Oil Search defends value of Santos deal

Investors have questioned Oil Search’s approach to the $21bn Santos merger amid some concern over the value of the deal.

Investors have questioned Oil Search’s approach to the $21bn Santos merger amid some concern over the value of the deal.

Oil and gas giants Oil Search and Santos are understood to have agreed terms on their $21bn merger and are on track to announce a final deal next week.

The exit of Oil Search’s head of comms on its own isn’t remarkable, but amid executive upheaval is just another cultural red flag.

Santos says its $21bn merger talks with Oil Search are progressing well as the energy group returns to profit amid record production.

ASX finishes at lowest level in two weeks. Financial stocks including CBA and resource companies sold off. After market close, BHP and Woodside confirm $40bn petroleum merger. BHP to pay record dividend.

A heated phone call with ConocoPhillips’ boss Ryan Lance signalled a missed opportunity for Oil Search to reduce its Alaskan stake.

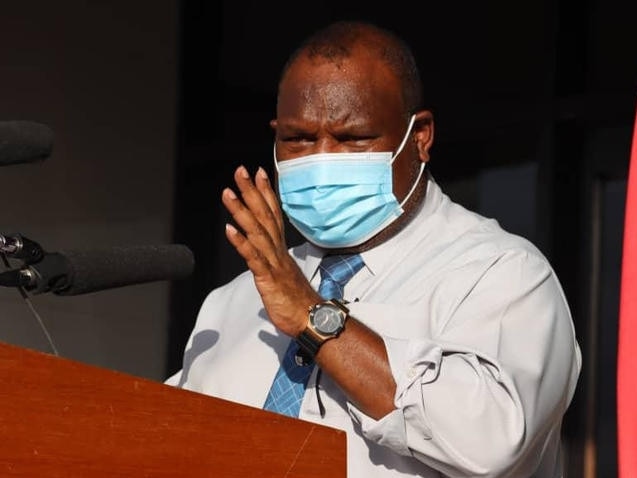

Papua New Guinea’s Prime Minister James Marape has warned a $21bn merger of Santos and Oil Search must pass a national interest test.

Santos is believed to have attracted Japanese trading companies such as Mitsui and Mitsubishi for the sales process of its Dorado project in Western Australia.

Santos may sell down part of its Papua New Guinea LNG stake to a rival to ensure the companies don’t crash its $21bn merger with Oil Search

The combined business is set to jump into the world’s 20 largest energy companies, leapfrogging Woodside Petroleum.

A weekend of hard negotiations between Santos and Oil Search led to agreement on one of Australia’s biggest oil and gas mergers.

Two huge transactions involving Afterpay and oil giants Santos and Oil Search have analysts tipping more M&A action ahead.

ASX ends 1.3 per cent higher at a record daily close of 7491. Tech sector rallied after Afterpay agrees to 31 per cent premium takeover bid from US giant Square and Oil Search accepts Santos’ sweetened bid.

The NSW government is set to slash the state’s petroleum exploration licences, except for those relating to Santos’ Narrabri gas project.

Australia’s oil and gas industry faces its biggest shake-up in a generation with a wave of M&A activity poised to reshape the sector.

Analysts at Morgan Stanley believe Santos should sell off Oil Search’s Alaska business should it succeed in a merger deal.

One of the questions being asked after Santos’s $22bn bid for Oil Search is where Woodside Petroleum fits into the picture.

After six months of talks, a high stakes mega merger between Santos and Oil Search is out in the open.

The fund giant warns it will vote against the management of companies it feels do not do enough to cope with the risks of climate change.

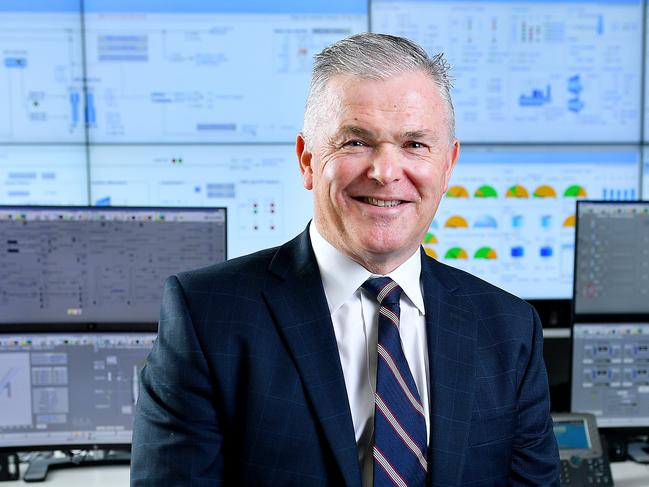

The long-awaited Santos bid for Oil Search is now public and for his next trick Kevin Gallagher needs to put some value on the table.

Santos has ambitions to be one of the 20 largest companies on the ASX, proposing a $22 billion merger with Oil Search.

If Santos CEO Kevin Gallagher pulls off Oil Search and delivers upside he will be worth every cent of his $6m incentive pay.

Santos is speculated to have been interested in a deal with Oil Search for at least three years, but now it has finally shown its hand.

Oil Search faces shareholder pressure to hold talks with Santos over a $23bn merger creating Australia’s biggest oil and gas producer.

Energy company Santos is understood to have made approaches to Oil Search about a merger deal in the past six months.

Stocks recovered nearly all their early losses by lunch but closed in the red. Blow for Crown, BHP record quarter, JB Hi-Fi surges, Santos in Oil Search merger offer.

The prospects of anyone drilling for oil in the Great Australian Bight in the next decade seem remote with Santos handing back its right to explore for oil in the region.

A new impact bond fund launched by global investment giant Nuveen counts ASX-listed Santos as one of its issuers.

Strike Energy’s Stuart Nicholls has taken Andrew Forrest to task over claims new gas projects were ‘fossils’ for their high carbon emissions.

Australia’s energy sector faces fresh competitive threats as the OPEC oil cartel flexes its muscle while LNG rivals like Qatar are expected to hike production.

Original URL: https://www.theaustralian.com.au/topics/santos/page/15