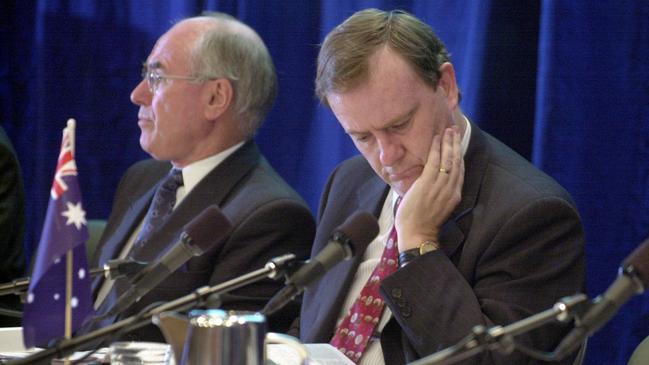

2002 Cabinet Papers: John Howard, Peter Costello say Australian governments ‘robbing future to pay for present'

John Howard and Peter Costello urge major parties to prioritise deficit and debt reduction to protect the nation from the next major economic shock.

John Howard and Peter Costello have urged the major parties to make deficit and debt reduction a major priority otherwise Australia will remain vulnerable in the event of another major economic shock like the global financial crisis or pandemic with little capacity to respond effectively.

In exclusive interviews with the former Prime Minister and Treasurer, they said the first intergenerational report 20 years ago made clear the significant fiscal challenges facing future governments as the population aged and demands on the budget would increase.

“I don‘t think governments subsequent to mine were as vigorous as they should have been in running a strong fiscal policy,” Mr Howard told The Australian. “There were particular pressures because of the pandemic, but we stopped obsessing about fiscal balances some years ago.

CABINET PAPERS 2002

‘Advantage lost’: Costello slams inaction on debt

Twenty years after warning cabinet of significant future budget pressures, former Treasurer Peter Costello says the fiscal and debt position of the nation is far worse than it needed to be.

‘I don’t have time for egomaniacs who take notes’

Amanda Vanstone lifts the lid on her time in cabinet, including her dealings with John Howard and disdain for ministers more concerned with publishing memoirs than serving the community.

Why Howard government refused to say sorry

Fears that present day Australians would be held responsible for atrocities of the past were behind the Howard government’s refusal to apologise to Indigenous Australians in 2002.

Hicks’ Guantanamo detention ‘lawful’, government ruled

Australian and US governments agreed on the need for a ‘consistent public position’ on Guantanamo detainee David Hicks, cabinet minutes from February 2002 reveal.

‘Why we never ratified Kyoto was beyond me’: Costello

Peter Costello laments rejection of 1997 Kyoto Protocol as cabinet documents from 2002 reveal Treasury argued for incentives to invest in cleaner energy.

Howard warns on ‘reform fatigue’

John Howard and Peter Costello urge major parties to prioritise deficit and debt reduction to protect the nation from the next major economic shock.

How Kyoto rejection kickstarted the climate wars

Concerns the Kyoto protocol would ‘risk Australia’s competitive advantage in emissions-intensive activities’ were one reason behind Howard government’s refusal to ratify the agreement.

Frustration over new security laws post-9/11

The Department of Prime Minister and Cabinet feared its inability to get state agreement on contentious new security measures in the wake of September 11.

How 9/11, Bali bombings changed our military

With the threat of terrorism looming large, the Howard government created a national special forces command to ensure ‘surgical’ military responses.

Release of Bali bombmaker ‘regrettable’

Former PM sympathises with victims and relatives over early release from jail of Bali bombmaker Umar Patek.

Australia wary of Afghanistan troop commitment

Declassified national security committee documents reveal that in June of 2002, Defence argued it was ‘not in a position to contribute’ to UN force in Afghanistan.

Christmas Island detention centre’s fast-tracking revealed

The Howard government fast-tracked plans to build the first ‘purpose-designed and built’ offshore detention centre controlled by Australia in 2002.

Timor Sea Treaty negotiations to be kept under wraps

Disclosure of details on joint resource-sharing agreement between East Timor and Australia would “damage security”, National Archives rules.

Push to restrain growth of disability pension

Concerns over ‘inappropriate access’ to the Disability Support Pension prompted Howard government to introduce measures to reduce number of recipients, cabinet papers from 2002 reveal.

“I think people have got a bit tired of reform, reform fatigue has set in, and that applies to both sides of politics. I understand why it has happened, but it doesn‘t justify it having happened. My mantra is that economic reform is like being in that never ending foot race.”

Mr Costello, who delivered the first of five intergenerational reports in 2002 and as Treasurer delivered 10 budget surpluses and paid of $96bn in government debt, told The Australian that successive Liberal and Labor Treasurers had missed opportunities for major economic reform.

“The contemporary lesson is you have got to seize opportunities and the IGA gives the Treasurer and the government a great opportunity to let the public in on long term thinking,” Mr Costello said. “If you don’t want to take that opportunity you will miss it.”

“We put all these long term issues on the table – the decline in fertility, the ageing of the population, increasing expenditures – and the need to take gradual steps over a long period to address these things. But I don’t think things have improved since the first IGA but we’ve just lost our stomach to deal with it.”

The interviews with Mr Howard and Mr Costello coincide with the release of cabinet records from 2002 by the National Archives of Australia on January 1, 2023.

These cabinet records chronicle the cabinet’s response to the Bali bombings, implementation of new counter terrorism and border security initiatives following the September 11 terrorist attacks, the financing of offshore processing facilities for asylum seekers, the continuing war in Afghanistan and new defence procurement, negotiation of the Timor Sea Treaty, the decision not to ratify the Kyoto Protocol on climate change, welfare reform in response to the McClure Report and the first intergenerational report.

Despite higher than expected receipts and lower than expected payments, the budget underlying cash deficit for 2021-22 was $32bn (1.4 per cent of GDP). Australia’s net debt at the end of the last financial year was $515.6bn (22.5 per cent of GDP) and interest payments on that debt is the fastest growing area of government expenditure.

Mr Costello said there should have been a stronger commitment made to fiscal repair and debt reduction after the global financial crisis and the Covid-19 pandemic, and said it was now an urgent responsibility for both Labor and the Coalition to commit to.

“Through the global financial crisis, the government moves into deficit and the government ratchets up debt, and when we come out that crisis, instead of turning the budget to surplus and paying the debt back, we just kept the debt marginally increasing,” Mr Costello said.

“We go into the coronavirus pandemic and we lift debt again. So, we have had two down cycles now and on neither of occasions as we came out of them have we said, ‘Right, now is the time to put the budget in surplus and pay the debt back’. So, we will go into the next downturn – there will be one – with debt ratcheted up. So, we have lost our advantage.”

Mr Howard supported temporary additional spending in response to the pandemic but said the failure to fast-track the budget towards a sustainable surplus meant that Australia was “not as well prepared now as we should be” for future shocks. He advocated further taxation reform to “increase the reliance on indirect tax” and “reduce the burden on personal tax”.

Mr Costello said the debt burden being placed on future generations by recent governments was unfair and both Labor and Liberal Treasurers had decided to “rob the future to pay for the present” rather than tackle debt and deficit.

“We are now in the best terms of trade ever recorded in Australia’s history,” the former Treasurer said. “The greatest since the gold rush, with iron ore prices, gold prices and gas prices. But we haven’t had a surplus budget in 15 years and it doesn’t look like we are going to have one any time soon, even with these record terms of trade.”

“(Debt) won’t be paid off in our lifetimes. In fact, it is not even the government’s policy to pay it off now; it’s the government’s policy to keep the debt and try and shrink it in proportion to the economy. It is not its policy to pay it back; that’s not anybody’s policy now.

“The unfortunate thing for young Australians is that a large portion of their taxes will go to service interest bills from previous generations’ debts. It won’t go to build their own schools and their own hospitals, it will go to service the debt of the previous generation. I think it is very unfair.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout