Super extension ‘costs billions’ and could prompt investments rethink

Funds brace for the possibility of a third $10,000 tranche being made available to workers hit by the COVID-19 crisis.

Leading superannuation figures have warned the need to hold billions of dollars in additional cash to meet the demands of an extended early release scheme could hit investment strategies — including support for capital raisings — as well as dampen returns.

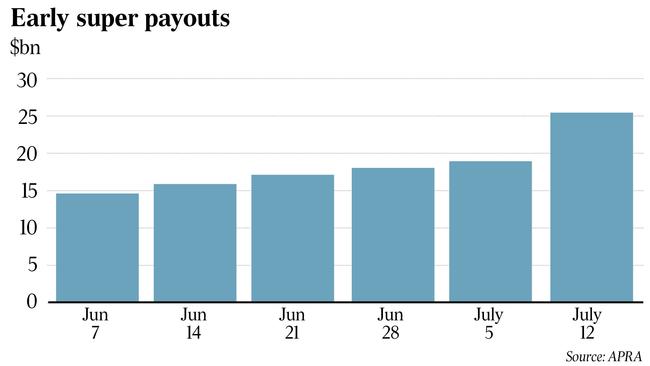

As early release super payout requests top $30bn, funds are bracing for the possibility of a third $10,000 tranche being made available to workers hit by the COVID-19 crisis, a prospect that would cause a substantial rethink of investments.

Super funds were caught off guard as Treasurer Josh Frydenberg on Thursday pushed out the closing date for access to the release of early super from September to end-December. While a $10,000 withdraw cap remains in place for this financial year, the extension would coincide with an expected peak in unemployment of 9.25 per cent which would see more members rush the scheme.

Hostplus chief executive David Elia warned of the impact of the super extension on member outcomes and investment in the economy, saying the need to hold more cash would limit the upside to returns.

“What it means from our perspective is that, yes, we will continue to support capital raisings, we will continue to invest in unlisted markets such as infrastructure investments, but our capacity to do more than what we would otherwise want to do will be limited.

“So we’ll still do it, but rather than putting $200m into a deal, we’ll probably put in $100m or $150m,” he told The Australian.

Sunsuper chief investment officer Ian Patrick also flagged that pushing out the scheme would, to an extent, weigh on the fund’s investment decisions, as he raised concerns about the possibility of a third tranche of early access.

“At the margin, it’s certainly going to make us weigh up any opportunity with a little bit more circumspection of what our liquidity demands might be, but there are far more meaningful policy issues that are an overhang to the deployment of liquidity than simply the extension (of the scheme) to the end of December,” Mr Patrick said.

“Personally, I think a bigger inhibitor to that (deployment of liquidity) is the prospect of further policy change that goes to a third tranche of early access.”

The possibility of options on super guarantee contributions for people under 25 was another issue of concern, he said.

“If any of those eventuated then I think those are more meaningful to our willingness to invest in unlisted assets.

“It’s not that these policy decisions are going to make or break our strategy, but we’re conscious of the fact that there could be policy changes and that we will need to be able to reflect on that as it comes.”

The early super access scheme, in place since April, allowed workers hit by the coronavirus crisis to access up to $10,000 of their retirement savings, tax-free, last financial year.

Since July 1, eligible workers have been able to tap into their nest egg for a further $10,000. The scheme was due to finish on September 24 before the government extended it “to increase the scope for individuals who may still be financially impacted by COVID-19 to access early release in the coming months”.

The latest data from the prudential regulator, from July 12, shows that 2.8 million super accounts have already been drawn down, with $25bn sucked out of workers’ retirement savings. But the total amount siphoned out to date is likely to have already topped $30bn, based on approvals from the tax office.

Doing the heavy lifting

Association of Superannuation Funds of Australia chief executive Martin Fahy expects up to $40bn by year’s end.

Superannuation was doing the heavy lifting in difficult times, he said, as he compared the cost of the government leaning on super with the rates at which it could borrow.

“The lost returns (from super), which have been, on average, 4 per cent to 5 per cent over the last 10 years, stand in sharp contrast to the interest burden for the government on its borrowings.

“We need to be mindful of that in terms of the amount of lifting that’s being done by superannuation,” he said.

Australian Institute of Superannuation Trustees chief executive Eva Scheerlinck warned of the scheme’s impact on retirement outcomes for affected workers.

“While we acknowledge that the extension of the early release super timeframe may be helpful to those in financial need, it is a great concern that so many Australians are being forced to protect their livelihoods with savings that are meant to help them avoid poverty in retirement,” she said.

Despite the heavy cost to super, the strong fiscal stimulus and encouraging investment signals from the government meant the industry could start to move forward and participate in the recovery to get the returns members needed, Dr Fahy said.

The liquidity needed by super funds during the scheme was just one of a number of circumstances that will challenge the investment strategies of funds, he warned.

“There’s seven or eight key macro conditions that are influencing funds’ abilities to generate long-term returns and deploy capital: the liquidity requirement around early release is one; JobKeeper is another (as workers halt contributions); dislocation in investment opportunities in markets; GDP globally; and the health event,” he said.

The industry also pointed to the importance of raising the super guarantee to the planned 12 per cent by the agreed timetable of 2025.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout