More than 300,000 double dip on early release superannuation

Applicants raise the stakes as the new financial year starts with rush for another bite at early access to superannuation.

The number of applications made by Australians seeking to access a second payout from their superannuation under the government’s early release scheme has rocketed past 300,000 within the first week of the new financial year, with applicants, on average, also asking for more money than they did the first time.

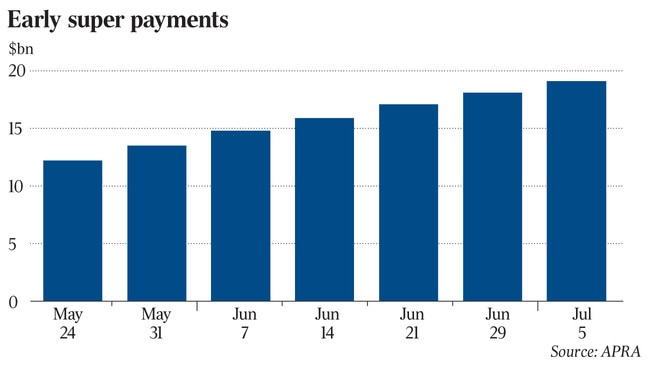

New figures show $1bn in super payouts were made in the first week of the new financial year, taking total payouts to $19.1bn since the scheme opened in April. But the value of applications over the week topped $4.3bn.

The scheme, launched on April 20, allowed Australians to withdraw up to $10,000 from their superannuation in the last financial year and withdraw a further $10,000 in the current financial year.

Data released by the Australian Prudential Regulation Authority (APRA) on Tuesday showed that between June 29 and July 5, 346,000 applications to withdraw money from superannuation accounts were made by individuals who had submitted an application last financial year.

The average amount applied for by second-time applicants was $8904, higher than the average of $7476 sought by a first-time applicant, and the average payment of $7511.

AMP Capital chief economist Shane Oliver told The Australian that the increased figure for repeat applications didn’t necessarily mean that Australians were attempting to drain their super.

“I suspect that what’s happened is that they took an amount out the first time that they expected would cover their costs but then found that economic conditions are harder than they first thought,” Dr Oliver said.

“It does have the effect of draining money out of their super, but it reflects the economic environment we’re in where people are finding they are needing more money than they previously thought.”

Dr Oliver said that when the initial tranche was opened, factors such as the expiration of JobKeeper and the uncertainty of a second wave were not on people’s minds, whereas now these factors are clearer.

“When people were doing this a few months ago in relation to the first tranche, there was probably more optimism,” he said, adding that the amount could naturally be higher because the government capped the amount of withdrawals at two from the start.

“People could be saying: ‘This may be it, so maybe I should increase the amount just in case I need it’,” Mr Oliver said.

On top of the repeat applications, a total of 165,000 initial applications were made in the week to June 6, bringing the total number of submissions made to the scheme since its inception to three million and the total amount sought by applicants to $23.3bn, with just over $19bn already paid out.

More than 132,000 members were paid out by superannuation funds to June 5, bringing the total number of payments paid by funds to their members to approximately 2.54 million.

Since inception, 83 per cent of applications received have been paid, down from 95 per cent at 28 June 2020 given the large number of new applications received during the week.

Last week, the prudential regulator foreshadowed the popularity of the second tranche, warning that its opening would result in an influx of applications that would negatively impact processing times for payments.

The appeal of the second tranche is visible on a fund level, with 116 of the 176 funds that provided data to APRA reporting they have received repeat applications.

AustralianSuper, the nation’s largest fund, remains the hardest hit by the scheme paying out more than $2.5bn to members across 415,564 applications, with 49,315 applications – or more than 10 per cent of the total – being repeat applications.

Other funds with large payouts include Sunsuper. It has paid out more than $1.88bn across 321,411 applications, approximately 42,000 of which are repeat applications.

Rest has paid more than $1.74bn across 295,102 applications, with 33,510 being repeats.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout