High iron ore price cushions cost of COVID-19 rescue measures

Strong world iron ore prices have underpinned Australia’s economic growth and helped cushion the cost of COVID-19 rescue measures.

Continued strong world iron ore prices have underpinned Australia’s economic growth and helped cushion the cost of the multi-billion-dollar COVID-19 rescue measures, according to the federal government’s latest economic and fiscal update.

The update has pushed out the timing of the government’s expectations for a fall in the iron ore price to $US55 a tonne from June this year, made in the mid-year economic outlook issued in December last year, to the end of December.

The economic statement says the higher-than-expected price assumption would effectively add about $2.2bn to government receipts over the next two financial years.

This comes as a result of the $9bn boost to nominal economic growth in the current financial year from the assumption of another six months of higher-than-expected iron ore prices.

Iron ore prices, which were below $US85 a tonne earlier this year, have been running at a stronger-than-expected level of more than $US100 a tonne recently as a result of continued strong demand from China and ongoing supply problems with Australia’s biggest rival, Brazil, following an accident at the mine owned by Vale, and the country’s skyrocketing incidence of COVID-19.

While the Treasury’s iron ore price assumptions continue to be conservative compared with market predictions, the statement underlines the importance of Australia’s iron ore sector, and revenue from iron ore exports, to the underlying strength of the federal budget at a time when its deficit is hitting post-wartime highs due to measures designed to mitigate rising unemployment levels due to the pandemic.

The Treasury update notes that “iron ore prices have remained resilient to date as the impact of falling steel production outside China has been largely offset by strong demand from Chinese steel producers and supply disruptions in Brazil”.

But it adds it has continued to maintain conservative assumptions for the iron ore spot price (of $US55 a tonne), due to “uncertainty about the supply and demand outlook”.

The update notes that export volumes of iron ore are also expected to remain strong.

“Iron ore exports are expected to increase due to ongoing demand from China,” it says.

It also notes that expansions in Australia’s iron ore capacity currently under way will also “support production volumes”.

These include two projects mentioned in the December statement — Rio Tinto’s Koodaideri iron ore mine and rail project, and Fortescue Metal’s Eliwana iron ore and rail development, both in Western Australia.

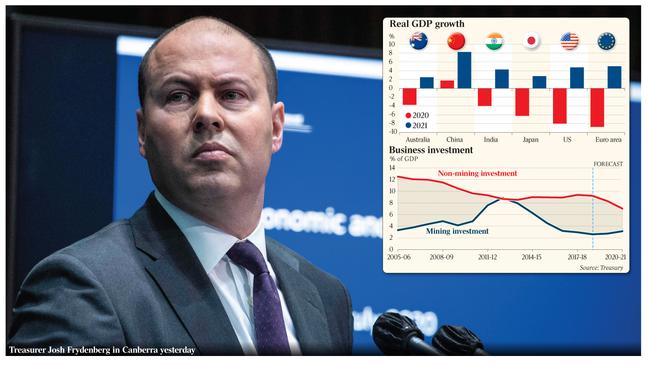

The update also points out that economic activity in Australia has been held up by a pick-up in investment in the mining industry from last year at a time when new business investment in the non-mining sector was already falling even before the pandemic-driven lack of confidence further downgraded investment plans.

The statement says mining investment in Australia is expected to grow for the first time in seven years, by 4 per cent in the 2019-20 financial year and another 9.5 per cent in 2020-21, partly due to capital spending in the iron ore sector.

“Industry consultation and recent capital expenditure data suggest that investment in large iron ore projects is expected to continue in order to sustain productive capacity and maintain large capital stocks accumulated over the investment boom,” it says.

The upturn in mining investments, particularly in the iron ore sector, contrasts with a much gloomier picture for the non-mining sector.

The Treasury is expecting new business investment to plummet by 12.5 per cent in 2020-21, “driven by a significant deterioration in the outlook for non-mining investment, which is expected to fall by 25.5 per cent in the June quarter”.

The economic statement estimates that China, Australia’s largest trading partner and the biggest buyer of Australian iron ore, will be the strongest of all major economies over the next two years.

It estimates that China’s economic growth will come in at about 1.75 per cent this year, picking up to 8.25 per cent next year.

This compares with a slump of 6.25 per cent this year for the economy of Japan, Australia’s second-largest trading partner, with expectations of a weak recovery of 2.75 per cent next year, and the US, where Treasury expects to see an economic slump of 8 per cent this year before recovering by 4.75 per cent next year.

Commenting after the release of the statement, Finance Minister Mathias Cormann said the resources sector had “been an incredibly important sector underpinning the strength of our economy in this crisis”.

He said one of the early decisions made by the government at the onset of the pandemic had been to find ways to keep the mining sector operating throughout the crisis in a way that was COVID-safe.

“There is no question that much of the resilience of the economy has been underpinned by the ongoing strong performance of the resources sector,” Senator Cormann said.

But he indicated that the October budget would contain measures designed to stimulate investment in the non-mining sector.

“We want to maximise investment across the economy,” he said.

“We want to see the resources sector continue to perform strongly, but we want to provide incentives and encouragement to businesses across the board to invest in future growth so they will hire more Australians.”

Senator Cormann rejected suggestions that the economy was vulnerable as a result of the deterioration of the federal government’s relations with China, which have been further worsened by the Morrison government’s call for an inquiry into the source of the COVID-19 pandemic.

The move, at a time when deaths in Australia were well below 100, was seen by China as attempting to point the global blame at it for the pandemic, prompting a warning by China’s Ambassador to Australia, Cheng Jingye, that Chinese consumers might react to this by buying fewer goods and services from Australia, including beef, wine, tourism and education — other key Australian exports.

Asked at the press conference about Australia’s relationship with China, Senator Cormann said Australia had “an important, mutually beneficial relationship with China”.

“We will continue to ensure it is in the best possible shape, moving forward,” he said.

But his comments come as there is growing concern that while China has little option to buy Australian iron ore in the short term, given the strength of its economy and the problems in supply rival Brazil, anger at the deteriorating ties with Australia is encouraging it to diversify its sources of supply by stepping up investment in new iron ore mines in other countries, particularly in Africa.

The chairman of investment bank Flagstaff Partners, Tony Burgess, who has been an adviser to mining giants BHP and Rio Tinto, warned recently that Australia should seize the opportunity of the COVID-19 pandemic to diversify its economy away from its reliance on commodity exports.

Quoted in an article in The Australian this week, Mr Burgess said iron ore prices were likely to fall in the future as China developed new sources of supply.

He said the Australian government needed to be more subtle in its diplomacy, particularly towards China, given the importance of the iron ore sector to the economy.

Mr Burgess added that China had been deliberately diversifying its sources of iron ore in Africa, including Simandou in Guinea, in West Africa.

“At the moment I don’t think the Chinese enjoy paying $US100 a tonne for iron ore because there are some supply issues in Brazil,” Mr Burgess said at a forum hosted by Hamilton Wealth Management.

“A couple of Chinese entities are preparing to develop Simandou.

“It’s not going to drop iron ore prices tomorrow, but in a couple of years, when markets factor in that supply coming in, I don’t think you will see iron ore prices at $US100 a tonne.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout