Slow demand to halt Glencore coal mines

Mining giant Glencore will temporarily shut its NSW and Queensland coal mines due to tepid demand and a slump in prices.

Mining giant Glencore will temporarily shut its NSW and Queensland coal mines due to tepid demand and a slump in prices and warned it was taking a hit from China’s ongoing moves to restrict Australian imports.

After axing its dividend and recording a net loss of $US2.6bn ($3.6bn) for the June half, Australia’s biggest coal producer said its 17 mines would close for several weeks in September amid a gloomy outlook for the fossil fuel.

Both thermal and metallurgical coal have suffered a slide in demand and price from the COVID-19 pandemic, with many producers suffering losses at current market prices.

“The COVID-19 pandemic continues to impact the global market environment including demand for Australian coal exports,” Glencore said in a statement on Friday. “In response Glencore is introducing measures to manage our coal production profile. This will include a combination of temporary site and equipment shutdowns at a number of operations.”

Glencore said the shutdown measures would allow it to “align our production levels with market demand while providing the flexibility to ramp back up as economies recover from the effects of COVID-19.”

Workers will be required to take leave, with shutdowns timed alongside the September school holidays.

Australian government forecasts shows metallurgical coal export revenues are forecast for a steep decline to $25bn in 2020-21, from $35bn in 2019-20, with contract prices to fall by about a third.

Thermal coal, shipped to Asian buyers for use in power stations, will also see revenues fall to $16bn in 2020-21, from $20bn this year, with spot prices falling sharply in the last six months.

A move by China to restrict some imports of coal could also re-emerge in the second half of the year as an issue and Glencore said it had caused problems for the Australian industry.

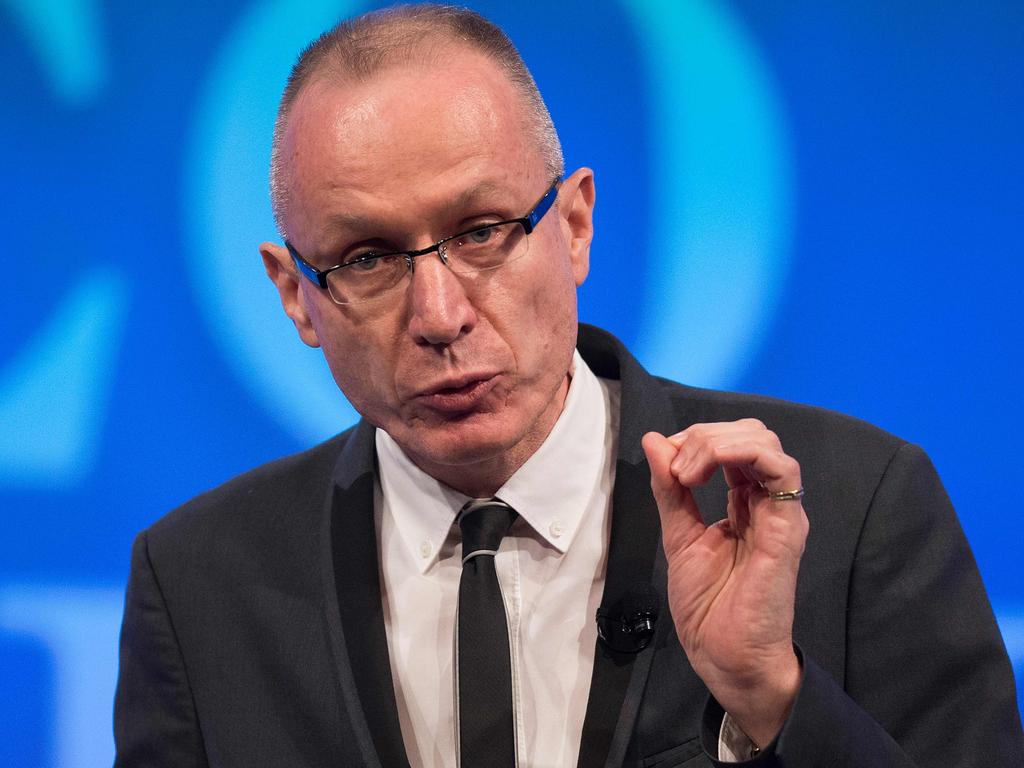

China in the first half of 2020 “had relatively strong imports but now they’ve slowed and they have cut Australian thermal coal imports and even coking coal imports,” Glencore chief executive Ivan Glasenberg told media after delivering its results.

“They are waiting outside China to be discharged and definitely Australia is not front of the queue.

“So yes, that is affecting the coal business and I think a large part of the downswing of the coal price in Australia today is on the back of definitely lower Indian demand from COVID-19, but China not accepting and not taking Australian coal is having a negative effect.”

Mr Glasenberg said China’s moves had damaged Glencore’s business but he remained optimistic that tensions between the two nations would ease.

“Australian coal is much cheaper than their domestic price — $US21 a tonne cheaper — and yet they are still taking the view to not import Australian coal, so it is definitely hurting it and we have seen it in the prices,” Mr Glasenberg said.

“I‘m not a politician and I am not an expert in the Australia and China political relationships and I hope being a commodity supplier, one of the biggest customers of Australia, they resolve it so we can sell more tonnes to China.”