Some super funds still manage positive returns: SuperRatings

Despite predictions of gloom, some balanced super funds still posted positive returns in the year to June, with the best up 3.8pc.

Only a handful superannuation funds managed to deliver positive returns for members in the last year, after the COVID-19 pandemic delivered the biggest financial market sell off since the global financial crisis.

The selldown also saw retail funds – which generally have a bigger exposure to cash and bonds – emerge at the top of the table for the first time in years, edging out their industry funds rivals.

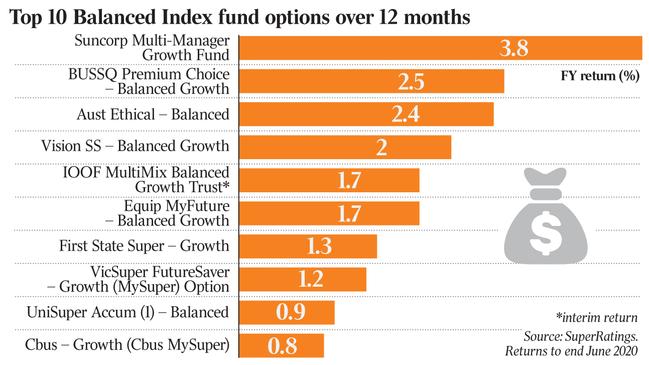

Queensland’s-based Suncorp emerged with the top performing fund which returned 3.8 per cent for the period, according to new data released by SuperRatings. This easily outperformed estimated median return for the financial year was a return of minus-1.2 per cent, according to SuperRatings figures.

The financial year performance contrasts with annualised figures in January, where the median balanced super fund returned 13.8 per cent over the 2019 calendar year, which at the time was the best gain in five years.

Still, SuperRatings said that while the fallout from the coronavirus crisis was clear, it was far from the depth of the market selldown in March, when lockdowns began in Australia.

“Managing risks while delivering a positive return in this environment has been a real challenge, and this is likely to continue through the rest of 2020,” SuperRatings executive director Kirby Rappell said.

He noted only 15 of the 50 funds tracked in the balance index generated a positive return for the financial year.

According to SuperRatings figures, Suncorp was the top returning balanced superannuation fund for the 12 months through to June, after its Suncorp Multi-Manager Growth Fund returned 3.8 per cent for the period.

That performance was followed by Queensland-based industry fund BUSSQ and Australian Ethical Super balanced funds, which returned 2.5 per cent and 2.4 per cent respectively. The widely held UniSuper accumulated balance fund increased 0.9 per cent.

Australian shares were down 7.6 per cent over the year. Listed Australian property was the worst performing asset sector, falling 20.7 per cent, while global listed property lost 17.6 per cent.

SuperRatings’ Mr Rappell said members should still bear in mind that it is the long-term performance of super funds that really counts.

Performance for the median balanced option continued to hold strong, returning an estimated 7.6 per cent over the decade through June 2020.

“Importantly, over the long term, returns remain very healthy,” Mr Rappell said.

“Super is a long-term game, so members should avoid chasing short-term results and ensure they are invested in a quality fund with the right investment strategy that is well positioned to deliver for their needs over the course of their working life.”

Only half of the top performing funds over 12 months were among the top performing funds over 10 years, which highlights the difficulty for investment strategies to perform well in differing market conditions over a longer term, SuperRatings said.

ChantWest senior investment manager Mano Mohankumar said Australian super funds were well diversified across their portfolio which helped protect the losses.

“Shares remain the main contributors to performance with about 25 per cent allocated to Australian shares and 29 per cent to international shares on average,” Mr Mohankumar said.

“But that still leaves another 46 per cent invested across other growth and defensive asset sectors. That diversification works to cushion the impact during periods of share market weakness.”

Australians took $19.1 billion out of superannuation funds as part the government’s early release super scheme, which allowed people hit with financial hardship as a result of the coronavirus crisis to withdraw up to $20,000 from their superannuation over two financial years.

Top 10 SR50 Balanced Index options over 12 months

Suncorp Multi-manager – Growth Fund – up 3.8 per cent

BUSSQ Premium Choice – Balanced Fund – up 2.5 per cent

Australian Ethical Pers – Balanced – up 2.4 per cent

Vision SS – Balanced Growth – up 2 per cent

IOOF MultiMix Balanced Growth Trust – up 1.7 per cent

Equip MyFuture – Balanced Growth – up 1.7 per cent

First State Super – Growth – up 1.3 per cent

VicSuper FutureSaver – Growth (MySuper) Option – up 1.2 per cent

UniSuper Accum (1) – Balanced – up 0.9 per cent

Cbus – Growth (Cbus MySuper) – up 0.8 per cent