Aurizon warns of coal freight slump

Aurizon lifted annual profit and will pursue a $300m share buyback, but expects a hefty fall in 2021 earnings.

Aurizon lifted annual profit and will pursue a $300m share buyback, but expects a hefty fall in 2021 earnings.

Many analysts still expect an iron ore price crash this year, but the case for it staying stronger for longer is building.

The NSW Department of Planning has been accused of uncritically repeating ‘misleading claims’ about the controversial $3.6bn Narrabri gas project.

It goes without saying that the man who ran Rio Tinto from 1997 to 2000 wants the company to apologise to local landowners.

The Australian mining sector is set for a fresh wave of mergers and acquisitions over the next few years.

Mining in Tasmania’s Tarkine is back on the agenda, with a reactivating iron ore mine seeking to axe protections for the Tasmanian devil.

BP Chief Bernard Looney’s bold pivot has confounded critics with the scale of reinvention plans to turn the oil giant green.

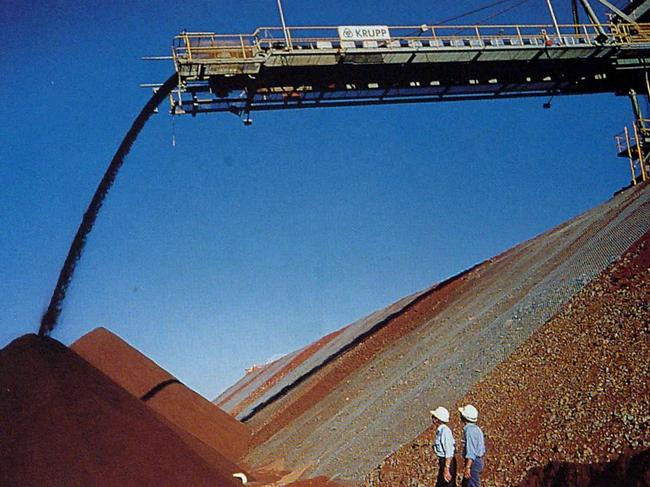

Rio Tinto in dispute with second group of native title owners over Pilbara iron ore mine.

The relationship between a government mines inspectorate and union safety inspectors has broken down in an investigation of a series of fatalities in the resources sector.

The state regulator has told the energy major to inspect its remaining two processing trains after major cracks were discovered.

Mining giant Glencore will temporarily shut its NSW and Queensland coal mines due to tepid demand and a slump in prices.

Rio’s decision to destroy the ancient Juukan Gorge caves allowed it to access iron ore worth $U135m, its chief executive says.

There are good reasons investors are buying up gold … and as a result, the ‘ultimate insurance policy’ is about to set records.

Woodside Petroleum has been drafted in as an expert adviser on the decommissioning and remediation of an offshore oil production ship in the Timor Sea.

EnergyAustralia says the “stars are aligning” on Santos’s $3.6bn Narrabri gas project where it holds a 20 per cent stake.

In the past two years, eight men have died and five have been badly burned in Queensland’s coal mines and quarries.

An Indigenous group says more than 700 of its heritage sites in the Pilbara have been destroyed or impacted by mining.

The nation’s gas industry took another hammer blow after a giant ¥140bn ($1.84bn) writedown.

Rather than paying over the odds, gas users need to set Marquess of Queensbury aside and start brawling.

High renewable targets and looming changes to emission rules add to pressure that could force the ageing Yallourn plant to close early.

The real question is how is Jacques still in the job nearly three months after the tragedy?

Analysts suggest the coronavirus crisis could propel the precious metal’s price above $US3000 an ounce in 2021.

Superannuation heavyweight HESTA says it and other investors will ultimately pay the cost of Rio Tinto’s damaged licence to operate.

An Anglo American underground coal mine in Queensland was allowed to keep operating, despite its methane drainage system being ‘at capacity and struggling’.

The Minerals Council of Australia has warned the Queensland government’s border closure will put hundreds of jobs at risk.

Andrew Forrest will be the latest billionaire to deliver ABC’s Boyer Lectures, a major departure from recent speakers.

Sumo Power allegedly signed up customers on cut-rate plans, knowing prices would be raised dramatically.

SA may be forced to consider banning new rooftop solar if it can’t figure out how to stabilise its energy supply, Dan van Holst Pellekaan has warned.

COVID-19 is speeding the switch to renewables and more pressure on coal, Origin Energy’s CEO says.

Frank Calabria believes digital transformation can help win customer trust, and give Origin an edge over its rivals.

Original URL: https://www.theaustralian.com.au/business/mining-energy/page/198