Cbus boss plans for more mergers

The $55bn industry superannuation fund backs legislated plans to increase the superannuation guarantee.

The $55bn industry superannuation fund backs legislated plans to increase the superannuation guarantee.

Two former Labor PMs have blasted moves to defer or stop the legislated increase in the superannuation guarantee to 12 per cent.

The overwhelming majority of economists say the federal government should abandon or defer the legislated increase in compulsory superannuation contributions.

The Morrison government is considering new laws to stop industry super funds giving up to $40m to unions and spending more than $400m on advertising and marketing.

Cbus has been critical of AMP’s leadership over its handling of the situation that has led to several staff exits.

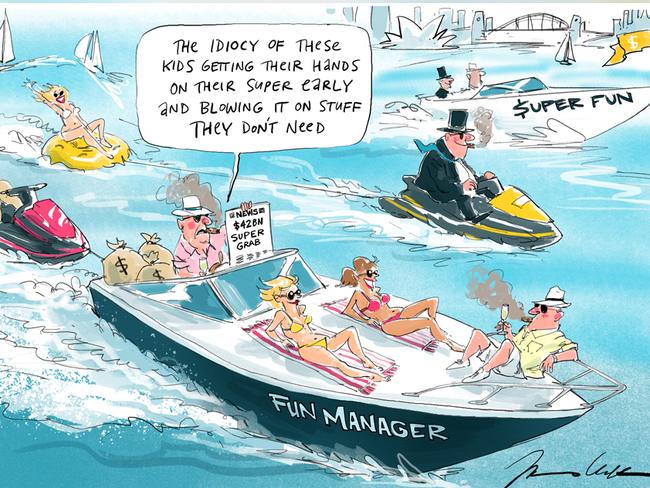

Our so-called expert advice on super is becoming out of touch with reality and in touch with the needs of vested interests.

The weekly amount paid out under the government’s COVID-19 early access of super scheme is at a record low.

Westpac’s has a new headache after ASIC toook new action stemming from the Hayne inquiry.

Delaying the release of the report was ‘undermining confidence in the retirement system’.

A healthy return in July was largely on the back of international shares, mainly driven by the US market.

The total amount paid out under the second tranche is growing by nearly 10 per cent a week.

An issue swept under the carpet for 28 years is threatening to come back and wipe small business out within weeks.

The median balanced option returned 0.9 per cent for the month of July.

The greatest concern for most Australians who are approaching retirement is that they don’t have enough money.

Superannuation heavyweight HESTA says it and other investors will ultimately pay the cost of Rio Tinto’s damaged licence to operate.

Errors in the execution mean the stimulatory measure ‘which is not equitable’ should be halted by December.

Scott Morrison slaps down suggestions super savings are being frittered away, despite alarming figures on withdrawals.

ATO crackdown: meet the criteria of hardship, or face a higher rate of tax income or a fine.

Banks and super funds have been given new rules designed to speed up the resolution of customer complaints.

Australian’s have come back for a second hit at their super balances.

Funds brace for the possibility of a third $10,000 tranche being made available to workers hit by the COVID-19 crisis.

Super funds resent us having access to the savings that so lavishly line their pockets. Here are some sound reasons why we should be able to.

If the sharemarket fell more than 7 per cent across the year, how did super funds finish with an average dip of just 0.5pc?

The SMSF sector got a boost when commencements suddenly picked up during the first phase of the pandemic crisis.

Public servants and military fund members are rushing to withdraw super for a second time, but there are questions about their eligibility to do so.

Australian super funds were carried to safety by growth assets and ever-widening diversification.

The regulator is now actively reviewing the SMSF estimates figures that caused consternation across the industry.

Applicants raise the stakes as the new financial year starts with rush for another bite at early access to superannuation.

Retail super funds could be in for a rough 12 months, says KPMG.

The pitfalls of timing and benefits of diversity shine through as some of the biggest super funds scrape through with positive returns.

Original URL: https://www.theaustralian.com.au/topics/superannuation/page/3