Coronavirus Australia: $25,000 Homebuilder grant has grand designs for tradies and homeowners

Cash grants to build or renovate homes will prop up one million jobs in the $688m building package | DO YOU QUALIFY?

A $15bn boost to economic activity will be delivered under the $688m HomeBuilder stimulus package, propping up more than one million jobs in the construction sector and handing Australians $25,000 cash grants to build new homes or renovate existing properties.

The six-month building support program has been designed to drive new work for carpenters, plumbers, bricklayers, architects, suppliers and electricians amid concerns of a 20 per cent drop-off in dwelling investment through the June quarter.

States and territories will be expected to absorb administration costs to implement the HomeBuilder scheme, which will be delivered directly to applicants through state revenue offices.

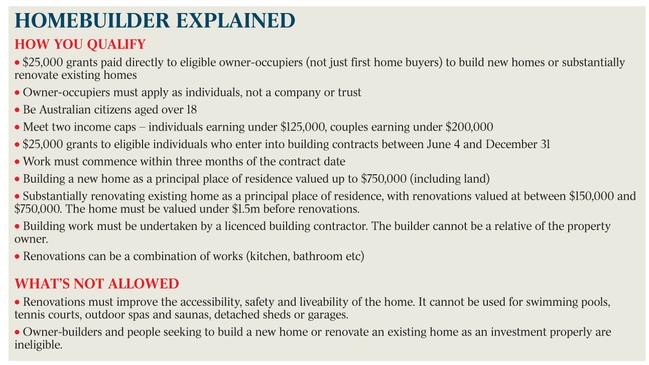

Owner-builders and people seeking to construct a new home or renovate existing buildings as investment properties have been excluded from the package. Swimming pools, tennis courts, outdoor spas and saunas, sheds and garages have also been banned from the HomeBuilder program.

As The Australian revealed on Monday, the construction boost, which requires building to occur within three months of entering a contract, extends financial assistance to Australian households outside of first homebuyers, who already receive state and federal support.

To access HomeBuilder, owner-occupiers must apply as individuals and not companies or trusts, be Australian citizens aged over 18, and meet eligibility under two income caps — $125,000 for individual applicants or $200,000 for couples.

Scott Morrison said the HomeBuilder package, providing eligible owner-occupiers with grants to build new homes or “substantially renovate” existing properties between June 4 and December 31, would help “fire up” the construction sector.

“This investment isn’t just about helping Australians bring their dream home to life, it’s about creating jobs and helping support the more than one million workers in the sector including builders, painters, plumbers and electricians across the country,” the Prime Minister said.

“This is about targeted taxpayer support for a limited time using existing systems to ensure the money gets used how it should by families looking for that bit of extra help to make significant investments themselves.

“If you’ve been putting off that renovation or new build, the extra $25,000 we’re putting on the table along with record low interest rates means now’s the time to get started.”

Under the HomeBuilder rules, renovations must be worth between $150,000 and $750,000 with the dwelling valued at less than $1.5m before works begin. New homes must be for principal places of residence, valued up to $750,000, including land.

The government stimulus package has been well received by industry leaders despite falling short of a Master Builders Australia push for a $13.2bn package, which it said would create 105,465 jobs and pump $30.9bn into the economy.

The building industry has forecast a 50 per cent drop in new dwellings by the end of the year, with the residential construction sector forecasting 171,000 projects before COVID-19, which has now slumped to 111,000.

Housing Minister Michael Sukkar, who will announce the building stimulus program on Thursday, said residential construction was “vital to Australia’s economy” with dwelling investment worth more than $100bn each year.

Final costs for the uncapped HomeBuilder program, which is expected to support 140,000 direct jobs, will be calculated in line with the take-up of the building assistance package.

“HomeBuilder will not only support the jobs of carpenters, plumbers, bricklayers and electricians on our building sites, it will also support the timber mill workers who produce the frames and trusses and the manufacturing workers who make the glass, brick and tiles for our homes,” Mr Sukkar said.

Housing Industry Association managing director Graham Wolfe said the HomeBuilder incentive was the “largest direct contribution to households an Australian government has ever made”.

“This package is an important first step in addressing the projected decline in housing activity over the next 12 months and will generate over $15bn in economic activity,” Mr Wolfe said.

All renovations and building work must be undertaken by a registered or licensed building service contractor, who was certified before June 4.

HomeBuilder applications will be processed once state and territory governments sign-up to a national partnership agreement. States and territories will backdate acceptance of HomeBuilder applications to June 4.

As part of the national agreement to deliver the non-taxable HomeBuilder program, compliance will be monitored by state and territory revenue offices.

The construction stimulus boost comes as the Australian Bureau of Statistics on Wednesday reported building approvals in April fell by 1.8 per cent in seasonally adjusted terms to 15,294 new dwellings.

The value of total buildings approved also dipped 0.6 per cent, for the second consecutive month.

ABS construction statistics director Daniel Rossi said building approvals “typically lag early indicators of housing demand, such as new home sales and new loan commitments”.

Stockland chief executive communities Andrew Whitson said creating new homes was one of the most important job multipliers in the Australian economy and acted as a significant booster to the broader economy, estimated to be worth about 5 per cent of GDP.

“A clear stimulus for the housing construction sector is a powerful measure to help restart the Australian economy and support a million jobs,” Mr Whitson said.

REA chief economist Nerida Conisbee said the building approvals data reflected the uneven slowdown hitting the market, with investors holding back and first- home buyers diving in.

“The big problem for apartments at the moment is that investors are not very active in the market, and it’s investors both local and offshore,” she said.

Master Builders Australia chief executive Denita Wawn said the HomeBuilder scheme would be a “lifeline for an industry facing a valley of death in the coming months”.

“Based on the government’s estimated 27,000 grants, we think the scheme will be used for $10bn in building activity, supporting the viability of 368,000 small builders and tradies — the businesses which employ 800,000 people in communities around Australia,” Ms Wawn said.

“The eligibility criteria mean that the vast majority of Australians will be able to access the scheme. More than 80 per cent of households have income of $200,000 or less.”

-

Case study 1: First home buyers Emma and Liam decide to build a new home

■ Emma and Liam enter into a house and land contract valued at $550,000 on September 25, 2020. Emma and Liam’s bank applies on the couple’s behalf to their state’s revenue office or equivalent body to receive the Federal Government’s $25,000 grant. The state revenue office conducts the eligibility checks and reviews the couple’s documentation and confirms that both Emma and Liam are Australian citizens, over the age of 18, have a combined taxable income under $200,000 based on their 2018-19 tax return and the value of the contract is under the $750,000 dwelling price cap. The state revenue office approves the application and will provide the $25,000 grant to the couple when they make the first progress payment (noting that construction must be contracted to commence within three months of signing the contract).

■ Emma and Liam commence construction on their new home and make their first progress payment to the builder on November 2, 2020. The state revenue office releases the $25,000 HomeBuilder grant directly into their nominated bank account once they have verified the couple has made their first progress payment to the builder.

■ As they are both first home buyers, Emma and Liam may also be entitled to their State’s First Home Owner Grant and stamp duty concessions as well as the Commonwealth’s First Home Loan Deposit Scheme and First Home Super Saver Scheme.

-

Case study 2: Owner-occupier Cassidy decides to substantially renovate her home

■ Cassidy enters into a contract to substantially renovate her home on December 31 2020, with renovations valued at $400,000. The value of her home is $900,000 based on an independent valuation. Cassidy pays the builder $10,000 to commence renovation of her home on February 2, 2021. Cassidy then applies directly to the revenue office in her state or equivalent body to receive the $25,000 HomeBuilder grant.

■ The revenue office conducts the eligibility checks and confirms that Cassidy owns the property, is an Australian citizen, over the age of 18 and has a taxable income under $125,000 based on her 2019-20 tax return. The revenue office also confirms the value of the renovations is within the HomeBuilder renovations price cap (between $150,000 and $750,000), the valuation of her home is less than $1.5 million and that Cassidy has made the first progress payment on the renovations. The revenue office approves the application and releases the $25,000 HomeBuilder grant directly into Cassidy’s nominated bank account.

■ As Cassidy already owns her own home, she is not eligible for the First Home Owner Grant, the First Home Loan Deposit Scheme or the First Home Super Saver Scheme. However, Cassidy may be eligible for stamp duty concessions or other grants depending on the state or territory she lives in.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout