IPO activity in Australia hits 20-year low as federal election may delay new listings

Australia’s subdued market for new stock market listings faces an uncertain outlook, with the federal election potentially delaying new IP0s in the first half.

The ASX is expecting a rebound in new sharemarket listings in 2025 as the economic outlook in Australia becomes clearer and volatility over the US election result eases.

“We are expecting 2025 to be a very busy year with the market becoming increasingly active as the year goes on,” the ASX’s group executive listings, Blair Beaton, told the Australian in an interview on Wednesday.

Mr Beaton was disputing a more cautious outlook for ASX listings in a new report released on Wednesday by accounting firm HLB Mann Judd.

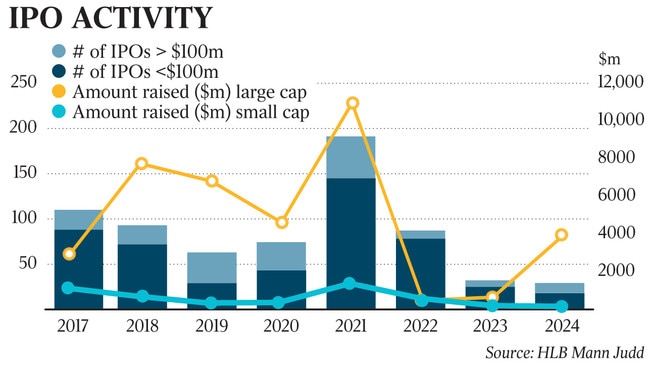

The report said the number of new listings on the ASX last year hit a 20-year low last year with only 29 new listings in 2024, down by nine per cent on the new listings in 2023.

The ASX says the number of new companies coming to the market last year was larger when the number of offshore companies doing secondary listing on the ASX is taken into account.

The ASX executive said there had been an “unprecedented level of activity” in the last few months of 2024 in discussions with representatives of companies considering listing on the ASX attending ASX run workshops.

“It is a really great indicator in respect to what activity we are going to see in 2025,” he said.

He said the new listings on the ASX was “going to kick off with a big bang in February to the Chemist Warehouse deal which is going to be a $30bn transaction.”

“It will be the biggest new listing we have ever had,” he said.

The deal will see Chemist Warehouse merge with ASX listed Sigma Healthcare which has a market capitalisation of some $4.5bn.

Mr Beaton said the ASX had conducted around 15 workshops involving around 30 companies each which were looking at listing on the exchange in the eight weeks to mid-December.

He said this represented a “spike” in interest, with the same level of briefings normally being held over a six month period.

Mr Beaton said he also felt the “expectation gap” between private equity owners looking to sell their companies and the amount they might raise in an IPO on the ASX had come down considerably.

“The expectation gap on valuations has disappeared,” he said.

“It has got to the level where private company investors are happy to sell their companies into a listed environment.”

Mr Beaton’s comments were responding to a more cautious outlook for ASX listings in a new report by accounting firm HLB Mann Judd.

HLB Mann Judd’s Perth partner and author of the report, Marcus Ohm said the 29 listings in 2024 were the lowest number of listings since the firm’s first report in 2004.

“And so far there is little sign of numbers improving in the first half of 2025,” he said.

“The outlook for 2025 is unclear, with the initial public offering pipeline for early 2025 limited to only three small cap listings.

“There continues to be a high degree of uncertainty, including an upcoming federal election, making it difficult to predict when the IPO market in Australia will experience any substantial rises in activity.”

But he added that he didn’t think the Federal election in Australia would deter companies considering an IPO.

“It’s more likely that potential policies coming out of the US on tariffs, for example, could have a larger impact in terms of commodities prices and the market,” he said.

He also noted that while there were only three companies noted by the ASX as upcoming listings, “the ASX has much greater visibility over how many companies are at earlier stages of the listing process.”

ASX figures show that $4.1bn was raised by companies in 2024 involving 67 new listings including IPOs, dual listings and debt listings.

The total funds raised was up by 284 per cent from that raised in 2023 in deals involving only 45 companies.

But it was still below the $4.9bn 5-year average for the ASX.

The ASX said last year saw another $35.9bn in follow-on capital was raised by ASX listed companies last year involving more 1271 transactions.

This was much larger than the $26.8bn raised in over 1157 transactions in 2023.

The ASX said this was the seventh year straight, ASX had ranked first globally by volume of follow-on transactions.

The ASX’s general manager, listings, James Posnett, said there were many company specific issues with the companies who were attending the ASX workshops about listing in the final months of the year.

He rejected suggestions that Australian companies might look to delay possible IPOs this year because of the Federal election.

“The bigger problem was the US election and is over and done with now.

“It is actually a positive.”

He said the ASX had not had any one mention the Australian election as an issue which would affect their plans for listing.

He said the outlook for the Australian economy was also much clearer with the prospect of rate cuts sometime this year.

“At the macro level things have become a lot clearer economically in terms of the interest rate cycle and inflation,” he said.

“Having 13 interest rate rises in such a short time is of course going to have an effect on the market.”

“It has been quite an extraordinary few years in terms of interest rate rises, and the effect it has had.”

“But now things have become clearer that interest rates will remain stable and come down.

“That is going to give more confidence to the market as the year pans out.”

The HLM Mann Judd report said the lower level of new IPOs on the ASX last year reflected “another challenging year for the IPO market, with significant macro and political factors globally.”

But Mr Ohm said it was positive that 2024 saw 11 large cap listings compared to seven in 2023.

DigiCo Infrastructure REIT was the largest IPO of the year, raising $1.9bn, the first IPO on the ASX to pass the $1 bn mark since 2021.

The second largest raising of the year was payments infrastructure company, Cuscal Limited which raised $340 million.

Food chain Guzman Y Gomez was the third largest listing, raising $335 million in a fully subscribed placement with its share price reaching $44.75 in early December compared to its issue price of $22.

The increased number of larger companies listing in 2024 saw a big increase in total new funds raised from IPOs over the year to $4.1bn, compared to only $847m in 2023.

The large cap listings made up 96 per cent of the total funds raised, with three listings with market caps in excess of $1bn which collectively raised $2.7bn, Mr Ohm said.

Mr Ohm said the overall trend suggested that while the IPO market in Australia continued to be historically subdued, there were some positive signals in the amounts raised in 2024, and the year end gains achieved.

The average year end gain for new listings was 12 per cent which, exceeding the ASX All Ordinaries Index gain of 8 per cent.

This contrasts favourably with 2023 when new listings recorded an average year end loss of 10 per cent, compared to an ASX gain of 9 per cent.

Some 38 per cent of new listings recorded a year end gain compared to their issue price.

The “materials” section of the resources industry continued to dominate the IPO market, accounting for 13 listings, making up 45 per cent of total IPOs.

But this was down from the 72 per cent in 2023, and the five year average of 56 per cent.

Mr Ohm said the fall in the number of materials companies listing was largely due to unfavourable conditions for battery metals.

He said conditions for junior exploration companies had been unfavourable, particularly through the second half of 2024.

“Only just over half the companies in this sector achieved their target subscription,” he said.

Ten industry sectors were represented with new listings in 2024, an increase from 2023 when only seven sectors were represented.

There were no listings in the software and services sector- the first time since 2010 there have been no IPOs in the sector.

Mr Ohm said this underscored “ongoing challenges in the technology space.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout