Coronavirus Australia: Do what you will with super, says Scott Morrison

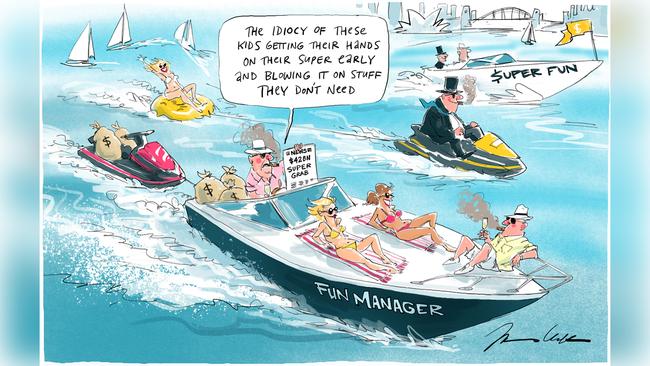

Scott Morrison slaps down suggestions super savings are being frittered away, despite alarming figures on withdrawals.

Scott Morrison has slapped down suggestions that superannuation savings being withdrawn early were being frittered away or undermining individuals’ ability to provide for themselves in retirement, following a large upward revision in the sum expected to be withdrawn.

The Prime Minister said on Thursday that the government wouldn’t “give lectures” to people on how to use “their money”, referring to a fresh government estimate that $42bn in superannuation savings would be withdrawn by individuals affected by the coronavirus recession by the end of the year — up from an estimate of $29bn in March.

“Superannuation doesn’t belong to the superannuation fund managers. It belongs to the superannuation fund members,” Mr Morrison said, answering a question about whether the money was “being used for purposes it wasn’t intended for”.

“The intent for which it is used is decided by the person whose money it is. But (in) the overwhelming majority of cases … my advice is, people are using it actually to restructure their own personal balance sheets.’’

In March the government let those who had lost their jobs or suffered a 20 per cent or more drop in their hours as a result of the pandemic access up to $20,000 of their money in super over two financial years, tax-free.

It extended the application window in last week’s economic and fiscal update.

Superannuation funds and the Labor Party have criticised the policy for undermining future retirement incomes and eroding the compulsory aspect of superannuation.

A senior researcher at the Grattan Institute, Brendan Coates, said on Thursday the policy, which has had more than 2.5 million people applying for it, was a “good move” and “put money in the hands of people when they needed it most”.

“Withdrawing super isn’t a step anyone should take lightly, but it’s better than defaulting on your mortgage when mortgage deferrals come to an end, or seeing your small business go under,” Mr Coates added.

He said the hit to future retirement incomes was “less than commonly portrayed”, suggesting someone on a median wage of about $60,000 could expect their retirement income to fall by about $80,000 in today’s dollars.

“But their total retirement income would fall by only $20,000 in today’s dollars, or around $800 each year, since their lower super balance at retirement is largely offset by larger pension payments since the Age Pension is means-tested,” he said.

Government analysis of data provided by one of the big banks found almost 60 per cent of super withdrawn had been saved or used to pay down debt.

Paul Bloxham, chief economist at HSBC, said the early-release policy had been “helpful”.

“All arms of policy (are) working in the same direction at the moment, and it makes sense that in face of negative shock we don’t just use the RBA’s balance sheet and the government’s but also allow households to use their own to adjust,” he added.

Mr Bloxham said the early release of super could be a “powerful tool” to help manage the economic cycle.

“The RBA is now at its limit, so this could be a mechanism where you allow people to redistribute their income over time,” he explained.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout