Superannuation sapped as double-dippers go for broke

Around 800,000 people have double-dipped into their super as Australians drain more than $25bn from the sector.

Around 800,000 people have double-dipped into their super as Australians drain more than $25bn from the sector.

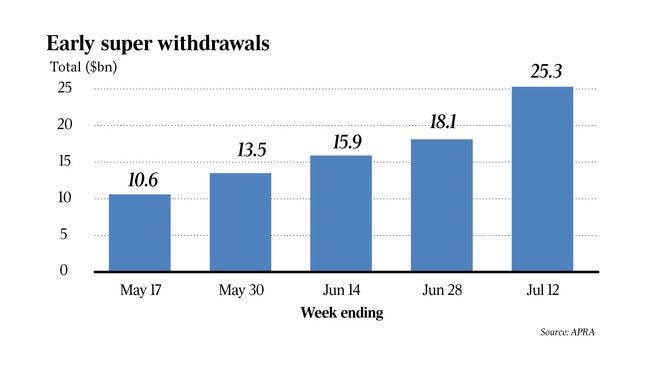

In the week through 12 July, 581,000 applications for early release were received by superannuation funds, totalling $6.2bn, in what was the first full week since the second tranche opened.

At least $25.3bn has now been withdrawn from the superannuation sector as part of the federal government’s temporary Early Release Scheme, as Australians deal with the financial impact of the COVID-19 crisis.

The government estimated that more than $29bn would be withdrawn under the scheme.

More than 3.3 million people have now tapped their super fund for extra cash amid widespread job losses as a result of the coronavirus outbreak, according to the latest APRA data.

“Clearly when people have lost income and lost jobs, there’s good reason why people have to take money out,” CommSec chief economist Craig James told The Australian.

“I suppose at this current time, everyone is doing all that it takes to survive at the moment rather than worrying about the future.

“As is always the case, you are always going to have people who are in their 20s and 30s that still see their retirement as a long way off and of course with the retirement age being constantly pushed out, it’s getting further and further away for people to access their superannuation.”

AustralianSuper, the nation’s largest superannuation fund, has been the hardest hit, paying out more than $3.3bn to members since the scheme’s inception.

Sunsuper members have withdrawn more than $2.5bn, while members in hospitality fund Hostplus have withdrawn nearly $2.2bn. Retail Employees Superannuation members have withdrawn more than 2.2bn.

Most of those members waited less than five business days for their super to appear in their bank account, in line with the guidelines, APRA said.

The average payment since the scheme started was $7718 and $8755 for repeat applications.

The scheme, launched in April, allowed Australians affected financially by the coronavirus crisis to withdraw up to $10,000 from their superannuation in the last financial year and a further $10,000 in the current financial year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout