We expect more, funds warn miners

Institutional investors have taken aim at the resources sector in the wake of Rio Tinto’s Juukan Gorge disaster.

Institutional investors have taken aim at the resources sector in the wake of Rio Tinto’s Juukan Gorge disaster, demanding higher standards in heritage protection and better relations with Indigenous communities to avoid the potential for “stranded assets”.

It also emerged on Wednesday that Rio’s most senior officers, including chief executive Jean-Sebastien Jacques, are fighting for their jobs, with the head of the nation’s biggest superannuation fund attacking Rio over its inadequate response to the destruction of the 46,000-year-old site.

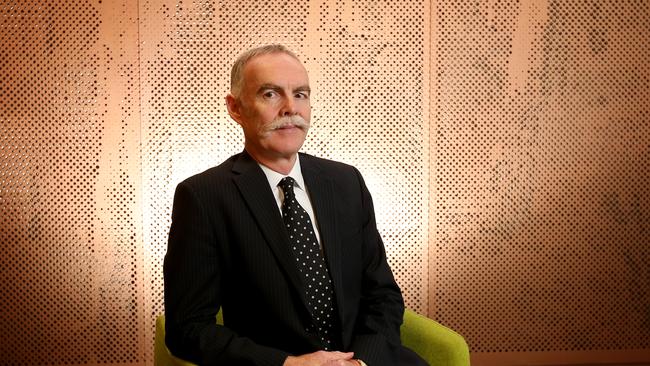

Ian Silk — the influential chief executive of AustralianSuper, which has $180bn in member assets including Rio shares worth $1.3bn — met with Rio chairman Simon Thompson on Tuesday.

Mr Silk voiced his dismay about the decision to blow up the site to secure access to $1.4bn in high-grade iron ore, and the subsequent restriction in accountability measures to financial penalties.

He said Rio’s review of the debacle, released this week, highlighted “profound systemic, operational and governance failings”.

“AustralianSuper has met with the chair of Rio Tinto and expressed our view that the proposed penalties fall significantly short of appropriate accountability for those responsible,” Mr Silk said. “We have asked the board to consider its response, and are continuing to engage with the company on the matter.”

Rio insisted on Monday after releasing the board review of the Juukan Gorge incident that Mr Jacques was “absolutely” the right person to lead the company and restore its reputation. The review found “no single individual or error” responsible for the catastrophic move to destroy the site.

While Mr Jacques would lose $5m in bonuses, he would not suffer any other consequences, with the primary blame for the decision-making pushed to previous leadership under Sam Walsh.

Mr Thompson said there were certainly failings in the past four to five years, but “in many respects” the origins of the problem and the decisions taken on the mine plan were made “quite a long time ago”.

Rio’s problems spread into the wider resources sector, with the $52bn industry fund HESTA releasing a statement detailing its expectations of 14 Australian mining and energy companies when they work with Indigenous communities.

HESTA considers it has “material” stakes worth at least $30m in each of the 14 companies, including heavyweights such as BHP, Woodside Petroleum, Origin Energy and Santos. The total value of the holdings is $1.84bn.

Chief executive Debby Blakey said the emergence of stranded assets was a “real risk” if companies failed to properly engage with Indigenous communities.

The fund had therefore told the group of 14 companies that it was embarking on a direct engagement program in relation to sensitive heritage protection issues.

Rio, according to Ms Blakey, was a “wake-up call” for investors, and she was hopeful HESTA’s statement on working with Indigenous groups would lead to collective action by investors. This could include voting against company resolutions at their annual meetings to seek change.

In the meantime, the engagement program would focus on whether companies were properly assessing and mitigating risks, the level of alignment with their public statements, and overall accountability issues.

The HESTA boss said investors were dismayed at Rio’s destruction of culturally significant sites at Juukan Gorge.

“Not only was priceless heritage destroyed and the costs borne by shareholders as a result, but we had believed this risk to be well-managed in our portfolio,” she said. “This has prompted us to renew our focus on ensuring fair and sustainable outcomes for Indigenous communities and companies.”

Ms Blakey said the HESTA statement was based on the principle that Indigenous people “own and determine” the value of their tangible and intangible heritage and decide who gets access to it.

Boards should have oversight of how companies monitored society’s shifting expectations, and if decisions made in the past were still appropriate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout