News Corp posts revenue and profit hit, but sports and masthead subscribers increase

The media major benefited from strong subscriber growth at Kayo and Binge in a market that was heavily disrupted by the global pandemic.

The return of live sport in Australia led to a surge in subscriber numbers for streaming service Kayo and digital subscriptions at Australian mastheads rose strongly, but the effects of COVID-19 on advertising revenue has hit profits for News Corp.

Kayo has particularly benefited from the return of the NRL and AFL and now has about 590,000 subscribers as at August 4, an increase of about 125,000 across July alone.

The over-the-top (OTT) streaming service, which also shows rugby union, soccer and other live sports, had 465,000 subscribers at the end of June, compared with 382,000 a year earlier.

Foxtel’s total closing paid subscribers at the end of June was 2.78m, down 12 per cent from a year earlier, but the launch of the new entertainment streaming product Binge in May has already attracted 217,000 subscribers.

News Corp, which owns mastheads including The Weekend Australian, The Daily Telegraph, Herald Sun and international titles The Wall Street Journal and The Times, reported a net loss of $US401m ($556m) for the June quarter on Friday-morning Australian time, including non-cash impairment charges of $US292m and higher restructuring costs due to the COVID-19 pandemic.

Total June quarter segment EBITDA fell to $US195m compared to $US269m in the prior year, while revenues fell 22 per cent to $US1.92bn, mostly due to negative impacts of COVID-19.

But earnings for Dow Jones, the division that owns The Wall Street Journal, were broken out separately for the first time and News Corp chief executive Robert Thomson noted the business had performed strongly in comparison to the rival New York Times.

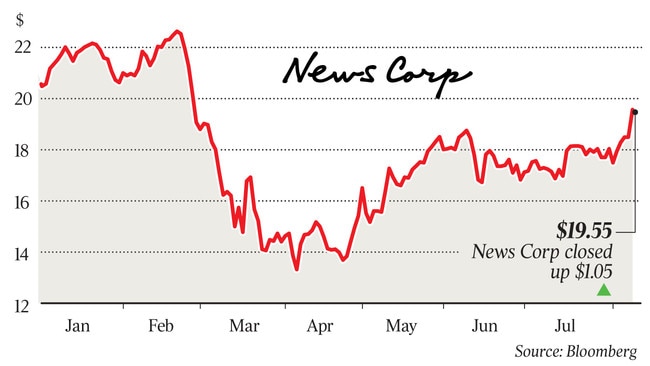

This backed a surge in its Australian-listed shares on Friday. News Corp shares finished the day 5.7 per cent higher to reach $19.55.

“In what has been a difficult year for many media companies, Dow Jones reported a 13 per cent increase in Segment EBITDA, based on the strength of its Professional Information Business, digital growth and the pre-eminence of The Wall Street Journal,” Mr Thomson said.

Dow Jones revenues were up 3 per cent to $US1.6bn, and EBITDA 13 per cent for the full year to $US236m.

News Corp reported fiscal 2020 full-year total revenues of $US9.01bn, an 11 per cent decrease compared to $10.07bn in the prior year. The decline primarily reflected an estimated $US370m, or 4 per cent, negative impact related to COVID-19 and tough advertising conditions.

Full-year EBITDA fell 19 per cent to $US1.01bn, after advertising was hit by the COVID-19 pandemic around the world and the sale of several units through the year.

The loss for the full year was $US1.55bn as compared to $US228m in the prior year, reflecting the previously disclosed $US1.69bn of non-cash writedowns, mostly related to Foxtel and the recently-sold News America Marketing business.

“Virtually all of our businesses prudently reduced costs, sometimes painfully, to ensure that they were robust enough to cope with volatility and disruption,” Mr Thomson said in a call with analysts in New York. “Conserving cash is a priority.”

Mr Thomson said the company’s “renewed emphasis on digital” products, including masthead subscriptions, was “evidence of our willingness to be decisive at a historic inflection point.

“One result of our candid approach on costs was that, despite the COVID-19 impact, our cash position strengthened to $US1.5bn from $US1.3bn as of December 31. We also saw increased profitability at Foxtel and our campaign to reset sports rights prices was successful. Just this week, we crossed the one million OTT paying subscribers mark, setting a new record thanks to our expanded streaming strategy.”

Mr Thomson added that it was “quite a moment” when describing the Australian Competition and Consumer Commission’s recently announced mandatory bargaining code that will see the likes of Google and Facebook pay companies such as News Corp for their content.

He also said Foxtel has been able to negotiate savings of about $180m for sports rights over the next three years. “This reset will have a positive long-term impact on Foxtel’s profitability,” he said.

Digital subscribers at the company’s Australian mastheads, including The Australian, were 647,600 as at June 30, compared with 517,300 a year earlier.