ASX notches five-day streak, 4.2pc weekly gain

A late surge sent the ASX to a fifth consecutive daily gain, taking its weekly lift to 4.2pc as banks built on a recent rally.

- HSBC tips $A to hit US75c

- Kogan hits record high

- UBS upgrades Westpac, NAB

- ANZ facing NZ action over insurance

That’s all from the Trading Day blog for Friday, June 5. The Australian sharemarket has come back from an early loss off the back of strength in financials to notch a fifth day of gains and take its weekly lift to 4.2 per cent. Locally, ANZ announced it was facing NZ action over an insurance bungle, while a UBS upgrade supported the major banks.

US futures suggest gains to come overnight, after a mixed session on Thursday.

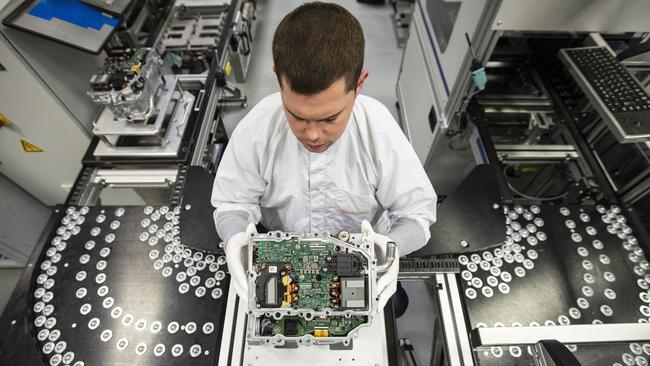

Glenda Korporaal 8.41pm: ‘New-collar’ jobs to lead the future

Former leading industrialist Andrew Liveris says Australians should stop thinking in terms of creating white-collar or blue-collar jobs and recognise that future manufacturing employment will be seen as “new-collar” jobs.

“As supply chains and factories become digital, as both existing factories get modernised and new modern factories get built, the skills to operate and build and deliver products and services to the consumer will be higher in technology content, and geared to a human/machine interface,” he said.

“These jobs will no longer be categorised as white-collar or blue-collar, but as new-collar jobs. They will be higher quality, less physical and more interesting. They will be available to high school or university graduates. Education will need to be modified to allow access to all for these skills.”

Mr Liveris is the former CEO and chairman of the Dow Chemical Company and was recently appointed an adviser to the National COVID-19 Co-ordination Commission which is charged with reporting to the federal government about building a new manufacturing sector.

In The Deal, Mr Liveris says the 21st-century roles will be “quality jobs, not quantity jobs”. They would be highly paid and in high-margin sectors.

He identified skills in design, programming, project management and product development as key to Australia’s future employment growth.

James Kirby 8.13pm: Super trap: Are you at risk?

Inside the financial advice sector they’ve been talking about it for years — the super trap, a zone you do not want to be in where you have too much saved to be on the pension but not enough to get the full benefits of being an independent investor.

It has never been easy to pin down the numbers on this issue. But now thanks to a paper for the Actuaries Institute the numbers are clearer: the trap zone is revealed as somewhere between $300,000 and $800,000.

There are two groups that get stuck in this zone. The first is those who have saved just a little more than is required to qualify for a full pension. The second group are already retired and are so worried about how long they might live that they opt for a life of “genteel poverty”. It’s the old problem of those in the middle getting the worst deal.

Jared Lynch 7.54pm: Call to abolish luxury car tax

Auto brands from Toyota to Audi and Mercedes-Benz are calling for the Morrison government to dump its luxury car tax, and the states to provide stamp duty relief to help struggling dealers after new car sales crash to their lowest levels in 30 years in the wake of the COVID-19 pandemic.

The two taxes comprise about 10 per cent of the cost of a $70,000 car, on top of GST, which is another 10 per cent. Carmakers say it is “a tax on a tax” and axing it would provide an urgent stimulus to car dealers.

And it is not just applied to prestige brands. Toyota sales attracted the highest luxury car tax (LCT) total in 2019: $119m.

Alan Kohler 7.14pm: Not a normal recession

This is not a normal recession — it’s an act of parliament.

A lot of analysis of the March quarter national accounts, including by the government, seems to be based on the idea that we’re in a normal, cyclical recession. We’re not.

It’s true there will be two consecutive quarters of negative GDP, so it’s technically a recession, but it’s not normal and it’s not the cycle.

Even calling it a recession at all is false: more precisely, it’s the closure of parts of the economy by the government for health reasons, with partial compensation.

You might think it doesn’t matter what you call it, that it’s just semantics and, anyway, it had to happen.

It’s true that it had to happen, but the naming is important: governments are acting like they are gallantly mopping up with Keynesian fiscal policy after a private sector recession that came out of the blue. But that simply isn’t what happened.

Ben Wilmot 6.46pm: Rethink on residential property forecasts

The introduction of the Morrison government home stimulus package and surprisingly steady home price values in the month of April have prompted some analysts to retreat from their glum housing forecasts.

With the stock market putting the coronavirus crisis behind it the housing market is still tipped to fall but far less than widespread predictions, including the Commonwealth Bank warning of a 32 per cent fall if there was a “prolonged” slump.

In one of the latest revisions UBS analysts softened their forecast of house price falls from close to 10 per cent back down to a fall in the 5 to 10 per cent range.

AMP chief economist Shane Oliver this week also pulled back from earlier predictions of a 20 per cent plunge if the downturn had been extended and is now forecasting a more moderate house price dip.

The market’s resilience has surprised some players but is in keeping with the relatively high demand for the limited stock available, according to a new realestate.com.au index.

UBS economists George Tharenou and Carlos Cacho and analyst Jim Xu said that resilient building approvals and the $688m HomeBuilder stimulus led them to upgrade their forecasts of 2020 housing starts to 153,000 from 130,000.

“However, we now expect home prices to fall by 5 per cent to 10 per cent over the next year versus our prior forecast of towards 10 per cent,” UBS said.

David Ross 6.17pm: CBA fined for agri account breaches

Commonwealth Bank has been slapped with a $5m fine in the Federal Court after it found the country’s biggest retail bank failed to provide customers the benefits of an AgriAdvantage Plus Package they were sold by the bank.

The scheme, sold to farmers between 2005 and 2015, entitled customers to fee waivers, interest rate discounts and bonus interest on savings, in exchange for the payment of package fees on 22 CBA products.

Customers paid $300 as an annual fee to access the package between 2005 and 2010, while after November 2010 they were required to pay a one-off establishment fee of $1000 or 0.25 per cent of total borrowing plus the $300 fee.

John Stensholt 5.45pm: AFL asks Sportsbet to curb ad controversy

The AFL has demanded assurances from one its biggest sponsors that they will curtail some of their controversial advertising ahead of the code’s return to the field next week.

Sources have confirmed with The Australian that the AFL wrote to wagering market leader Sportsbet this week about their sponsorship deal, worth about $8m annually and one the betting giant is set to assume after its recent merger with BetEasy.

Sportsbet’s irreverent advertising and branding campaigns have long attracted the attention of punters, making it an essential part of the company’s rise to becoming entrenched as the biggest digital or corporate bookmaker in Australia.

Leo Shanahan 5.20pm: Deal ‘close’ for AAP newswire

AAP boss Bruce Davidson has said the company has agreed terms with the Peter Tonagh-led consortium for the sale of the newswire service.

Mr Tonagh, a former News Corp and Foxtel CEO who is leading a consortium to buy the business and told The Australian he was hopeful of an announcement before the weekend that would see an agreement on a term sheet for the purchase of the 85-year-old business.

AAP chief executive Bruce Davidson told staff on Friday afternoon there had been an agreement on general terms with the hope of an agreement on a final sale in the next two weeks.

Gerard Cockburn 4.49pm: Hostplus pays out $1.3bn in early super

Major industry fund Hostplus has been sapped of $1.29bn from members claiming financial hardship due to the coronavirus crisis.

As of May 31, Hostplus has processed 188,056 withdrawal requests through the federal government’s early release of super scheme.

The scheme was implemented as a financial assistance measure in response to COVID-19. People who have become unemployed or experienced a reduction in working hours are eligible for the package.

“Our staff are working around the clock to ensure our members can access their funds as soon as possible during this challenging time,” Hostplus chief executive David Elia said.

“Unfortunately, some requests have been delayed due to the need to conduct further compliance checks or if there is a need for the member to update their account details.”

4.36pm: Banks rally 20pc in two weeks

Friday’s lift marked a second week of outperformance by the major banks, helping the financial sector to a 19 per cent gain for the fortnight versus the wider benchmark’s lift of 9.1 per cent.

UBS banking analyst Jon Mott said the sector looked “relatively attractive” given low returns and expensive valuations in other asset classes and parts of the market as he upgraded Westpac and NAB to Buy.

The upgrade prompted a 3.4 per cent lift in Westpac to $18.79 while NAB added 3 per cent to $19.48. Across the rest of the majors, Commonwealth Bank added 1.6 per cent to $68.73 and ANZ rose 2.9 per cent to $19.77.

Regional peer Bank of Queensland also go a lift – gaining 9 per cent to $6.21 while Bendigo and Adelaide Bank gained 4.7 per cent to $7.32.

Here’s the biggest movers at the close:

4.12pm: ASX notches 5-day win streak

Australian shares recovered from an early slip to notch a five-day winning streak on Friday, looking past economic blues to focus on the path to recovery with a switch from growth stocks to value.

A mixed night on Wall Street set the benchmark ASX200 up for a rocky start, but an upgrade on the financial sector from influential broker UBS was just what the market needed to push higher.

At its worst the ASX was down by 0.5 per cent but by the close the index was higher by 7 points or 0.12 per cent at 5998.7 – cementing a weekly gain of 4.2 per cent.

On the All Ords, shares finished higher by 5 points or 0.07 per cent to 6116.5.

AUDUSD last up by 0.7 per cent to US69.92c.

4.03pm: Currencies, stocks turn risk-on

It’s risk-on in currencies and stocks ahead of US non-farm payrolls data.

AUD/USD rose 0.9pc to a new 5-month high of 0.7004 and the S&P/ASX 200 share index rose 0.4pc to an intraday high of 6017.8.

The extension of intraday gains came as S&P 500 futures rose 0.9pc to 3137.38. Meanwhile 10-year AU bond yields rose 7 bps to a 10-week high of 1.092pc

It looks like global markets are preparing to “look past” what are expected to be better but still-bad US non-farm payrolls data.

Jared Lynch 3.47pm: Shares unfazed by CSL vaccine deal

Australia’s biggest health company CSL says it has the capability to produce 100 million COVID-19 vaccine doses by the end of next year if clinical trials are successful.

CSL has entered into a partnership with the University of Queensland (UQ) and Oslo-based Coalition for Epidemic Preparedness Innovations to accelerate development, manufacturing and distribution of a COVID-19 vaccine, which it expects will be available in 2021.

Already early preclinical results of UQ’s COVID-19 vaccine candidate have shown it produces high levels of antibodies that can neutralise the virus.

CSL last traded down 2.5pc to $287.

Read more: CSL can make 100 million COVID vaccines

3.13pm: Altium discounts prompt BP downgrade

Heavy discounting of Altium’s subscription services has prompted Bell Potter to trim its earnings per share forecasts and downgrade the stock to Sell.

Analyst Chris Savage writes that discounts on Altium’s products were expected given the company’s target to reach 50,000 subscribers, but 40 per cent was more than the broker had forecast.

“This seems quite aggressive and is likely in response to some inertia from customer’s preserving cash,” Mr Savage writes.

“It also suggests that revenue this month from AD licence sales will be lower than anticipated and the shortfall in FY20 revenue relative to the previous aspirational target of $US200m will be greater than we had forecast.”

Last month, the electronics software maker warned of more headwinds from the COVID-19 pandemic after observing distress among start-ups and smaller companies in April.

Bell Potter cut its rating on the stock to Sell, with a target price of $32.50.

ALU shares last traded down 4.6 per cent to $34.77.

Read more: Altium warns of pandemic pain ahead

2.28pm: Pilbara Minerals leads lithium jump

Lithium miners are on a tear in afternoon trade, led by a 21pc jump in Pilbara Minerals, as Germany last night announced further stimulus for the electric vehicle industry.

As part of a huge economic stimulus plan, Germany doubled its electric vehicle incentives, and excluded petrol and diesel cars.

The boost for the sector is fuelling a rise in locally listed miners – Pilbara Minerals is higher by 20.7pc to 35c while Orocobre is adding 5.6pc to $2.83 and Galaxy is up by 13.2pc to 94.5c.

2.01pm: Kogan hits record high

Online retailer Kogan.com has set a new record high on Friday, after posting strong sales momentum amid the coronavirus shutdown.

Shares hit a high of $13 apiece in early trade, and last traded up 8.5pc to $12.37.

RBC analyst Tim Piper notes that the company has been a beneficiary of the “structural step-up change in online shopping”.

“This online shopping shift has continued to play out through May, and Kogan’s marketing activity has resulted in strong operating leverage in May with year-to-date 4Q20 earnings up 200pc and run-rating at $7m a month,” he writes.

“The outlook for sales from here is a little more uncertain when the economy reopens and government stimulus begins to wind down in coming months; however, Kogan has acquired a significant number of new customers at low cost over the past couple of months.”

Kogan $KGN is in its 12th straight week of gains. Up 10% this week & up 62% this calendar year #ausbiz https://t.co/QJaION30Ei

— CommSec (@CommSec) June 5, 2020

1.55pm: Beware rising bond yields: CS

Credit Suisse macro strategist Damien Boey warns investors to guard against a sustained rise in bond yields.

Australia’s 10-year yield has surged from 0.90pc to a 10-week high of 1.08pc in the past three days.

“We understand that investors will celebrate higher bond yields as a sign that growth is returning amid stimulus and reopening efforts,” Mr Boey says.

“Some might even be tempted to interpret curve steepening as a signal for value, financial and cyclical recovery in earnest within the equity market.

“However, we also note that US equities are trading on such stretched valuations on a through-the-cycle basis, that they are priced for negative returns on a 10-year horizon, and vastly inferior returns to bonds.

“In other words, the equity risk premium is effectively negative, meaning that valuation is a major constraint on the market, notwithstanding recovering growth expectations.”

US equities in particular “cannot absorb higher interest rates”, yet if inflation becomes a threat, central bankers will at some point have to taper or tighten, “wrong footing anyone positioned for lower-for-longer rates and lower-for-longer volatility”.

And he’s concerned that more shocks or higher uncertainty could see passive and risk-parity funds liquidate in a potentially broad and disorderly fashion.

1.24pm: ASX turns positive

Australia’s S&P/ASX 200 share index has just turned positive intraday.

The index rose 0.1pc to 5997.3 after falling 0.5pc to 5963 this morning as S&P 500 futures rise 0.4pc ahead of US non-farm payrolls data tonight.

The Financials, Energy, Industrials and Real Estate sectors are leading gains amid a switch from defensives and growth to value.

NAB and Westpac are up about 3pc after UBS upgraded to Buy while former market darlings including CSL and Afterpay are down more than 3pc.

Afterpay fell even though Bell Potter’s Lafitani Sotiriou raised his target price by 26pc to $65.

1.15pm: HBSC tips $A to hit US75c

HSBC currency strategists have revised up their Australian dollar forecasts after the currency bounced 27pc in the past three months.

They now see AUD/USD rising steadily to US75c at mid-2021, up from a previous forecast of US70c.

“Historically it has been a good time to buy the Australian dollar in the depths of a global recession,” say HSBC strategists led by David Bloom.

“We recognise that this economic recovery is likely to be very different and the Australian dollar is vulnerable to false starts.

“Nevertheless, beyond the initial Risk On-Risk Off phase, we see four factors that should be viewed as AUD-supportive over time.”

Those factors are greater fiscal flexibility; unconventional monetary policy differentials; a more resilient external position; and cheap valuations.

But unlike previous recoveries where the AUD has been able to rely on rising interest rates and a booming terms of trade to propel it higher, these drivers “tend to be more structural than cyclical”, so the rally should be “more like a marathon than a sprint”, and the currency should throttle back and gains to proceed at a steadier pace”, they say.

AUD/USD last at 0.6949.

1.01pm: CSL drag offsets bank rally

Lift in the major banks has pared much of the market’s intraday losses, but shares remain marginally on the back foot at lunch.

At 1pm, the benchmark ASX200 is off by 5 points or 0.1 per cent to 5986.4.

Upgrades for NAB and Westpac have spurred both to jump by 2.9pc while Commonwealth Bank trades up by 1.5pc and ANZ higher by 2.2pc.

Elsewhere, CSL is winding back by 3.7pc, even after announcing a deal with University of Queensland to manufacture 100 million COVID-19 vaccine doses.

Rosie Lewis 12.25pm: Investment test won’t lift tensions: PM

Scott Morrison has rejected suggestions the government’s new national security test for foreign investment bids will create further tension with China.

“No, I don’t believe why it should. Countries make decisions on their own interests for their own rules and we respect the rules and interests of other countries so I see no reason why that should be the case,” he says.

“Australia will always design its foreign investment rules on that basis as other countries do there. So I don’t think there is anything extraordinary about that.”

Asked if the government could resume ownership of the Port of Darwin as a last resort, the Prime Minister says the sale to a Chinese company was not done with the federal government’s authority and was a decision solely of the Northern Territory government.

“The wisdom of that decision or otherwise can only be explained by the Northern Territory government at that time (in 2016) which was obviously different to the government we have today,” the Prime Minister says.

Read more: Foreigners face tougher security test to invest

Gerard Cockburn 12.18pm: Commonwealth Super Corp names new boss

Former industry fund boss Damian Hill has been appointed chief executive of the $50bn Commonwealth Superannuation Corporation.

Mr Hill will commence the role in July, taking over from inaugural chief Peter Carrigy-Ryan who has held the role since 2011.

Mr Hill was chief executive of the Rest Industry Fund from 2006 to 2018.

The Australian previously revealed that the CSC, which is the default superannuation scheme for federal government employees, has paid more than $100m to public servants and military personnel under the early release of super scheme.

Read more: Public servants rush to cash out super claiming hardship

12.00pm: Why markets are rallying: Citi

Citi’s global strategy team, as lead by Robert Buckland have identified five key reasons global markets are rallying, noting no further gains on the global benchmark MSCI index to mid-2021.

Mr Buckland writes that the recent stock re-rate is impressive given the experience in previous global recession, when the peak-to-trough fall in equities was similar to the drop in EPS.

Here’s their reasons:

- Central bank liquidity

- Cheap relative valuation of equities

- Short covering – the prospect of $6tr of global QE over the next 12 months has triggered a huge short squeeze

- Narrow leadership by a few big Tech stocks – although “still trivial compared to the 2000 bubble”

- Increased focus on 2021 and the subsequent recovery but Citi says market estimates are too high

“At the start of the year, the bottom-up analyst consensus was for global EPS growth of 10pc in 2020. Now, they are expecting -19pc. We think that the actual outcome could be -50pc,” Mr Buckland adds.

11.37am: Collins St Value Fund snags 13pc return

Collins Street Value Fund has done it again with a 13 per cent net monthly return for May, on top of a 13 per cent return in April.

With a 7pc net return for the 3 months to May 31st, the boutique value fund beat its benchmark All Ords index by 16pc net after fees for the 3 month period which has included the fastest bear market and fastest bull market in history.

The fund has returned 12pc net returns since inception in February 2016 – outperforming the All Ordinaries Index by 4pc net per annum.

Among shareholdings driving the strong 3-month performance were a 79pc rise in Paradigm Biopharma, a 44pc rise in National Tyre and Wheel, a 61pc rise in Ora Banda Mining a 43pc jump in Cash Converters and a number of uranium positions.

During May the fund started deploying capital into the market across a range of bespoke and deeply discounted opportunities.

11.11am: $A won’t worry RBA now: ANZ

ANZ head of FX research, Daniel Been says the recent 27pc rise in the Australian dollar from an 18-year low of $US0.5505 in March to a 5-month high of $US0.6988 won’t worry the Reserve Bank.

He finds that, historically, the RBA’s focus on the currency has been closely linked to valuation, rather than absolute levels.

“The rally has come from a position of currency undervaluation and is aligned to improvements in both risk appetite and global growth prospects,” Mr Been says.

“As a result, at this stage, the move is unlikely to warrant attention from the RBA.”

“Should the improvement in growth fundamentals stall, but the Australian dollar continue to rally alongside improved liquidity, we think the currency will attract the RBA’s attention above $US0.70, and become a larger consideration for the setting of policy above $US0.75.”

Gerard Cockburn 11.07am: Westpac cuts variable rates by 24 points

Westpac has slashed its variable home loan rate from 2.93 per cent to 2.69 per cent, the lowest on offer by a major bank.

The country’s second largest retail bank has cut its variable rate by 24 basis points, however the advertised rate is only available to new customers with a loan-to-value ratio of 70 per cent.

RateCity research director Sally Tindall said Westpac is attempting to attract customers with a decent amount of capital ready to put into a home loan.

“We are seeing this more and more, where banks are throwing rock bottom rates at people who have a decent amount of equity up their sleeve,” Ms Tindall said.

“The bank is looking for ideal borrowers to have a nice buffer that can protect its home loan book.”

Lachlan Moffet Gray 10.57am: Beacon to win in HomeBuilder scheme

Citi says small cap retail stock Beacon Lighting Group is well-placed to take advantage of the government’s $680 million HomeBuilder scheme and outperform the retail sector once the JobKeeper wage subsidy scheme ends.

The group closed up 6.5 per cent on Thursday, jumping from $1 a share to $1.065 a share on the announcement of the scheme.

Noting that 60 per cent of Beacon’s customers are home renovators, Citi upgraded their 12-month target price to $1.24 a share on the expectation that short-term demand will boost net profit by 9 to 14 per cent through the 2020-22 financial years.

Beacon opened up 0.94 per cent at $1.075 a share on Friday but last traded at $1.04.

10.33am: Qantas extends weekly rally to 20pc

Qantas shares are adding to gains for the week on news of a lift in flight capacity.

In Friday’s session, shares are up by 4.23pc to $4.68 – and as high as $4.81 – the highest level in three months.

The gain represents a 20pc surge in shares over the past week and has rubbed off across some of the rest of the travel sector.

Flight Centre shares are up by 1pc to $15.08, while Corporate Travel is up by 1.7pc to $13.58.

Read more: Qantas to triple number of domestic flights by end of June

10.26am: Macquarie tips value opportunities

Macquarie’s Matt Brooks has come up with a list of Aussie companies that have underperformed the most since the February peak and also display value.

In the ASX100 these include Downer and GPT Group, while in the Small Ords index they include Karoon Energy, GrainCorp, Daician Gold, Nickel Mines and Aurelia Metals.

“A global rotation to value has already begun,” Mr Brooks says.

“Stocks that had been underperforming since the March lows have started to outperform, a pattern consistent with the steeper yield curve.”

Mr Brooks says a “value rotation” is also “a reaction to high valuations for the overall market”.

Plus some stocks that led the bounce are already near or above pre-COVID highs.

“We think the value rally might last until investors worry more about withdrawal of stimulus, which could prove difficult,” he adds.

10.07am: Bank lift can’t offset broader drag

Financials are outperforming in opening trade, supported by UBS upgrades on the sector, but even that isn’t enough to keep the broader benchmark from slipping into the red.

At the open, shares are off by 13 points or 0.22 per cent at 5978.8.

Westpac shares are higher by 1.7pc and NAB by 1.5pc after upgrades from UBS, while Commonwealth Bank is adding 0.8pc and ANZ by 0.7pc.

The major miners and CSL are doing the most damage, while Qantas is adding to the week’s rally as it makes plans to treble its domestic capacity in the next two months.

9.52am: Viva Leisure completes $21.5m placement

Gym owner Viva Leisure has raised $21.5m in a placement and institutional entitlement offer, well supported by its current institutional shareholder base.

The group said today it had completed the $2.20 per share offer, with a 100pc take up rate from eligible shareholders excluding those associated with top holders chief executive Harry Konstantinou and director Mark McConnell.

“The success of the equity raising is a clear endorsement of Viva Leisure’s long term strategy. It will strengthen our balance sheet and liquidity position, increase our financial flexibility, and ensure that we can pursue accretive and strategic future acquisition opportunities, accelerate refurbishment of existing locations and accelerate new site rollouts,” Mr Konstantinou says.

VVA shares last traded at $2.60.

9.30am: Bank upgrades could support ASX

Bank upgrades from UBS could help support the Australian sharemarket on Friday, even amid selling before the long weekend.

UBS upgraded Westpac and NAB to Buy citing a “less bleak” outlook, and while their shares rose yesterday, the upgrades might not yet be fully reflected in their prices.

Elsewhere there’s not much to push the S&P/ASX 200 down today despite a 0.2pc fall in overnight futures.

European and US markets fell despite some positive fundamental developments, which may be a sign of exhaustion in overbought markets.

The ECB increased its quantitative easing program by EUR600bn versus EUR500bn expected, Germany approved a new EUR130bn fiscal stimulus package (3.8pc of GDP) and US services ISM rose to 45.4 vs 44.4 expected.

Although the S&P 500 stalled below chart resistance from its March peak at 3136.7, it pared a 1pc intraday fall to just 0.3pc by the close.

Yesterday, the S&P/ASX 200 hit a record-high 12-month forward PE multiple of 19.55x and a record-low 12-month forward dividend yield of 3.4pc.But such a high valuation won’t necessarily stop the market while rates are near zero or negative and central banks are doing unprecedented QE.

9.07am: UBS more optimistic on banks

UBS analyst Jon Mott has raised NAB and Westpac to Buy from Neutral, noting the economic outlook was “less bleak” than previously though.

NAB’s price target has been increased by 24pc to $20.50 and Westpac by 11pc to $20.50.

Mr Mott notes that Australian banks have come under sustained pressure over a number of years from:

- Strengthening of capital, funding and liquidity;

- Increased competition via new entrants and returning players, as well as mortgage brokers;

- Sustained pressure on margins from falling interest rates;

- Higher compliance and technology spend;

- Pressure to meet community expectations post Royal Commission;

- And now the fallout of the COVID-19 crisis and recession

Plus the decision by ANZ, WBC, BOQ and Macquarie Bank not to pay a dividend reminds investors that banks are “not annuity businesses”.

Still, Mr Mott says the outlook for the economy is better than feared.

“The likelihood of a further deterioration in asset quality and risk-weighted assets inflation driving additional highly dilutive capital raisings has reduced materially,” Mr Mott says.

“Re-rating to book value with renewed dividends looks possible … on balance we believe the banks looks relatively attractive especially given the low returns and expensive valuations in other asset classes and other parts of the market.”

He adds that the lower reliance on JobKeeper than government expectations also provides some flexibility for further targeted stimulus as current packages, loan deferrals and rental relief expires in October.

8.50am: What’s on the broker radar?

- Afterpay target price raised 26pc to $65 – Bell Potter

- Ampol reinstated at Hold – Jefferies

- ASX cut to Underperform – Credit Suisse

- Atlas Arteria resumed at Neutral – Macquarie

- IAG cut to Sell – Shaw and Partners

- Macquarie Group raised to Buy – Shaw and Partners

- NAB raised to Buy – UBS

- Reece rated new Neutral – JP Morgan

- Santos raised to Add – Morgans

- South32 raised to Buy – UBS

- Stockland target price raised 17pc to $3.55 – UBS

- Suncorp raised to Buy – Shaw and Partners

- Wagners price target raised 20pc to $1.20 – Morgans

- Westpac raised to Buy – UBS

8.30am: Kogan.com thrives in lockdowns

Online retailer Kogan.com has reported sharp rises in sales and profit in the fourth quarter to date, as coronavirus restrictions hit the retail sector.

In a business update based on unaudited figures, Kogan.com says gross sales more than doubled in April and May, while gross profit was up 130 per cent.

The number of active customers grew to 2.07m as at May 31, “with an incremental 126,000

active customers in the month of May”.

Adjusted EBITDA1 grew by more than 200pc across the quarter, and financial year-to-date adjusted EBITDA1 to the end of May rose more than 50 per cent, it said.

8.12am: ANZ facing NZ action over insurance

New Zealand’s Financial Markets Authority says it has filed High Court proceedings against ANZ Bank New Zealand, alleging the bank charged some customers for credit card repayment insurance policies that offered them no cover.

The FMA alleges ANZ issued duplicate policies to some customers which provided no additional benefits or cover, and charged premiums and, secondly, that it failed to cancel policies for ineligible customers, while also charging premiums.

The regulator claims ANZ contravened the Financial Markets Conduct Act by making false and misleading representations about the cover of the policies. It is seeking declarations of contravention, pecuniary penalties and costs.

The FMA says ANZ first identified the issues as early as September 2017, but did not disclose them in a review of retail banks in 2018.

FMA General Counsel, Nick Kynoch said: “While ANZ has embarked on their own remediation program, and ultimately self-reported this matter, the case points to a failure of internal systems and controls resulting in customer harm over a significant period of time.

“ANZ sold a product that, for some customers, offered no benefit.”

The issues date back to at least 2001, although the FMA says its claim reflects the introduction of the Financial Markets Conduct Act, which came into effect in April 2014.

7.40am: Oil prices steady

Oil prices were little changed in choppy trade overnight as investors awaited a decision from top crude producers on whether to extend record output cuts.

The Organisation of the Petroleum Exporting Countries (OPEC) and allies led by Russia, a group known as OPEC+, are debating when to hold ministerial talks to discuss a possible extension of the existing cuts.

Brent crude futures ended the session 20 US cents, or 0.5 per cent higher, at $US39.99 a barrel after a volatile session. US West Texas Intermediate (WTI) crude futures rose 12 US cents to $US37.41.

Reuters

7.20am: Shares to slip early

Shares on the Australian market are poised to slip in early trade after US investors ended a string of days of consecutive rises.

At 7.15am (AEST the SPI 200 futures contract was down 14 points, or 0.23 per cent, to 5,986.0, indicating early losses.

In the US overnight, a report showed that the number of workers filing for unemployment benefits eased for a ninth straight week, roughly in line with the market’s expectations. Yet economists saw pockets of disappointment after the total number of people getting benefits rose slightly. That number had dropped the prior week, which had raised hopes that some companies were rehiring workers.

The S&P 500 lost 10.52 points, or 0.3 per cent, to 3,112.35 after being on track earlier in the day for its longest winning streak since December. The Dow Jones Industrial Average rose 11.93 points, or less than 0.1 per cent, to 26,281.82, and the Nasdaq composite fell 67.10, or 0.7 per cent, to 9,615.81.

The S&P/ASX200 benchmark index hit a peak of 6,040.2 before retreating somewhat to finish Thursday up 50.2 points, or 0.84 per cent, at 5,991.8 points.

The All Ordinaries index rose 47.1 points, or 0.78 per cent, at 6,112.

One Australian dollar was buying US69.43 cents, up from US68.90 cents at the close of trade on Thursday.

AAP

7.10am: Lufthansa to quit Frankfurt’s Dax 30

German airline giant Lufthansa will leave Frankfurt’s Dax 30 index, the stock market said, after its share price collapsed during the coronavirus pandemic.

The real estate group Deutsche Wohnen will replace Lufthansa on the Dax from 22 June, Deutsche Borse said in a statement.

The share price for Lufthansa, a Dax member since the bourse was set up in 1988, had started to fall well before the pandemic.

But it plunged with the crisis, which saw almost all of the group’s passenger operations come to a halt.

Lufthansa said it would undergo “far-reaching” restructuring as it posted a first-quarter net loss of 2.1 billion euros ($US2.3 billion) on Wednesday. The airline’s supervisory board on Monday approved a nine-billion-euro bailout deal from the Germany government.

AFP

6.50am: American Airlines shares soar

Shares of American Airlines posted a record percentage gain after the carrier said it will aggressively add back flights in July – a bet that the slow recovery in air travel will gain speed this summer as states re-open their economies.

American said it plans to operate 55 per cent of the U.S. flights that it ran in July 2019. That would a huge increase over the 20 per cent schedule that American ran in April and May.

Overseas trips are expected to recover more slowly. American will operate just 20 per cent of the international flights that it ran last July.

American could still cancel many July flights right up until departure time, but investors appeared to regard the planned schedule as a sign of confidence that air travel is coming back.

Shares of American Airlines Group Inc., which is based in Fort Worth, Texas, rose 41 per cent to close at $US16.72. That’s the stock’s biggest one-day percentage gain since the current company was formed by a 2013 merger with US Airways. Other airline stocks were carried along in American’s slipstream, although they rose by smaller percentages. The stocks have been battered this year, and American’s shares are still down 42 per cent in 2020.

AP

6.15am: Wall St mixed as rally halts

US stocks tumbled in a choppy trading session as investors weighed their optimism about the reopening of the economy against fresh data that showed the pandemic’s continued toll.

The Dow Jones Industrial Average swung between gains and losses throughout most of the session, before rising 12 points as of the close of trading. Companies from Microsoft to UnitedHealth Group to Nike dragged the blue-chip index down, while a rally in heavyweight Boeing helped mitigate the losses that the other indexes suffered.

The S&P 500 dropped 0.3 per cent, snapping a four-session winning streak. The Nasdaq Composite fell 0.7 per cent, pulled down by declines in shares of mega-cap technology companies.

After adding 0.8 per cent yesterday amid the continuing bull market, the ASX is tipped to open lower. At 6am (AEST) the SPI futures index was down 24 points, or 0.4 per cent.

Stocks have rallied for much of the week, despite the social unrest and widespread protests that have gripped the country since George Floyd, a black man, died after being restrained by Minneapolis police. Traders had instead focused on promising signs of an economic recovery, as well as optimism that global economies could see more stimulus measures.

Yet Thursday’s data on job losses and trade paused that hopeful rally, giving investors the chance to take profits after a strong rally in recent weeks.

“There’s a little bit of [questioning] of how far can this [rally] go?” said Brad McMillan, chief investment officer at Commonwealth Financial Network. “From a bearish perspective, there’s still a lot to worry about.”

“But from a bullish perspective, we do see the pandemic under control and no meaningful signs of a second wave yet,” he continued. “A V-shaped recovery seems more possible than it was a week ago.”

The S&P 500 and the Dow are on pace for their third consecutive week of gains, which would be the longest winning streak for both indexes this year. The S&P 500 has risen 1.9 per cent week-to-date, cuttings its losses for the year to 4 per cent.

Yet new data released before the markets opened Thursday weighed on investor sentiment for most the trading session. The Commerce Department said the US trade deficit widened in April as imports and exports both dropped sharply amid coronavirus-related shutdowns around the world. The foreign-trade gap in goods and services expanded 16.7 per cent from the prior month to a seasonally adjusted $US49.41 billion.

Meanwhile, the number of Americans drawing unemployment benefits ticked up to 21.5 million in the week ended May 23, though the pace of increase significantly slowed from earlier in the crisis, the Labor Department said.

Elsewhere, the pan-continental Stoxx Europe 600 fell 0.7 per cent after the European Central Bank said it would scale up its bond-purchase program to EUR1.35 trillion ($US1.52 trillion) through June 2021. The bank also left its key interest rate unchanged at minus 0.5 per cent.

And in Asia, Hong Kong’s Hang Seng index ticked 0.2 per cent higher, while the Shanghai Composite Index edged down 0.1 per cent.

Dow Jones Newswires

Simon Benson 5.50am: FIRB heading for shake-up

A new national security test will apply to all foreign investment bids for sensitive assets, including telecommunications, energy, and technology companies down to small-scale defence suppliers and service providers, in the biggest shake-up of foreign acquisition and takeover laws in 45 years.

The Treasurer will have “last-resort” powers to force assets to be sold or to impose conditions even after a sale is approved if national security is at risk.

The zero-dollar threshold for screening will apply to all foreign investments in any businesses with a national security profile, under the most comprehensive reforms to rules governing the independent Foreign Investment Review Board since it was established in 1975.

5.45am: US unemployment crisis

In further signs of the crisis facing the world’s largest economy amid the coronavirus pandemic, new data showed a record plunge in US exports as lay-offs exceeded 42 million.

The two key reports on economic health indicate that even as Wall Street regains its strength and some industries show signs of recovery as virus lockdowns ease, the United States is not out of the woods yet.

The Labor Department said 1.87 million workers filed new jobless claims last week, 249,000 less than the week prior but still a grievous figure nearly three times higher than the weekly record in the pre-pandemic economy.

“This and other indicators suggest not that the job market is improving but that it’s getting bad less quickly,” Jared Bernstein, senior fellow at the Center on Budget and Policy Priorities think tank, said on Twitter.

The decline in initial claims means the wave of lay-offs caused by businesses closures ordered in mid-March to stop the spread of COVID-19 are slowing.

More than 42 million workers lost their jobs, at least temporarily, since mid-March, but the new data showed 21.5 million people were receiving benefits in the week ended May 23, an indication that millions either had their benefit claims rejected or have since been rehired, or more likely a combination of the two.

After falling last week, the insured unemployment rate ticked up half a point to 14.8 per cent — a huge number of Americans not working, but that only reflects those with unemployment benefits.

That is a grim omen for Friday, when the Labor Department releases the all-important May jobs report and likely show national unemployment increasing to closer to 20 per cent from 14.7 per cent in April, which was the highest unemployment rate in 90 years.

AFP

5.40am: Investors take profits

A rally in global stock markets petered out but resolute action from the European Central Bank to fight the coronavirus fallout put a floor under losses from investors cashing in on recent gains.

The euro rose and southern European bond yields slipped after the ECB added another 600 billion euros ($US675 billion) to its already gigantic stimulus war chest, and said it would continue its pandemic bond-buying for another year at least.

But if boosted ECB support seems huge, so does the expected eurozone downturn it is designed to alleviate, with ECB chief Christine Lagarde forecasting a 2020 contraction of 8.7 per cent in the area’s gross domestic product (GDP).

“Whatever it takes,” said Holger Schmieding at Berenberg. “Like finance ministers, central banks across the advanced world continue to do their utmost to contain the mega recession.”

The ECB’s move came a day after Germany said it would pump 130 billion euros into a stimulus package to kickstart the region’s biggest economy.

At first, European stock markets were unimpressed, with investors locking into profits “after enjoying a very bullish session yesterday”, as David Madden, analyst at CMC Markets UK, put it.

But then, some cautious buying brought markets off their worst levels. “European equities and US futures rose from session lows after the ECB boosted its Pandemic bond buying program and extended it through June 2021,” said Edward Moya at OANDA.

“The DAX and Euro Stoxx 600 are starting to look much more attractive following Germany’s new stimulus package and the ECB’s increased pandemic purchase plan, both which have exceeded market expectations,” he said.

London closed down 0.6 per cent, Frankfurt lost 0.5 per cent and Paris slipped 0.2 per cent.

Oil was back under pressure amid “rising doubts” that OPEC and its allies will really manage to agree on a meaningful extension to a current crude output agreement, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

AFP

5.35am: Driverless cars ‘not completely safe’

A new study says that while autonomous vehicle technology has great promise to reduce crashes, it may not be able to prevent all mishaps caused by human error.

Auto safety experts say humans cause about 94pc of U.S. crashes, but the Insurance Institute for Highway Safety study says computer-controlled robocars will only stop about one-third of them.

The group says that while autonomous vehicles eventually will identify hazards and react faster than humans, and they won’t become distracted or drive drunk, stopping the rest of the crashes will be a lot harder.

AP

5.32am: Wine into sanitiser

French winemakers will transform wine that went unsold during the country’s two-month coronavirus lockdown into hand sanitiser and ethanol to make room for the next harvest, a farming agency said on Thursday.

Wine sales and exports, particularly to the US, plunged at the height of the coronavirus crisis, leaving winemakers with millions of litres of unsold wine.

“From tomorrow, 33 licensed distillers will be able to collect the wine and distil it,” said Didier Josso, head of the wine branch in the farming agency FranceAgriMer, at a video press conference.

The alcohol resulting from the distillation is exclusively reserved for the pharmaceutical and cosmetic industry and the production of hand sanitiser, and for the production of ethanol.

AFP

5.30am: ECB sees ‘tepid’ recovery

European Central Bank chief Christine Lagarde said the eurozone economy faced an “unprecedented contraction” because of the coronavirus pandemic, and warned that the first signs of a rebound from easing lockdowns were “tepid”.

Hit hard by the containment measures that up-ended supply chains and depressed demand in recent months, the eurozone economy is expected to shrink 8.7 per cent in 2020, Lagarde said.

As countries gradually begin to reopen, there are signs of the slump “bottoming out”, she said.

But “the improvement has been tepid compared with the speed at which economic indicators plummeted in the preceding months”, the former French finance minister added.

AFP

5.28am: Eurozone economy to shrink 8.7pc

Hit hard by the coronavirus pandemic, the eurozone economy will see a sharp contraction of 8.7 per cent in 2020 before rebounding in 2021, European Central Bank chief Christine Lagarde said Thursday.

Growth is expected to come in at 5.2 per cent next year and 3.3 per cent in 2022, Lagarde said, warning that the extent of this year’s recession would “depend crucially on the duration and effectiveness of containment measures” as well as policies to cushion the economic impact of the crisis.

AFP

5.25am: US trade gap jumps

As the coronavirus shut down businesses and transport, a record drop in US exports and imports in April drove the trade deficit up more than $US7 billion to $US49.5 billion, the government reported.

Exports of US goods and services fell more than 20 per cent compared to March, while imports dropped a more modest 13.7 per cent, the Commerce Department reported.

For the year to date, the US trade gap swelled by $US26 billion, or more than 13 per cent, compared to the same period of last year, according to the report.

AFP

5.20am: ECB boosts pandemic support

The European Central Bank has boosted its pandemic emergency support program by an unexpectedly large 600 billion euros to 1.35 trillion euros ($US1.5 trillion) in an effort to keep affordable credit flowing to the economy during the steep downturn caused by the virus outbreak.

The new stimulus comes on top of added spending by European governments and similar stimulus efforts by the US Federal Reserve, the Bank of England, the Bank of Japan and other central banks around the globe as the world tries to cope with a sharp, simultaneous blow to both developing and rich economies. The central bank for the 19 countries that use the euro also extended its monetary stimulus program to at least the end of June next year, from the end of 2020 currently.

ECB President Christine Lagarde will give her assessment of the economy at a news conference after the meeting, which due to the pandemic was held by teleconference among the 25 members of the bank’s governing council.

The ECB’s moves in many ways reflect similar concerns to those motivating the Fed, which has slashed short-term interest rates to near zero and started buying $2 trillion in Treasury securities and mortgage-backed bonds to keep credit markets functioning.

Under the pandemic support program, the ECB buys corporate and government bonds and other financial assets from banks, paying with newly created money. That helps lower longer-term interest rates, keeping the pandemic from drying up needed funding for borrowers.

The large size of the intended purchases also sends a signal to financial markets that the ECB is determined to ensure interest rates remain low throughout the eurozone and prevent borrowing costs from rising for indebted governments such as Italy.

AP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout