commissioner Greg Tanzer.

The lack of fresh information made NAB look good in a report ASIC released on the issue.

“NAB refutes the allegation that it departed from community standards and expectations in its dealings with the regulator, and in particular that it was not ‘full and frank’ in its dealings with ASIC,” Mr Young said.

Mr Young’s submission did not address evidence before the commission that when he spoke to Mr Tanzer, Mr Hagger had just stepped out of a board meeting that had approved the increased compensation.

NAB also denied breaking the law by continuing to pay lucrative grandfathered trailing commissions to advisers, contrary to the best interests of members, when it transferred members from one fund to another in a successor fund transfer.

“The decision made regarding commissions in the context of the SFT did not involve NULIS entering into consideration of the broader question as to whether the grandfathering of commissions should continue,” he said.

Nor did NAB fail to act in the best interests of members when it took years to move members from a high-fee fund to a low-fee MySuper fund.

The bank also denied breaking the law by failing to invest MySuper in illiquid assets because NAB wouldn’t allocate any budget to do so.

“On the contrary, that evidence indicates that, upon underperformance being identified and attributed to the fund’s lower allocation to unlisted assets, the matter was appropriately addressed,” Mr Young said.

AMP

AMP, which manages $120 billion of superannuation savings, argued against a bevy of recommendations that it breached the superannuation act by failing to operate in the interests of members and said its “conflicts are appropriately managed”, as it rejected “any suggestion that they have failed to meet their obligations”.

However, AMP did concede that it was open to finding it had breached the Corporations Act and the SIS Act relating to a number of high-fee low-return cash products that whittled away member savings with negative returns.

But AMP denied this failure had anything to do with a conflict of interest in its business, as it also hit back at recommendations it breached the law by entered into arrangements that hindered it from acting in members’ best interest.

Internal assessments of AMP’s super products found them to be regularly among the worst performing in the country and that its fees were often among the steepest.

AMP also said there was “no basis” for allegations it breached the law by letting its various arms dictate the legally required transfer of old funds to newer low-fee vehicles. The “fact” that other parts of the AMP Group “needed to sign off on the proposed pricing” of its ostensibly low-fee MySuper products was not “inconsistent” with its argument that the trustee had ultimate control of the savings, it said.

“The evidence shows that the Trustees have consistently advocated for the financial interests of the members,” AMP said.

The royal commission heard AMP had policies which meant the board of its superannuation business was not told about “significantly underperforming” products for more than five years, and that its complex web of subsidiaries kept the trustee of its superannuation business in the dark over its strategy and plans, including one to drag out the legally-required transition to low-fee funds, to retain up to $86.5 million of future profits.

“AMP’s outsourced model is effective,” AMP said.

The royal commission heard AMP only found out about members with negative returns in cash products after the prudential regulator told the superannuation industry it was doing a sector-wide review of cash investments run by nest egg managers.

Despite this, AMP claimed it was not open to find its trustees were “wholly dependent” on investment information given to them by AMP’s various money managers, nor did this have an impact on its ability to comply with superannuation laws.

Rather, AMP said its business monitoring policy was “generally effective in bringing issues to the trustees’ attention”.

AMP also said it did not breach its duties by being unable to lower fees for savers, arguing the trustees “can, and do cause their outsource providers to lower fees” and that its trustees were “a better position to agitate for change in circumstances where the services are provided by related entities” rather than on the open market.

Despite this, AMP only reduced pricing for its MySuper members once in the last five years — just weeks before the royal commission’s superannuation hearings. It said it took so long to make these decisions as it did not want to see its various businesses lose money.

“Of course, the trustees would always like fee reductions to occur sooner, but, as noted above, processing fee reductions takes some time because it is necessary to ensure that any reduction is sustainable and does not impact on the viability of the funds or their outsource providers,” AMP said.

AMP also said its trustee did not have an “obligation” to monitor the financial advice given by AMP advisers, which saw one customers losing money on their superannuation after it was invested wholly into a high-fee cash fund. “There is a separate regulatory framework that regulates the provision of advice,” AMP said.

CBA

Commonwealth Bank admitted it had breached the Superannuation Act in fumbling its way through a 2014 requirement to move assets to low-fee funds, but hit back at a raft of other recommendations of misconduct.

The nation’s largest bank accused Mr Hodge of “conflating” circumstances around CBA’s legally required transfer of funds from high-fee legacy products to low-fee MySuper products with a “separate” breach where it accepted new savings into the legacy products and then attempted to cover up the snafu by asking savers to nominate an investment choice so they would not have to be transferred to a low-fee default product. Rather than breaching the law, CBA said this was evidence the trustee “recognised the risk” in transferring its customers to the MySuper product.

In response to a recommendation that CBA committed more than 13,000 criminal breaches by failing to transfer members, the bank accepted it has contravened the section of the Superannuation Act by accepting contributions into the legacy products. But CBA said it did not accept the breach came with the “necessary degree of moral obloquy” to warrant a breach of the Corporations Act, putting it down to a “genuine misunderstanding” of the law.

CBA said it was “genuinely of the belief” the members in the fund it failed to transfer across wanted to be in higher-fee products as they were advised customers.

However, CBA also hit back at suggestions it had breached best interests duties, arguing its trustee’s habit of charging trailing commissions, its commitment to acting honestly and fairly and to manage conflicts of interest could not “be assessed in a vacuum”. Pointing to a series of legal case studies, CBA said the “mere assertion of a failure to act in the best interests of members is problematic”.

Westpac

Westpac admitted to breaching its obligation under the Corporations Act to act efficiently, honestly and fairly when providing a financial service by charging about 760 customers of its BT subsidiary fees for no service.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout