Early super access may have been abused by ineligible public servants

Public servants and military fund members are rushing to withdraw super for a second time, but there are questions about their eligibility to do so.

Public service workers and military super fund members are rushing to withdraw their superannuation for a second time, despite the government’s COVID-19 early release scheme applying only to those who have been financially affected by the pandemic.

The scheme allows Australians to access up to $20,000 of their super in two tranches — one last financial year and one this financial year — if their job has been lost, they are eligible for JobKeeper or their working hours have been reduced by 20 per cent or more.

The Australian understands that no federal government agency has publicly announced reduced work hours for staff or significant job cuts.

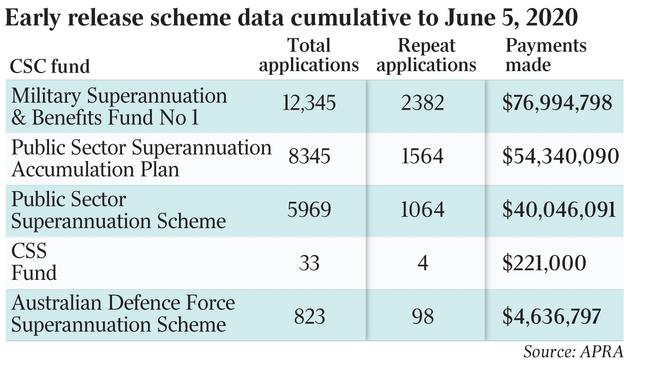

Australian Prudential Regulatory Authority figures show that from the scheme’s April inception to July 5, repeat requests counted for 18.5 per cent of the 27,515 withdrawal applications made to five funds managed by the federal government’s $48bn Commonwealth Superannuation Corporation.

Of these funds, only two — the Public Sector Superannuation Accumulation Plan and the Australian Defence Force Superannuation Scheme — can still be used by employees who have left the public service, meaning that the vast majority of repeat applications made to the CSC have been by current employees of the federal government or ex-employees who have not consolidated their old account.

“The majority of CSC customers accessing early release of their superannuation are customers with ‘preserved’ superannuation balances,” a CSC spokesman told The Australian.

“This means they are no longer contributing to their CSC fund, because they no longer work for the Australian Public Service or Australian Defence Force.”

CSG fund members were previously revealed by The Australian to be one of the keenest demographics in the first tranche of the scheme, draining more than $100m collectively from their accounts by late May.

Now just over $176m has been paid out to CSC fund members, with more to come as repeat applications are processed.

The average withdrawal amount per member, at $8599.40, is also higher than the current average payment of $7511 across all applicants to the scheme.

The withdrawals came as balanced super funds had one of their worst-performing years in decades, with a return of minus 1.2 per cent for the median balanced option in the 12 months to June 30, according to SuperRatings figures.

That compared to a median annual return of 7.6 per cent over the past decade, and came as the benchmark S&P/ASX 200 Index lost nearly 11 per cent in the 2020 financial year.

The Australian Taxation Office told The Australian that the application process was based on self-assessment, meaning claims were not verified unless they were specifically audited.

“Like Australia’s income tax system, the COVID-19 early release of super scheme is designed on self-assessment, and the information provided to the ATO is initially accepted as true and correct,” an ATO spokesman said.

“The onus is on the applicant to ensure they meet the eligibility criteria for early release of superannuation, as well as ensure the information they provide is correct.”

A false claim made under the scheme can attract a fine of $12,600 and result in the withdrawn super being declared taxable income.

Grattan Institute household finance director Brendan Coates said the figures raised questions about the number of applicants to the scheme who were compliant. “It’s hard to rationalise that level of withdrawals on the basis that it’s solely ex-public servants who are now experiencing financial hardship,” Mr Coats told The Australian.

“The simple fact that you don’t have to prove that you qualify makes it likely that there are some people who are accessing the scheme who may not qualify.

“It will be potentially quite a shock for some of them if the ATO audits them, finds they are not eligible and then requires them to pay a fine, which could leave them in a worse financial situation.”

Mr Coates said he understood that when the scheme was introduced, it was imperative to get money into the hands of people who needed it — but with the second tranche now open, the ATO should take the time to audit all claims.

“I think for at least the second time around, we should be taking the time to make people demonstrate that they need access to the scheme,” he said.

A spokesman for the ATO said the department was auditing some repeat applicants.

“In some instances, applications have been declined where the applicant does not meet certain eligibility criteria (such as submitting a second application in the same income year) or where a risk of fraud is detected,” he said.

“The ATO is also contacting individuals who have applied for early release of super where there is a concern that they may be ineligible.

“If an applicant is unable to demonstrate their eligibility when asked for evidence an application may be revoked.”

In total, more than $19bn has been paid out to 2.54 million fund members.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout