Afterpay halves losses as customer numbers double, shares hit new high

Shares in tech darling jump past $90 to new high as buy now, pay later pioneer halves its annual net loss to $19.8m.

Australia’s burgeoning buy now, pay later sector faced a moment of truth yesterday with market darling Afterpay and rival Zip lifting the lid on their financials.

Both companies doubled revenues year-on-year, and now face increasing investor and regulatory interest as they capitalise on an increasingly digital economy and fast-evolving consumer behaviour.

Afterpay has halved its annual net loss to $19.8m, in a year where heavy investment in expansion saw active customers more than double.

The payments group’s underlying sales revenue of $11.1bn was up more than 100 per cent year-on-year, from $5.2bn in 2019.

Earnings before interest, taxation, depreciation and amortisation (EBITDA) rose 73 per cent rise to $44.4m.

Shares in the company pushed to a fresh record on opening, touching as high as $95.97, before closing at $91.26. The rally gives Afterpay a market capitalisation of more than $25bn. At the depths of the coronavirus crisis the stock was trading at just $8.90.

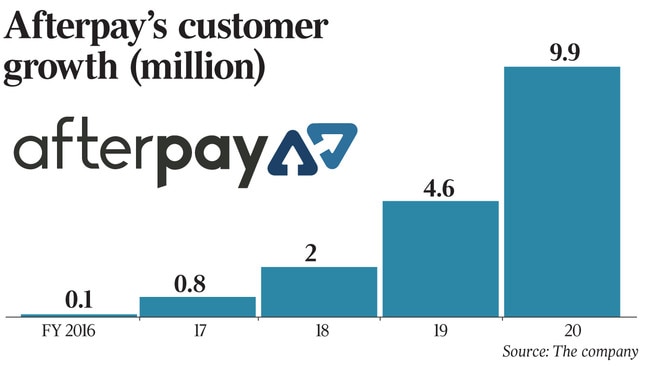

Active customers numbers at June 30 grew to 9.9 million, from 4.6 million in the prior year.

The result followed a year in which Afterpay worked to expand its foothold in the US and UK, and prepared for launches in the Canadian and European markets.

Afterpay also confirmed a push into Asia, announcing it would acquire Indonesian BNPL provider EmpatKali as part of “initial steps to explore select opportunities in Asian markets”.

“This acquisition is just the beginning, it’s the formation of putting in an in-country team to keep exploring opportunities,” chief executive Anthony Eisen said.

“We do see from a number of our key retailers that desire for us to be where they are. Obviously the push into North America, with Canada, and Europe, with the UK, is in line with that but Asia and some countries in Asia features in that opportunity as well.

“We’re at the beginning but we think we can cautiously but effectively look into developments during the 2021 financial year to put some irons in the fire.”

As its overseas presence grows, underlying sales revenue from the US and UK contributed 41 per cent of the group’s total in the 2020 financial year, up from 19 per cent in the prior period.

The buy now, pay later operator said it had been a “net beneficiary” of the impact of COVID-19, as consumers shifted towards online spending and away from traditional forms of credit, but it emphasised uncertainty around the pandemic’s impact on global growth.

“I think we’ve developed as a company and we’ve evolved. But the culture of our company is still based on this real passion that we’re still very new,” Mr Eisen told The Australian. “The model around customer centricity is part of what is a global shift. This shift towards online, and COVID-19 has accelerated that by years not months, and the shift away from traditional credit which you’ve seen since the GFC, is an opportunity that is still very much in its infancy.

“There’s nothing about the spirit or the position of the company at all that reflects something that’s very mature in terms of our making. It still has that spirit to it, and I hope it maintains that way too.”

The executive also emphasised Afterpay’s points of difference from incumbents such as the banks, and said he was used to competition.

“We are the verb and our own category,” Afterpay said in its results presentation. “The traditional credit industry needs the consumer to lose for them to win, they survive by charging interest and pushing consumers into revolving debt. We trust in the next generation and reward people spending responsibly. We see the world differently.”

The results come ahead of an expected ASIC report into Australia’s buy now, pay later sector this month, and potential fresh regulation.

“Through collaboration, we want to be leading and introducing new forms of customer protection,” Mr Eisen said. “We think it’s complimentary, not a substitution [for regulation].”

The company told investors it had responded to regular ASIC requests for information during COVID-19 as the regulator monitors markets including buy now pay later.

“Afterpay has consistently maintained significantly lower loss rates than our peers, as well as traditional credit products, who employ credit checks to recover debts, price credit, and potentially impact customers’ credit scores and ability to borrow. We welcome regulation that is based on delivering positive outcomes.”

New statistics from Worldpay show that BNPL is the fastest growing online payment method, growing at 32 per cent annually. It’s forecast to become 17 per cent of the e-commerce market by 2023.

The company also predicts in Australia BNPL products will double their market share by 2023, given currently only 1 in 10 Australians used a product like Afterpay or Zip in 2019.

Meanwhile Afterpay’s main rival Zip’s revenues – and losses – continue to mount, with the buy now, pay later provider posting record full-year revenue of $161m, while losses before tax climbed to $44.9m.

As its overseas presence grows, underlying sales revenue from the US and UK contributed 41 per cent of the group’s total in the 2020 financial year, up from 19 per cent in the prior period.

In its full-year results for the year ending June 30 2020, Zip declared it had “emerged as a global BNPL leader”, recording total transactions of $2.1bn, up 87 per cent year-on-year. The company said it now has more than 2.1 million customers and nearly 25,000 partners on its platform.

Revenue was up 91 per cent year-on-year to $161m for the year ending June 30 2020, while ‘bad and mountful debts’ increased to $53.7m.

The company closed down 4.7 per cent to $9.20, after a record day on Wednesday in which the company closed up 27.5 per cent on news of a new partnership with eBay.

The company said it had demonstrated ‘strong resilience’ throughout COVID, delivering positive cash EBTDA while growing into new markets, including the US through an upcoming expected acquisition of New York-based QuadPay.

“We‘re very pleased with these numbers,” co-founder Peter Gray told The Australian. ”They have really demonstrated the resilience of the business through challenging times in terms of COVID. We were able to adapt and maintain our transaction volume, and obviously the shift to online will assist the business.

“The QuadPay acquisition is a great entry point for the business into the largest addressable opportunity in the world, America, and the momentum that business is coming off as well is very similar to Australia.

The company’s shareholders will vote next week to approve the $400m QuadPay acquisition.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout