Coronavirus: Worst slump in history decimates retailing

Retailers suffered their worst month of sales in history in April, according to data released on Thursday.

Retailers suffered their worst month of sales in history in April, according to data released one day after national accounts figures showed the COVID-19 crisis had thrown the nation into its first recession in close to three decades.

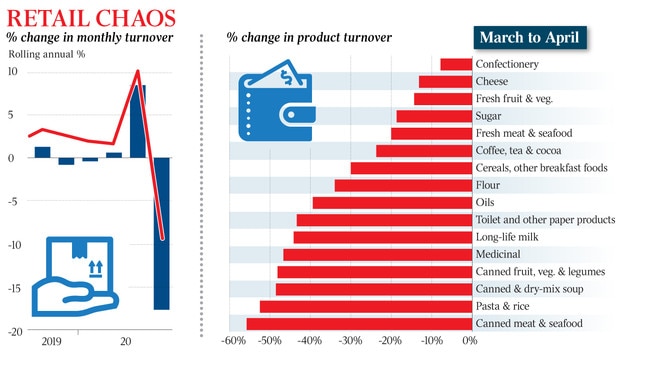

Retail turnover plunged a record 17.7 per cent in April, seasonally adjusted numbers from the Australian Bureau of Statistics revealed, underlining how collapsing household consumption had driven the pandemic downturn.

An economic contraction of 0.3 per cent in the March quarter will be overwhelmed by what economists expect will be a historically deep downturn over the three months to June, in the order of a 6-8 per cent fall in GDP.

Mark McInnes, chief executive of Premier Investments, the owner of brands such as Smiggle, Peter Alexander and Breville, said “these are the worst numbers in the history of Australian retailing”.

With many shops closing their doors in April, clothing and footwear turnover halved, while department store sales dropped by 15 per cent. The ABS figures also showed the devastating impact of social-distancing measures on cafes and restaurants, where spending collapsed by 35 per cent.

Economists are hopeful April will represent the worst of the COVID hit to jobs and activity, and that the success in squashing the spread of the virus and phased reopening of the economy, along with unprecedented fiscal support, will help limit the damage.

“Thankfully, the April retail trade fall-off shouldn’t be repeated in May,” Citi chief economist Josh Williamson said.

Australian Retailers Association chief executive Paul Zahra said his members were “heartened” by the return of some shoppers and the opening up of most shops in recent weeks.

The former David Jones boss warned that it was still too early to gauge the full extent of the damage to shops’ bottom lines.

“I don’t know that we are through the worst; we will have to see how they bounce back,’’ Mr Zahra said. “We are officially in recession, and the unemployment rate will double over the next few months. Most Australians’ wealth is in their homes and we have a declining housing market.

“We are remaining optimistic, but still very cautious.”

National Retail Association chief executive Dominique Lamb said the retail figures were not a surprise. “Our members lost a billion dollars in March, and April was far worse,” Ms Lamb said.

“We have seen businesses commence trading gradually in most states. People are returning to shopping centres, but spending less time there.”

While the JobKeeper program has taken the pressure off paying staff, the September 30 expiry date looms large for still-struggling retailers, Ms Lamb said. “We are very hopeful this was the worst of it, but we are very aware we are only at the start of a two- or three-year recovery period.”

Along Melbourne’s trendy Chapel Street, many shops are shut or open with reduced trading hours. Boutique owner Jo McLean reopened Jfahri about two weeks ago, having closed at the end of March. She said this week had been very difficult. “I think since the government came out … and said we’re in a recession … people are very freaked out.’’

Ms McLean said she was noticing more people leaving shops without buying anything. She said two girls who were now unemployed had come into the shop on Thursday and tried on outfits, commenting that they would buy the dresses if they still had jobs.

Mr Zahra said negotiating with landlords was the other, more imminent, “pain point” for retailers.

Mr McInnes agreed renegotiating leases was a major hurdle to be jumped in coming weeks.

April’s drop in spending came hard on the heels of an equally unprecedented growth in sales in March of 8.5 per cent, as panic buying supercharged shopping in supermarkets and chemists amid fears of a total lockdown.

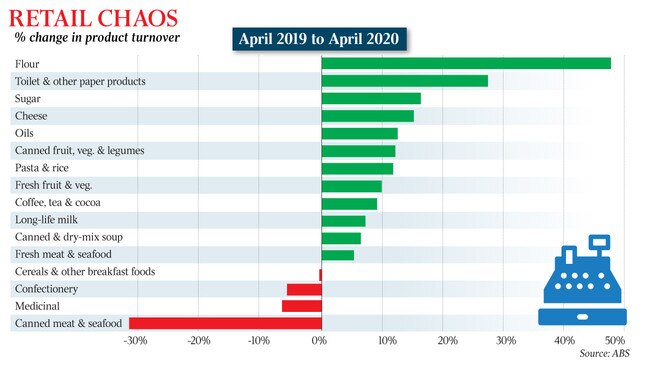

The end of hoarding sent food retailing plunging 17 per cent in April from its artificially high levels of the month before. Sales of canned foods, and pasta and rice, halved. Still, the fall in sales of essential items remained well above the comparable month last year. Purchases of pantry items such as flour and toilet paper were close to 50 per cent and 30 per cent higher.

Additional reporting: Tessa Akerman

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout