Afterpay, Zip in revenue chase

Shares in tech darling jump past $90 to new high as buy now, pay later pioneer halves its annual net loss to $19.8m.

Shares in tech darling jump past $90 to new high as buy now, pay later pioneer halves its annual net loss to $19.8m.

Cbus has been critical of AMP’s leadership over its handling of the situation that has led to several staff exits.

Goldman Sachs joins the AMP investment banking team of advisers, as potential buyers continue to run the numbers on the wealth group.

Listed financial conglomerate Link Group’s departing CEO says if the GFC and dot.com crash were 6 on the financial Richter scale, COVID-19 is 8.5.

For decades AMP management has had possibly the best view in Sydney. They should have been looking inside instead.

Former Optus CEO Paul O’Sullivan’s focus will be on recovery when he takes over from David Gonski as ANZ chairman.

Institutional investors have taken aim at the resources sector in the wake of Rio Tinto’s Juukan Gorge disaster.

Parliament hears damning accusations by another former female AMP employee, alleging ‘consistent and systematic’ harassment’.

The decision removes a cloud over executives and directors, including chair Catherine Livingstone and CEO Matt Comyn.

The prudential regulator has admitted that remote monitoring has diminished the effectiveness of its oversight with financial institution.

Funds under management fell to $21.4bn, down 14 per cent on the year prior as it suffered $3bn in net outflows.

Rapid expansion has seen the value of recent buys re-evaluated.

The non-bank lender had a 19 per cent lift in annual net profit on the back of growth in its home loan portfolio.

Jefferies has hired former JPMorgan analyst Sebastian Woodard to its local team, as it continues to grow its footprint after a raid on CLSA.

Several corporate and private equity buyers are thought to be keeping a watching brief or actively running the numbers on AMP.

The insolvency industry is coming to grips with the fact that it’s been completely sidelined from the biggest ticket of industry reforms since the 1980s.

The hedge fund manager said he had made some missteps including selling out of music streaming giant Spotify at the wrong time.

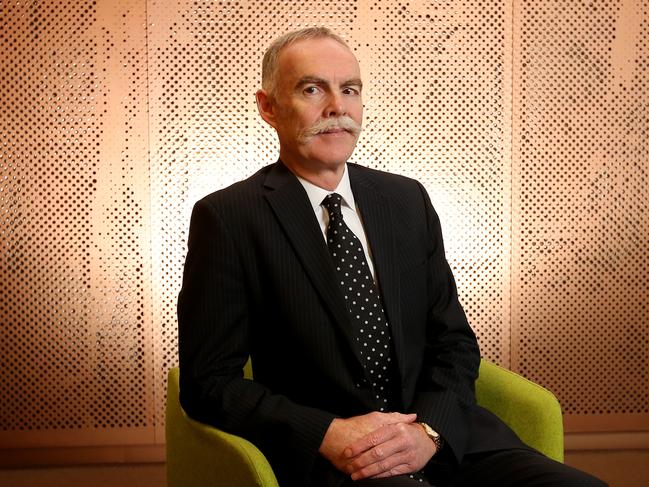

AMP chief Francesco de Ferrari has a supporter in former AMP chief investment officer Merv Peacock.

Former celebrity financial planner Sam Henderson pleaded guilty on three charges on Tuesday for misrepresenting his qualifications over several years.

CBA says requests for payment deferrals have risen amid Melbourne’s lockdown, in contrast to the rest of the country.

A lack of financial advice may have contributed to workers pulling more than $30bn from their superannuation accounts, the wealth manager says.

A spate of blunt phone calls and emails to the besieged David Murray-led AMP board late last week spelt the end for the group in its current form.

AMP is embarking on yet another journey to repair trust and fill key board and executive vacancies, after a tumultuous period marred by revelations of poor executive conduct.

AMP’s new chair Debra Hazelton smashed all sorts of glass ceilings in her time as a senior executive in the Japanese banking world.

Two household-name companies, Rio Tinto and AMP, two corporate governance nightmares, two different reactions.

Te funder has set out a deliberate strategy to boost corporate funding side of the business because concentrating on class actions in Australia would have exposed it to too much risk.

The weekly amount paid out under the government’s COVID-19 early access of super scheme is at a record low.

National Australia Bank leads the pack, with $368m paid for its fees-for-no-service misconduct to 54,826 customers.

CBA’s new business banking boss Mike Vacy-Lyle is determined to step up relationships with SME, and has some key industries in focus.

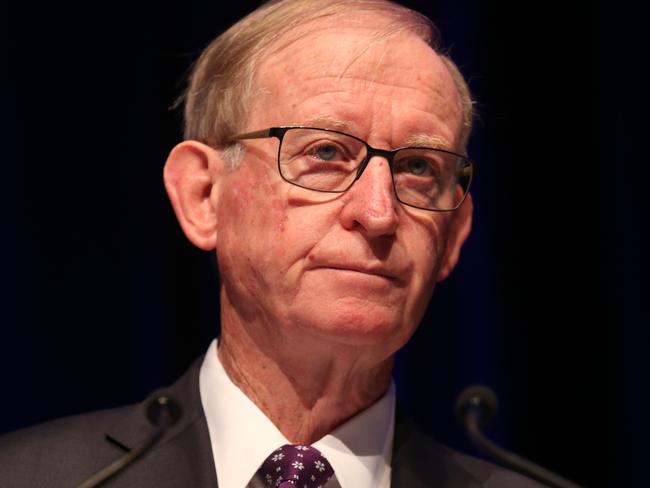

David Murray has fallen on his sword to protect his appointed chief executive in a classic old school response to a governance nightmare.

Original URL: https://www.theaustralian.com.au/business/financial-services/page/197