High demand for limited residential property stock makes analysts rethink forecasts

Analysts retreat from glum housing forecasts after stimulus and house price data.

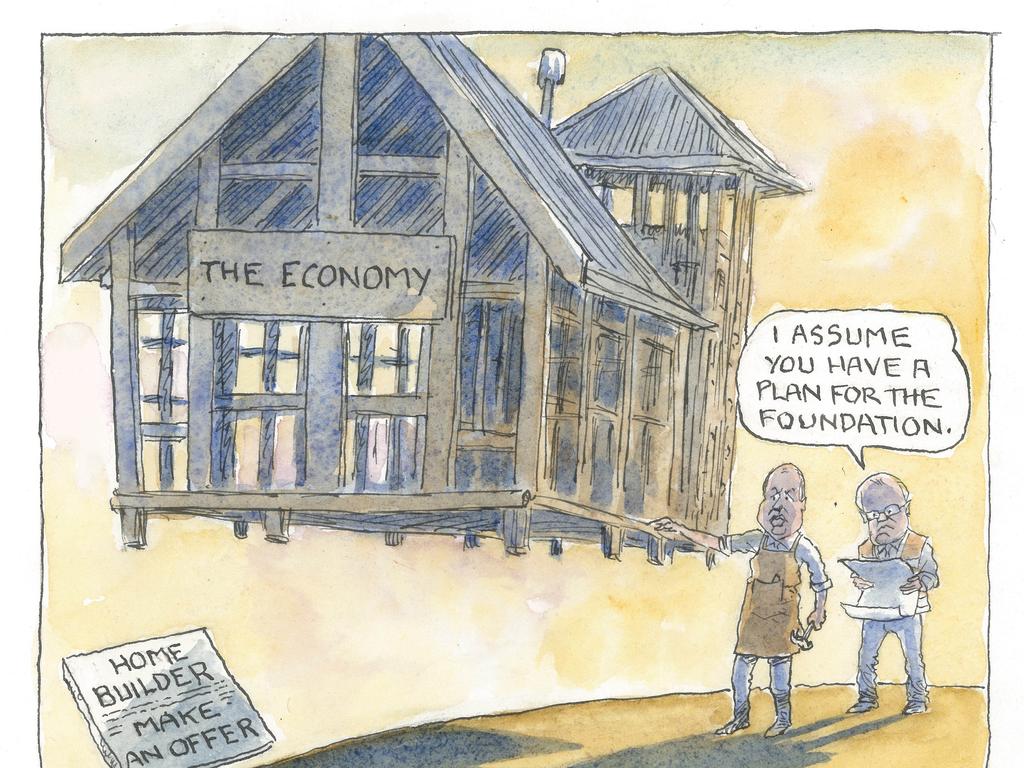

The introduction of the Morrison government home stimulus package and surprisingly steady home price values in the month of April have prompted some analysts to retreat from their glum housing forecasts.

With the stock market putting the coronavirus crisis behind it the housing market is still tipped to fall but far less than widespread predictions, including the Commonwealth Bank warning of a 32 per cent fall if there was a “prolonged” slump.

In one of the latest revisions UBS analysts softened their forecast of house price falls from close to 10 per cent back down to a fall in the 5 to 10 per cent range.

AMP chief economist Shane Oliver this week also pulled back from earlier predictions of a 20 per cent plunge if the downturn had been extended and is now forecasting a more moderate house price dip.

The market’s resilience has surprised some players but is in keeping with the relatively high demand for the limited stock available, according to a new realestate.com.au index.

UBS economists George Tharenou and Carlos Cacho and analyst Jim Xu said that resilient building approvals and the $688m HomeBuilder stimulus led them to upgrade their forecasts of 2020 housing starts to 153,000 from 130,000.

“However, we now expect home prices to fall by 5 per cent to 10 per cent over the next year versus our prior forecast of towards 10 per cent,” UBS said.

“This revision is more about the economy than today’s stimulus. That said, the increase of our forecasts for commencements puts some downward pressure on prices, but we still see a significant decline in completions ahead,” UBS said.

The $25,000 cash payments for both new homes and renovations, estimated to cost $688m, was dubbed a positive but UBS said it was “materially less” than the $4bn-$10bn flagged and did not include other measures floated such as extending the First Home Buyer Deposit Scheme.

Grants are available for owner occupiers with the income thresholds at $125,000 for singles and $200,000 for couples. The grants are for new homes valued up to $750,000, including house and land and for certain renovations of $150,0000 to $750,000, with a prior property value of less than $1.5m.

“Given the short time of the stimulus, it will largely favour detached housing, rather than multi’s, albeit limited titles inventory suggests building more new homes will be very challenging within the time frame,” the UBS team said.

UBS said listed company updates suggested inquiries in the detached sector had returned to pre-COVID levels. But a 24 per cent in detached home sales recorded by the HIA indicated a weaker trend.

The collapse of the PCI residential new orders and sales also indicated a slump of dwelling commencements towards 100,000 in coming quarter, UBS warned.

Border closures will all but halt migration with underlying demand slumping from more than 200,000 to 130,000 later this year.

Research house CoreLogic said home prices fell in May, but the pace of decline at just 0.4 per cent, was less than expected.

UBS warned there was still a downside risk from the approaching “fiscal cliff” of about $85bn in the last quarter of the year as well as the expiry of repayment deferrals on $250bn of debt.

“We also now see much less downward pressure on new home prices that was expected to negatively feedback to sentiment and established home prices. However, a negative factor for investors is rents will face further weakness, as first home buyers exit the rental market, and migration demand stays weak at least until next year,” the UBS economists said.

AMP Capital chief economist Dr Shane Oliver in March had a base case for a recession in which unemployment would hit 7.5 per cent and would push average home prices down around 5 per cent, but the risk was that a deeper downturn with a 20 per cent fall in prices.

Dr Oliver said subsequent government support measures along with an earlier reopening of the economy had reduced the risk of worse case scenarios for home prices.

“However, our base case is for home prices to fall around 5-10 per cent, as true unemployment will remain high, government support measures and the bank payment holiday end in September, immigration falls and new supply is likely to be boosted via government measures,” Dr Oliver said.

AMP Capital still sees Sydney and Melbourne as likely to see 10 per cent falls as they are more exposed to immigration and have higher debt levels whereas Adelaide, Brisbane, Perth and Hobart were only likely to see small falls and Canberra prices were likely to be flat.

REA Group this week launched a new residential buyer demand index, which also provided a positive signal for home prices.

It found the current undersupply of properties had resulted in demand surging on the realestate.com.au portal with REA director of economic research Cameron Kusher saying that serious buyer activity had increased for the past nine weeks and was up 100.8 per cent from its low.

“As the recovery from the impacts of COVID-19 continue, this forward-looking index shows the buyers are back but sellers are yet to follow,” Mr Kusher said.

One of the likely drivers of such high volumes of serious buyer activity is that there are so few properties listed for sale.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout