Santos is believed to have attracted Japanese trading companies such as Mitsui and Mitsubishi for the sales process of its Dorado project in Western Australia.

Working on the sale – which will result in Santos reducing its interest to about 60 per cent, from 80 per cent – has been investment bank Goldman Sachs. An outcome is said to be close.

Dorado is an integrated oil and gas project that is planned to be developed in two phases.

Also on offer is the opportunity to buy into the Santos-owned Van Gogh and Pyrenees projects in WA. A deal could see a suitor invest about $1bn in Dorado.

Sources say there has been strong interest, but the priority is finding the most suitable partner.

Lately, Santos has been focusing on the $21bn merger with Oil Search.

Market experts believe additional assets will be placed on the market by Santos should it be successful in its $4.52-a-share plan to merge with its rival, where its shareholders would own 61.5 per cent of the overall group.

While Goldmans, Citi, UBS and JB North & Co all have roles with Santos already, the talk in the market is that the recently formed Barrenjoey Capital Partners is gunning for any upcoming mandates selling off additional assets.

Barrenjoey largely comprises former top Australian operatives from UBS, but it recently hired Morgan Stanley oil and gas banker Nick Godhard.

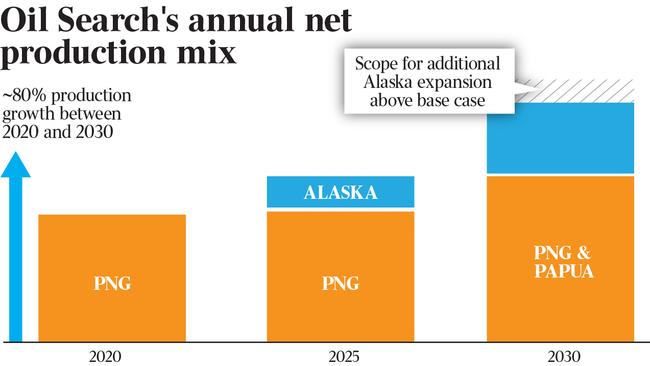

The asset that keeps coming up in conversation is the 51 per cent stake Oil Search holds in the Alaskan Pikka project, estimated to be worth between $US1.5bn and $US2bn ($2bn-$2.7bn).

Already, owners Oil Search and Repsol are each hoping to reduce their interests by about 15 per cent, but some believe Santos would be keen to sell the entire operation given the geographic distance from the rest of its assets in Australia and PNG.

Sources believe the logical buyer for the Pikka project is US multinational ConocoPhillips.

Market experts predict that holding the Alaska asset could complicate fundraising efforts from institutional investors, worried about the conventional oil project’s impact on the environment.

However, a fan of the project is said to be Santos chairman Keith Spence, who was an Oil Search director when it became involved in the development.

A selldown of its 30 per cent stake in the Gladstone LNG project could also be on the Santos wish list, but expectations are that finding a buyer would be a challenge, with approval needed from the other owners.

Any sale of Cooper Basin assets would probably be off the agenda for Santos, sources say.

Since before the merger with Oil Search surfaced, though, UBS has been working on a plan to spin out the Santos oil and gas project infrastructure in WA, the Northern Territory and Queensland that could be worth about $5bn.

The understanding is Santos would be eager to retain about 20 per cent of the infrastructure and operating control of the assets.

One option is for Santos to sell down the earnings stream for the Gladstone LNG, Barossa and former Quadrant Energy-owned assets in WA in a move similar to what Total did with its stake in GLNG. But the priority is said to be first holding the assets in a separate structure to demonstrate their higher valuation multiple.

They generate about $US400m of earnings before interest, tax, depreciation and amortisation annually and are said to be worth 10-12 times that number, whereas the Santos operating business trades at about five times EBITDA.

Asset sales from a combined Oil Search and Santos group are expected to happen after a review by Santos CEO Kevin Gallagher.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout