Surge of M&A promises to reshape Australian oil and gas landscape

Australia’s oil and gas industry faces its biggest shake-up in a generation with a wave of M&A activity poised to reshape the sector.

Australia’s oil and gas industry faces its biggest shake-up in a generation with a wave of M&A activity poised to reshape the sector, with BHP considering selling its $18bn petroleum division just days after Santos’s $23bn Oil Search merger pitch.

Vacant leadership seats at two of Australia’s biggest oil and gas companies, Woodside Petroleum and Oil Search, and the resurgent oil price have set the sector up for a significant consolidation that could reshape the Australian sector for decades to come.

Santos is in talks with a badly wounded Oil Search board over the terms of a mega merger after Oil Search let chief executive Keiran Wulff go this week, and chairman Rick Lee was forced to admit he had misled the market by denying the company had received a takeover offer during an investor call to discuss the company’s leadership spill.

And now Woodside is said to be in talks with BHP over the possible acquisition of the resource giant’s petroleum division, after it emerged BHP was again considering divestment of its remaining fossil assets.

The results of the deals, if they come to fruition, could dramatically reshape the listed resources landscape in Australia, creating two large-scale oil and gas companies with solid operational footings and projects that span the globe.

The “actual moves themselves and the direction of travel they suggest for the industry are not surprising. BHP’s core business is mining, and the role of its petroleum unit within the portfolio has been a discussion point for many years,” Wood Mackenzie research director Angus Rodger said.

“With scale and resilience set to be a crucial differentiator in the years ahead for upstream companies, there is also logic to this Santos and Oil Search tie-up.”

Santos’ potential merger with Oil Search would create a new force in Australia’s oil and gas sector with gas operations spanning both coasts of Australia, Papua New Guinea and an oil project in Alaska which WoodMac expects would be sold should the tie-up proceed.

At current market prices, Santos would leapfrog Woodside to take the crown as Australia’s biggest listed oil and gas company.

But that deal would be easily eclipsed if mooted talks between BHP and Woodside come to fruition. The mining giant’s petroleum business is valued at $US13bn ($17.8bn) on a bullish oil price view or $US10bn based on $US60 per barrel oil, Bernstein said on Wednesday.

While BHP boss Mike Henry has previously said oil and gas remains an attractive business for the resources giant in the medium term, sources said BHP is again considering spinning off or selling its petroleum division in a move that could hasten its exit from fossil fuels.

“We think it is ripe for either divestment or a thorough revamp as the current portfolio to us presents an incoherent mix of disparate assets, especially in Australia,” Credit Suisse analyst Saul Kavonic said.

The reports come amid persistent rumours that BHP has been in talks with Woodside this year over a combination of their assets.

Putting together Woodside and BHP’s assets could be a good move, Mr Kavonic said, with the Perth producer a leading candidate to pursue a deal.

“Woodside could present BHP with a world class LNG pillar to match its other world class mining pillars, ample cost synergies, joint venture alignment benefits at Scarborough, value uplift from a bolstered balance sheet in BHP hands, and reposition the portfolio to negotiate with North West Shelf JV partners from a more patient and advantaged positions,” he said.

“We see petroleum asset sales by BHP as more likely than a bid for Woodside, however.”

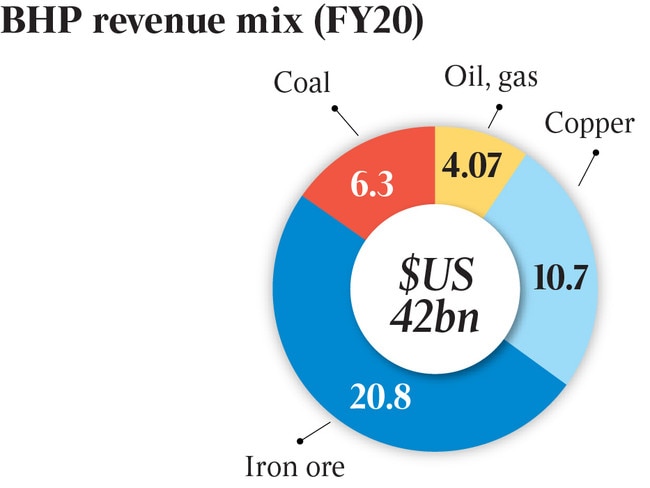

While the sale of BHP’s remaining fossil fuel assets would undoubtedly alleviate some of the pressure on the company from climate activists and ESG-minded investors, RBC analysts noted on Wednesday the division contributed only a minority of BHP’s carbon footprint.

“Although a divestment would certainly assist with the ESG narrative, in practice the business only accounts for about 5 per cent of scope 1 and 2 emissions and 7 per cent of Scope 3 emissions,” RBC resources analyst Tyler Broda said in a client note.

“BHP is an outlier in the mining sector for its petroleum business and this is often cited in our investor discussions as a point of detraction, especially considering the derating seen in the European oil and gas sector.”

But Mr Broda noted that BHP had not been noticeably marked down by the market, compared to pure-play oil and gas companies in Europe, was under no balance sheet pressure to sell, and that growth in BHP’s petroleum division could still provide an offset to the likely decline in iron ore prices in future years.

“A potential sale is consistent with CEO Mike Henry’s previous commentary about expectations for an oil price recovery to open up options for the group’s petroleum business and this thesis has traced out well thus far,” he said.

“With BHP’s historical track record from shale, we think BHP has been successful in recent years in rotating capital. The question is what would be the use of any freed up capital at this stage, especially with group cash flow generating substantial shareholder returns already.”

The seismic shake-up in Australia’s oil and gas landscape mirrors a bigger structural shift among international majors who put non-core assets up for sale after the oil price crash to cut debt, while others wanted to bring in lower carbon energy sources.

Few are looking to sell their tier one projects given expectations for high returns as the global economy roars back to life and demand for the fossil fuel fires up again.

Instead, majors have been looking to cut the fat from their portfolios even as it‘s proven hard to capture buyers for late-life fields or infrastructure-style returns from LNG plants. Private equity, which backed the growth of the US shale boom, has largely stayed on the sidelines in Australia given longer time frames to realise returns.

Up to $40bn of Australian deals were predicted in the next few years by consultancy Wood Mackenzie, but few assets have yet changed hands.

Exxon put its ageing $2.5bn Bass Strait fields offshore Victoria up for sale and then abandoned the process after tepid interest while BHP is looking to also sell out of Bass Strait and may follow Chevron out the door at the country‘s biggest LNG plant, the Woodside Petroleum-operated North West Shelf.

Italy’s Eni has long been looking to sell its stake in Darwin LNG and other Northern Territory assets but halted the sale process in January and now appears committed to remaining in Australia.

Shell, BP and Total may also be in the market to offload part of their Australian positions given the higher carbon intensity compared with rival countries.

Still, the Santos-Oil Search merger approach may bring rival buyers out of the woodwork.

Oil Search’s Papua New Guinea partners, ExxonMobil and Total, are seen as the most likely suitors while US player Harbour Energy will no doubt be watching the tie-up talks closely after its $14bn bid for Santos was rejected in 2018.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout