Weak dollar could see more misses than hits ahead

The weak Australian dollar could deliver sharp misses from retailers and other importers this earnings season, but could underpin a financial windfall for some others.

The weak Australian dollar could deliver sharp misses from retailers and other importers this earnings season, but could underpin a financial windfall for some others.

Australian retail supremo Solomon Lew had a first-hand view of how the now two-time US President tackled business deals and it offers plenty of lessons for leaders.

Markets are optimistic about the outlook for Trump’s policies, although a strong dollar and higher interest rate could eventually challenge US ‘exceptionalism’, says Westpac’s Luci Ellis.

US shares consistently beat ours for value and under newly installed President Donald Trump there are indications the pattern will accelerate.

J.P. Morgan and Citi both see 2025 as an ‘inflection year’ for listed property trusts with rate cuts set to broaden support for the sector, but they differ over favourites.

ASX is at risk of new enforcement action or further licence conditions over a damaging settlement outage caused by a decade-old systems error.

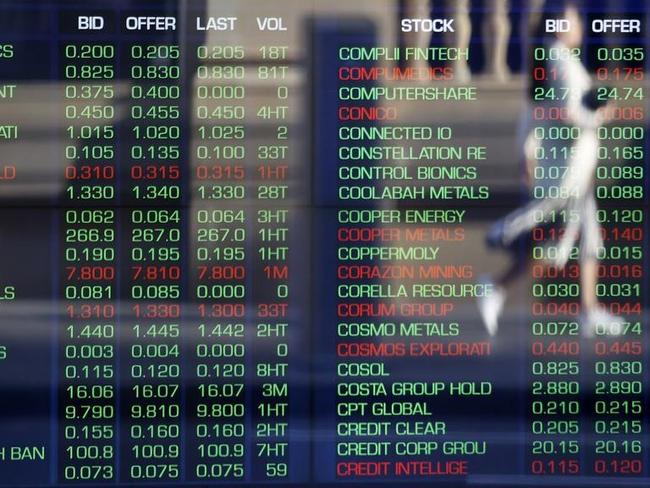

ASX down after most US stocks fell. Department store chain, Premier shareholders show huge support for merger. Bain boosts Insignia offer to $4.60 per share. Evolution drops on downgrades. Fortescue ships record amount of iron ore.

Bank of America says investors remain overall bullish on the US dollar and stocks and ‘bearish’ on everything else, but may be warming to European stocks and becoming less enamoured with the US.

The secret behind the steady exit of local investors from the Australian sharemarket is not so much the attraction of Wall Street, but the poor value offered by the ASX.

Australia’s subdued market for new stock market listings faces an uncertain outlook, with the federal election potentially delaying new IP0s in the first half.

The ASX rises 0.3 per cent to a seven-week highs on positive US leads. Qantas shares soar on US peer gains. CBA, Goodman, NAB, Westpac, WiseTech top contributors. Paladin soars as operations improve. Iluka drops on estimates miss.

Australia’s weak dollar could see inflation tick up slightly, but it is unlikely to move the RBA on its next rate cut decision, a leading economist says.

Global markets were choppy as Donald Trump plotted tariffs of 25 per cent on Canada and Mexico next month, raising big questions for China.

All eyes are on Donald Trump, and with the US closed on Monday for Martin Luther King Day, Australian markets will be among the first to react.

Local bourse rides US gains after ‘very good’ talk between Donald Trump and Xi Jinping before US inauguration. Star warns of ‘material uncertainty’ over ability to continue as going concern after cash flow update. CC Capital gets edge over bidding rival Bain for Insignia.

The sharemarket is expected to rise on Monday but the rest of the week could be volatile as markets wait to see incoming president Donald Trump’s executive orders.

The new boss of Star is surviving on just a few hours of sleep a night trying to save the casino and thousands of jobs. Even if he gets through this, does it have a long-term future?

Got an idea? Five of the nation’s leading venture capital firms have tens of millions to invest in up to 50 new start-ups. Here are the industries they’ve shortlisted as the hottest to back.

A rollercoaster ride for financial markets in the past week is likely to continue after the inauguration of Donald Trump on Monday because uncertainty about his policies endures.

Banks weigh after a bearish note from Citi. Miners supported after China’s GDP surprise. Rio Tinto, Glencore reportedly in merger talks. Insignia soars after CC Capital outbids Bain. Lovisa gains on broker upgrade.

Original URL: https://www.theaustralian.com.au/business/markets/page/2