On the numbers put to him, Oil Search chair Rick Lee was 100 per cent correct in rejecting the proposal in late June and there was no reason to discuss the issue in public. Just because it is now public doesn’t change the numbers, but the missteps mean Lee will have to engage.

What has happened since the offer was rejected has changed the dialogue, because Lee heads into the battle with no full-time chief executive and a series of public gaffes that raise question marks over the quality of the board.

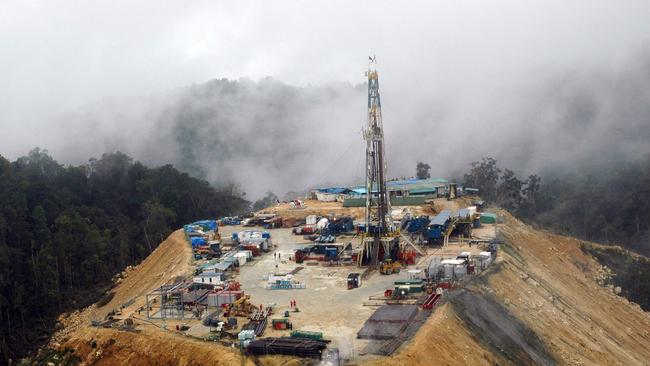

Into the mayhem, Gallagher and his chair Keith Spence look like a model of security even if questions are raised about why they are going further into history by buying more oil and gas.

Lee has stumbled from one snafu to another, from his belated recognition that Keiran Wulff may not have been the ideal chief executive, to his selective memory over the Santos offer last month, to a realisation that something must be said and finally, compounding the whole issue, by later admitting there was some industrial logic to the merger.

Wulff sadly has a history of anaphylactic shocks and suffered one after taking his first Covid vaccine. The reason he is no longer boss is more a function of personality.

None of which gets to the bottom line, which is that the proposed offer from Santos fundamentally undervalues Oil Search even amid all its snafus.

The solution is simply a higher bid please, and then that industrial logic may see the light of day with the superior Santos team running the combined shop.

Volatility on the cards

When stock prices are trading at historically high multiples fuelled by a flood of cash from record low interest rates and fiscal spending, the occasional slump in prices is to be expected.

Even with Monday’s fall, the S&P 500 index has nearly doubled from its March lows last year, while the Australian index was up 62 per cent over the same period.

This year, the S&P/ASX 200 index is up 10.2 per cent in price terms and 12.2 per cent including dividends and is now trading at 17.6 times forecast earnings against a “normal” 15 times.

Next month’s earnings season will include some crackerjack numbers, but the concern at present is over the impact of Covid now that lockdowns are locked in.

This will be heard in CEO commentary given the profits are already in the can, but short-term sentiment always wins – so how the corporate chiefs sell the numbers holds the key.

The US has added another twist – that of inflation and when risk is up. So, its take your pick between Covid and the Fed and higher rates.

The bottom line is financial markets are in a rarefied air, which means increased volatility, especially as stock prices are up strongly over the past year.

The best advice is to hang in for the ride because a short-term fall is long overdue.

Ports sell-off ruling

Federal Court judge Jayne Jagot put her finger on the problem with the NSW government’s port privatisation program: “The state’s motive was profit maximisation. It wanted to sell to the successful bidder the existing container port monopoly across most of NSW at a price that reflected the value of that monopoly.”

She was also correct in identifying that the motives for the NSW ports sell-off was to “ensure that it retained what it would pay for – the full extent of the existing monopoly of Port Botany in respect of container port services in NSW”.

Justice Jagot spent another 462 pages clouding the issue and coming to the wrong conclusion if good government policy is the aim.

The country is crying out for more micro-economic reform to convert a short-term bounce in the economy to sustainable gains.

Reform means more competition, but this was furthest from the mind of then premier Mike Baird, who did his best to reduce competition in his ports.

Port Kembla offered the best hope to compete with Botany so Baird fixed that by selling the two together, then Newcastle was a long shot for containers but Baird did his best to kill that by imposing charges to make any plans it had of competing in containers a long-term dream.

This meant Baird looked clever by selling two monopolies, which he did his best to ensure would never compete.

It was a classic short-term win for a potential bigger long-term loss.

Justice Jagot found the “mere speculative hopes” of a container terminal at Port of Newcastle “were and remain far-fetched and fanciful on the evidence and were not a real chance or real possibility”.

Take a bow judge, that was the whole idea of Baird’s strategy.

This was dressed up “in the public interest as it provides for the most effective use of investment and efficiency of the freight task in NSW”.

Just maybe the efficiencies would improve if Botany had to compete against both Kembla and Newcastle.

But in the end Justice Jagot was having nothing of it and comprehensively and illogically dismissed the ACCC case.

This was one of those cases regulators need to take even if they lose because the issue is of national importance, and in this Justice Jagot concluded on the wrong line but along the way highlighted the misguided motives of the Baird government.

IAG leadership team

IAG boss Nick Hawkins has settled his leadership team amid a major industry reshuffle, with management changes across the board.

After snaring Jarrod Hill from Chubb to run his broker business, Hawkins has appointed former Zurich Australia chief Tim Plant to the job of chief insurance and strategy officer.

The latter title would appear to cover most of the tasks of a chief executive, which puts Plant in as the clear No. 2 at the insurer.

Hawkins was looking for someone with strong local and international knowledge.

Hawkins took the top job late last year from Peter Harmer.

QBE has former Westpac executive Sue Houghton as its new Australian boss starting on August 3, with the new chief, Andrew Horton, due to start on September 1.

Interim QBE Australia boss Frank Costigan is likely to take some time out before pursuing other opportunities.

Separately, IAG unveiled the coming sale of its Malaysian joint venture, with Liberty acquiring the business. It means the insurer will return $340m in proceeds on the deal.

Once a leader in the Australian business community in terms of its Asian ambition, IAG has now all but sold out, with a small Beijing-based road service group, Bohai, and a small Vietnamese insurance group its remaining assets.

The company had a joint venture in India with the State Bank of India among other strategic assets that it has exited to concentrate on the local insurance duopoly.

New hire Plant has worked across the industry, including stints with Elders Insurance, Icare and Australian Eagle.

Hawkins has Julie Batch running his direct insurance operations, which include RACV and NRMA. Craig Olsen is listed as executive in charge of strategic projects, which looks to be a short-term role.

The insurance industry is in the middle of a Covid rollercoaster, with claims falling during lockdowns but climbing quickly as more cars are on the road.

The long-awaited Santos bid for Oil Search is now public and for his next trick Kevin Gallagher needs to put some value on the table because right now there is none.