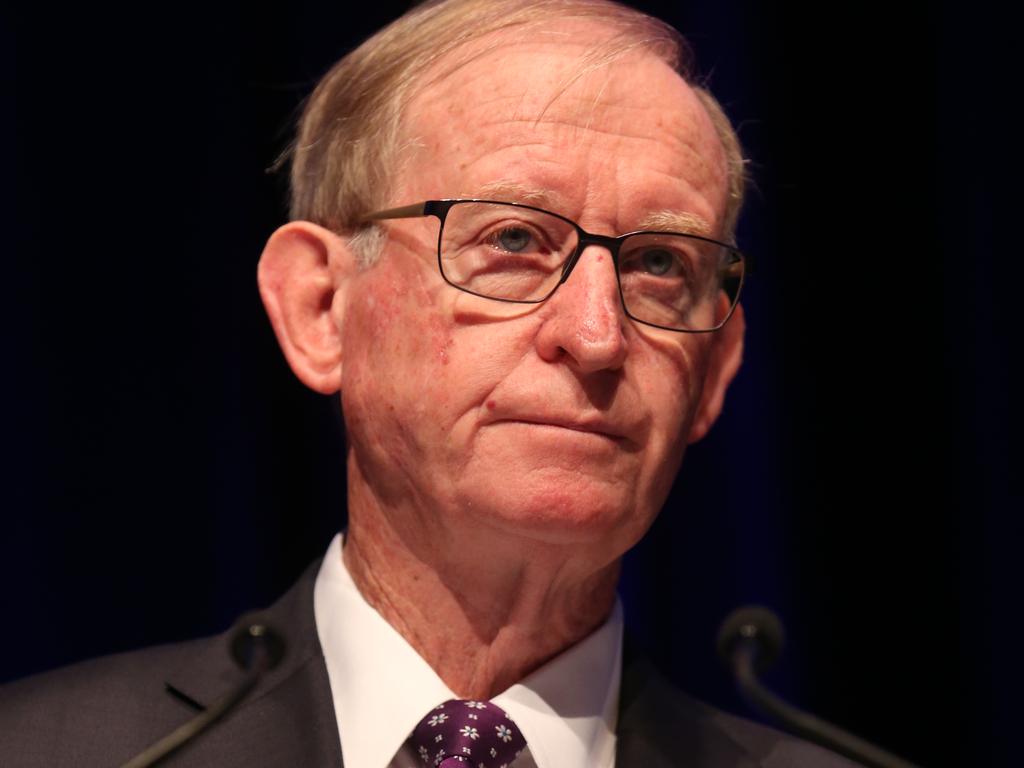

David Murray quits as AMP chair over Boe Pahari appointment

AMP is embarking on yet another journey to repair trust and fill key board and executive vacancies, after a tumultuous period marred by revelations of poor executive conduct.

AMP is embarking on yet another journey to repair trust and fill key board and executive vacancies, after a tumultuous period marred by revelations of poor executive conduct sparked the resignation of chairman David Murray and board member John Fraser, while AMP Capital boss Boe Pahari was demoted.

The under-pressure 171-year old wealth company ceded to investor demands for action on Monday and appointed former Mizuho Bank Australia boss and Commonwealth Bank executive Debra Hazelton as group chairman, effective immediately.

The high-profile board exits and demotion of Mr Pahari was the result of a marathon AMP board meeting on Sunday. It sought to address investor angst over Mr Pahari’s role as head of AMP Capital, given a sexual harassment complaint made against him in 2017, and the damage the fallout was causing the company.

The latest changes also mark a shake-up of the board, leaving two vacancies at a time when AMP’s two key business units remain without permanent executives in charge, given the scandals that have embroiled the group over the past two months.

The board resignations follow growing pressure on AMP over the appointment of Mr Pahari to lead the real estate and infrastructure unit in July, after he was penalised as much as $500,000 over a sexual harassment complaint made in 2017 by former employee Julia Szlakowski.

Late on Monday, Mr Pahari issued a formal apology to Ms Szlakowski and AMP issued the short conclusion of a yet-to-be-released investigation into his conduct by UK employment law specialist Andrew Burns QC.

“I find that there was poor judgment exercised by [Mr Pahari] during this evening and one moderate and two minor incidents which overall added up to a relatively modest breach of the AMP Workplace Behaviour and Equal Opportunity Policy. However, this involved a senior manager who ought to have been observing a high standard of equality and diversity practice and who ought to have had a much better understanding of how his actions might be perceived by and may affect a junior colleague,” the investigation found.

AMP was again in the spotlight early this month when its Australia boss Alex Wade left abruptly due to conduct issues and the sending of lewd photos to a female employee.

Mr Murray — a veteran of the financial services industry and former CBA chief executive — took the reins as AMP chairman in June 2018, after the Hayne royal commission led to a purge of the Catherine Brenner-led board.

Former treasury secretary and UBS Asset Management executive Mr Fraser also decided to step down from AMP’s board and as chairman of the capital division “in light of David Murray’s resignation”.

Shareholders were largely supportive of Monday’s changes, but stressed that AMP had to refocus on improving culture and executing its three-year turnaround plan. AMP’s stock rose 1 per cent to $1.445 on Monday, outpacing gains of 0.3 per cent in the S&P/ASX 200, but remains well down on a 12-month high of $2.09 hit in February.

Investors started rallying hard against Mr Pahari’s leadership of AMP Capital last week, when sordid details of the sexual harassment complaint were made public by Ms Szlakowski and her lawyers.

Ms Szlakowski’s complaint outlined Mr Pahari extending her London hotel booking without permission, calls and texts in the early hours of the morning after a night out, and referring to his “limp dick” when she declined to use his credit card to buy clothing.

Mr Murray said while his view remained that the matter against Mr Pahari was “dealt with appropriately” in 2017, he was taking responsibility for the promotion of Mr Pahari given some shareholders disagreed.

“AMP needs to continue its transformation under chief executive Francesco De Ferrari with the support and confidence of its investors, institutional clients, employees, partners and clients, without distractions,” he added.

Mr De Ferrari takes over leadership of AMP Capital on an interim basis while an executive search for the division is conducted.

In a statement on Monday, Ms Szlakowski said it gave her “some comfort” that AMP had acknowledged the seriousness of her complaint and was trying to address cultural shortcomings.

“That work, however, still has a long way to go,” she added.

Ms Szlakowski renewed her calls for AMP to release her seven-page complaint, the investigation document and other material relating to the report.

She settled the matter and parted ways with the company in 2018.

Funds management firm Allan Gray, a substantial shareholder of AMP, labelled AMP’s actions decisive.

“Change was needed in creating a safe workplace and sound culture,” portfolio manager Simon Mawhinney said. “AMP’s actions on this matter have now been decisive and we would like to give the company the latitude to execute on their stated strategy and cultural journey.”

But S&P Global Ratings said the AMP board and executive change highlighted “governance challenges” and a potential dependency on key individuals.

“We will continue to monitor the degree to which these challenges may disrupt the overall strategic direction of the group as well as the group’s ability to effectively execute its strategy,” S&P said.

The Australian Council of Superannuation Investors welcomed the board changes and Mr Pahari stepping down from running AMP Capital, saying they reflected acknowledgment that “significant change” needed to occur after an initial “inadequate” response to the sexual harassment complaint.

“This is an important step in addressing concerns raised by investors and resetting company culture,” ACSI chief executive Louise Davidson said.

As part of the changes announced, Mr Pahari will resume work at his previous level with a focus on AMP Capital’s infrastructure equity business. It is understood he will be stripped of responsibility in his prior role for distribution of AMP group products across the US, Europe and UK.

Ms Hazelton said under her leadership, the board would focus on working with the leadership team to “deliver long-term value” for shareholders and customers.

“I am determined to restore the trust and confidence of our clients, shareholders and employees,” she said.

Ms Hazelton is also a non-executive director on the boards of Treasury Corporation of Victoria, Persol Australia and the Australia-Japan Foundation.

More Coverage