Two top stocks to sell right now

The tech sector has richly rewarded investors over the past year but our expert stock pickers say time’s up for two of the best performers. Here’s what you should sell.

The tech sector has richly rewarded investors over the past year but our expert stock pickers say time’s up for two of the best performers. Here’s what you should sell.

Top super funds have delivered their third best returns of the past decade but don’t expect a repeat performance this year, the sector’s investors say.

Goldman Sachs’ top equity strategist warns US stocks are “priced for perfection” and “increasingly vulnerable to a correction” after an exceptional rise in past years.

You can be your own worst enemy when it comes to successful investing, so learn from my mistakes with this guide of what not to do.

Slow spending lifts chances the RBA will move earlier than expected to deliver interest rate relief.

Chinese-American stockbroker Webull admits it’s been a quiet achiever since its arrival two years ago but is ready to throw down the gauntlet to the establishment for market share.

The US market has been a shareholder’s dream over the past year but Deutsche Bank believes it’s European stocks’ time to outshine.

The shine has come off fast-fashion jewellery chain Lovisa as concerns grow that a slower-than-expected store rollout will impact the company’s earnings expectations.

November retail sales undershoot expectations despite Black Friday boost. Casino group Star’s investors react to latest cash crisis. Rex board aware of ‘bewilderingly bad’ sales: ASIC. Arcadium lifts on US nod to Rio buyout.

A quarter of a century after predicting the dot.com crash, influential US billionaire investor Howard Marks sees some worrying signs returning to shares.

The RBA will welcome the latest sign underlying inflation is falling rapidly toward its target band, but a February rate cut depends on even more positive results.

Investors buoyed by cooling underlying price pressures. Forrest named in bombshell ExxonMobil lawsuit. Avita’s downgraded earnings guidance weighs. Computershare falls on UBS ratings cut.

Mid-cap equities, those companies whose market capitalisation is defined as being in the ‘middle’ of the market, are a dynamic space.

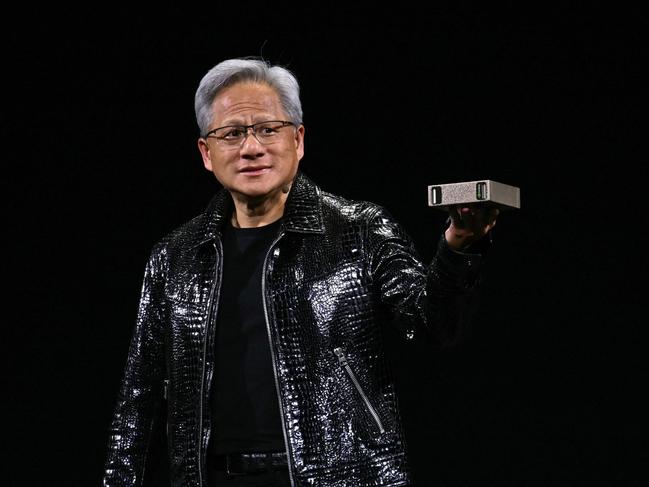

Nvidia chief Jensen Huang’s highly-anticipated keynote speech at CES 2025 in Las Vegas was a boost for Asia’s chip-related stocks.

The Australian sharemarket saw a step-up in activity from the prior year’s lows, with confidence growing in recent months.

Australia’s stock market rises for a fourth day running, setting three week intraday and daily closing highs as gains in most sectors outweigh falls in iron ore miners. Morgan Stanley says Aussie bank share prices ‘not justified’. IDP Education up on Macquarie upgrade. WiseTech’s new buy. Nvidia hits record.

Hefty new taxes on US imports from various countries was a Trump election platform, but what does it mean for your shares?

The near-term outlook for stocks appears to be challenging as US economic data ceases to exceed expectations and bond yields rise on Donald Trump’s policy promises.

Despite some change, the investor community expects improvement in company accountability, and ASA plans to press this in discussions with listed companies.

CC Capital trumps Bain takeover bid for Insignia. Infratil flags more CDC support as debt costs weigh on valuation. Shares in Goodman, Nine up after notable investor moves. Whyalla Steelworks restarts with unresolved issues.

Original URL: https://www.theaustralian.com.au/business/markets/page/4