Rio Tinto admits underpaying Pilbara landowner royalties

Rio Tinto in dispute with second group of native title owners over Pilbara iron ore mine.

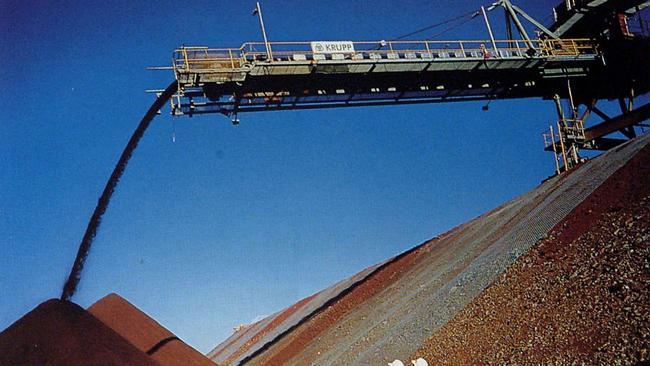

Rio Tinto is embroiled in a dispute with a second key group of native title owners over underpayment of tens of millions of dollars of royalties from a major Pilbara iron ore mine, as chief executive Jean-Sebastien Jacques fronts a parliamentary inquiry to apologise for the destruction of heritage sites at Juukan Gorge.

It is understood the Gumala Aboriginal Corporation has demanded a full audit of Rio’s royalty payments and flagged the need to renegotiate a land use agreement covering the Yandicoogina mine after Rio wrote to the corporation, notifying its directors of an royalty underpayment spanning “a number of years” and attaching payment of about $40m plus interest.

Financial records show the underpayment is larger than the annual royalties received by GAC in the 2019 financial year, the second biggest payment in its history.

The dispute flared even as Rio was frantically back-pedalling from its decision to destroy a 46,000-year-old heritage site at Juukan Gorge covered by agreements with the Puutu Kunti Kurrama and Pinikura peoples (PKKP), with Mr Jacques telling a Parliamentary inquiry on Friday the backlash to the blast had “triggered some reflection in our company”.

Amid Rio’s claims it is resetting its relationship with the traditional owners of the land it mines, Mr Jacques told parliamentarians on Friday the mining industry must “find a way to win the hearts and minds of our communities where we operate”. Industry sources familiar with similar royalty agreements say it is not uncommon for mining companies to make minor adjustments to payments after the close of the financial year, as their own financial figures clarified what was owed. But they expressed surprise at the total amount involved in Rio’s miscalculation.

And it was not just the amount owed that infuriated the GAC board, with sources saying the manner in which Rio notified GAC exacerbated tensions, with Rio initially refusing to detail the reasons for the underpayment.

It is believed the Yandicoogina agreement does not allow GAC to access the underlying information used by Rio in the complex formula used to calculate the royalty payments, an issue that has been a long-term source of friction.

Sources say GAC considered returning the money and arguing Rio had repudiated the agreement, as a possible trigger for its renegotiation on more favourable terms.

It is understood GAC is also seeking an independent audit of Rio’s royalty payments, and access to the underlying data used to calculate regular payments.

The Yandicoogina agreement was signed in 1997 and is one of WA’s oldest royalty agreements between native title holders and a major mining company. Unlike more modern agreements, it is calculated on the basis of ground disturbance at the mine and its surroundings, not on the tonnes of iron ore extracted and sold.

And it is not clear whether the formula includes a link to the iron ore price. At the peak of the mining boom in 2012 and 2013, GAC received a payment of about $38m. Payments plunged as the iron ore price fell in following years, dipping below $10m in the 2015 financial year, before rising sharply with the iron ore price surge in early 2019 to hit $36m.

During the period Yandicoogina has produced at a steady rate of about 55 million tonnes a year.

The notice and payment from Rio came only weeks after GAC launched a review of its Gumala Enterprises commercial arm, which runs businesses in mining services contracting, civil works and tourism services, citing the need to reduce costs and restructure the company in the face of a downturn in work related to the COVID-19 pandemic. While the trust that backs the operation of GAC remains one of the richest in the country, with almost $110m under management at the end of June 2018, the period from 2014 to 2018 — likely to be included in Rio’s underpayments period — saw significant financial difficulty for GAC, as royalty payments plunged, forcing the group to curtail community projects and cut back on benefits offered to members.

Rio did not respond to questions from The Weekend Australian about the reason for the underpayments, and how it came to underpay royalties by such a significant amount, instead issuing a statement saying it “greatly values” its relationship with GAC.

“Rio Tinto has reviewed payments due under a land use agreement with Gumala Aboriginal Corporation which identified an additional payment owing with interest applying,” a spokesman said.

“Rio Tinto greatly values its relationship with the Gumala Aboriginal Corporation and its members and Rio Tinto remains in discussions with them on this matter.”

GAC could not be contacted for comment on Friday.

Rio’s agreements with traditional owners typically contain confidentiality provisions restraining them from taking legal action over disputes, and from speaking publicly about them.

Rio came under fire for those clauses at the parliamentary inquiry on Friday, with Queensland Senator Matt Canavan asking the company to provide an assurance it would not pursue legal action against the PKKP — which is still to lodge a submission to the inquiry — if it were to breach confidentiality provisions by giving evidence to parliament.

It is not the first time Rio has made backpayments to GAC over royalties. A review of the Yandi agreement in 2013, conducted by former politicians Fred Chaney and Paul Lennon, noted Rio had made similar errors in the past.

“We note that since the last review Rio Tinto has advised of past errors in royalty calculations and has now remitted the underpaid amounts plus interest,” the report said.

“This is a reminder that in a complex agreement there is always the possibility of inadvertent error.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout