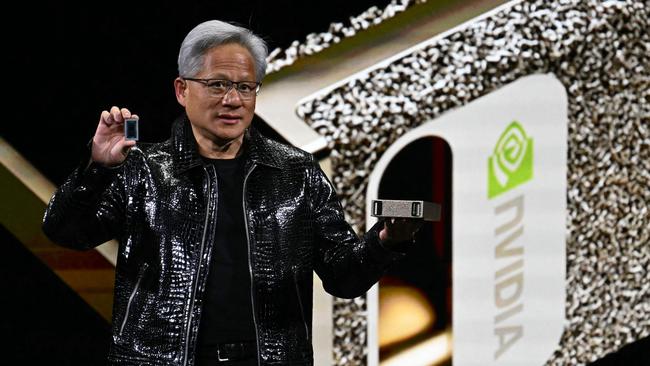

Mr Huang announced a raft of new chips, software and services which should keep Nvidia at the top of the artificial intelligence boom for years to come.

The speech also saw a jump in the stocks of its chip gear suppliers. Tokyo Electron, Advantest, Disco and Lasertec rose more than 6 per cent.

In Taiwan, Nvidia assembly partner Hon Hai Precision Industry Co rose more than 4 per cent and Taiwan Semiconductor Manufacturing Co jumped 3 per cent.

The Bloomberg Asia Pacific Semiconductors index rose as much as 2.9 per cent to be up almost 8 per cent in the past two days, but trimmed its positive reaction to about 1.5 per cent.

Shares of Toyota Motor jumped as much as 3.9 per cent after Mr Huang flagged the Japanese carmaker will be a customer for Nvidia’s autonomous driving AI products.

However, Nasdaq 100 futures turned from up 0.1 per cent to down 0.3 per cent after Huang’s CES 2025 appearance. S&P 500 futures were down about 0.1 per cent in late Asia-Pacific trading.

No doubt Nvidia continues to position itself to stay at the forefront of the artificial intelligence boom. Mr Huang outlined a world of a billion humanoid robots, 10 million automated factories, and 1.5 billion self-driving cars and trucks, developments in which Nvidia is planning to play a pivotal role.

He said the industry was still “chasing and racing to scale artificial intelligence”. However, that’s well known by now and perhaps not enough to fuel further gains in the short term.

Nvidia led a rebound in the S&P 500 over the past three days, setting a record high close of $US149.43 per share on Monday. A three-day rise of 11 per cent was its best since the three days ending September 12. Nvidia soared 185 per cent from a 52-week closing low of $US52.25 set on January 8, 2024.

However, the tepid reaction from the broader market warns of a pullback amid worries about the inflation outlook as investors and the Federal Reserve await details of US President-elect Donald Trump’s economic policies.

A Washington Post report that Trump’s tariff plans may concentrate on “critical imports” rather than the “universal” basis he campaigned on was seen as a plus for US stocks on Monday, but it was quickly smacked down by the President-elect who said his tariff policy wouldn’t be scaled back.

Partly reflecting inflation risks which could increase funding costs by further limiting the amount of US interest rate cuts by the US Fed, the US 10-year bond yield rose 3 basis points to 4.63 per cent, its highest daily close since April.

It comes after Fed officials last month halved the amount of cuts they expect this year and Fed chair Jerome Powell said some officials “did take a very preliminary step and start to incorporate highly conditional estimates of economic effects of policies into their forecast at this meeting”.

As bond yields push higher, stocks have become “rate-sensitive again”, narrowing the breadth of the rebound, according to Morgan Stanley’s chief investment officer Michael Wilson.

Last month he highlighted a 4 per cent to 4.5 per cent range on the 10-year Treasury yield as a “sweet spot” for equity multiples.

A break above 4.5 per cent, driven by less dovish monetary policy expectations or a rise in the term premium, would be a “headwind” for multiples, as it was in April.

Recently, these drivers have pushed the 10-year yield above 4.5 per cent and the correlation of equity returns to bond yields has flipped decisively into negative territory, with yields up and stocks down and vice versa — something not seen for the past six months or so.

Meanwhile, economic surprise indices have fallen and, thus, are not the driver of higher yields.

“The combination of these factors makes rates the most important variable to watch in early 2025,” Mr Wilson said. In his view it’s another reason to stick with the highest quality stocks.

While the economic cycle has been extended, he said it was a “later cycle environment” — typically a backdrop consistent with outperformance of the “quality” cohort.

Relative earnings revisions for the high-quality factor are “inflecting higher” and the recent rise in bond yields provides yet another reason to stay higher in the quality curve as companies with stronger balance sheets and less leverage are likely to remain less rate-sensitive.

He does see scope for broadening in leadership in 2025, but believes it will be concentrated in larger cap, higher quality stocks as we’re entering a late-cycle extension, as opposed to a new cycle.

“We think the slow rebound in animal spirits is likely a by-product of higher rates despite Fed cuts, a stronger dollar and a lack of clarity around tariff policy,” Mr Wilson said.

As long as those dynamics persist, investors should focus on areas showing relative strength from an earnings revisions standpoint — including software, financials, and media and entertainment.

Nvidia chief Jensen Huang’s highly anticipated keynote speech at CES 2025 in Las Vegas was a plus for Asia’s chip-related stocks, but US stocks index futures fell slightly.