Santos-Oil Search $21bn merger must pass PNG national interest

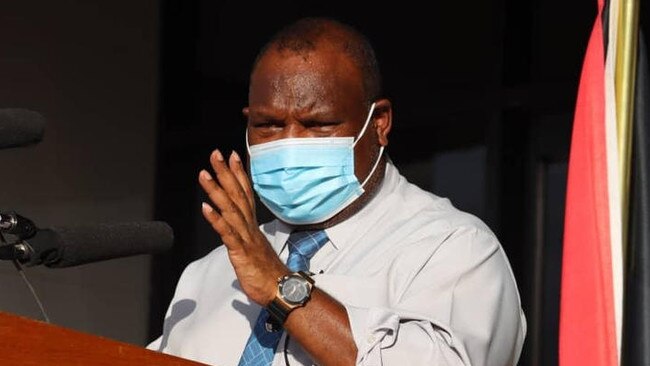

Papua New Guinea’s Prime Minister James Marape has warned a $21bn merger of Santos and Oil Search must pass a national interest test.

Papua New Guinea‘s Prime Minister has cautioned that Santos’ planned $21bn merger with Oil Search must pass a national interest test and the country doesn’t want to be regarded as a branch office for a foreign company.

Oil Search, operating in PNG since 1929, has recommended the merger and the two companies are undertaking due diligence on each other as the next step in progressing a deal.

Prime Minister James Marape said a bigger company may be able to fast-track a stalled LNG expansion but said the Pacific nation must be a big part of any enlarged business.

Oil Search and Santos own 29 per cent and 13.5 per cent stakes respectively in the PNG LNG project while Oil Search also holds a 22.8 per cent share in Papua LNG, which will add a further two trains of LNG or 60 per cent extra capacity by 2027.

The combined company will own 42.5 per cent of PNG LNG and 17.7 per cent of Total’s Papua LNG but analysts expect it will sell down its stake in PNG LNG.

“Oil Search Limited is a prominent PNG company whose activities comprise a significant percentage of PNG’s GDP and provides the livelihood to thousands of Papua New Guineans both directly and indirectly. Any proposed merger must satisfy the national interest test,“ Mr Marape said.

“We do not wish for the largest oil and gas company operating in our country to simply be a branch office of a foreign company. It is important that while maintaining a strictly commercial focus, the interests of all employees, contractors and service providers are given the highest priority.”

Credit Suisse has suggested the PNG government could use its merger approval as leverage to grab more value for the country, noting it has knocked back proposed deals in other sectors.

PNG said it was open to a beefed up company fast-tracking long stalled LNG expansion options for the country.

“I strongly recognise that the merger of these two important licence players in the market can deliver higher capacity and value to our projects. It brings a stronger combined balance sheet to the table,” Mr Marape said.

“PNG welcomes the fast-tracking or prioritising of any upstream oil and gas development and downstream LNG export investment in PNG, whether by capital raising and investment or as a direct consequence of a merger or an acquisition.”

Talks have restarted between PNG and ExxonMobil over the P’nyang gas project amid hopes a non-binding memorandum of understanding will be agreed with the US giant after the development was delayed due to a contractual stand-off.

PNG’s Petroleum Minister Kerenga Kua has previously expressed concern that a deal may remove a “national champion” and dilute investment amid a plan to double LNG production.

Both Exxon and Total are seen as potential rival bidders for Oil Search given the potential to add to their existing PNG positions. Oil Search lost a bidding race in 2016 for PNG’s InterOil to Exxon after the Houston-based giant swooped with a higher bid.

Santos offered an olive branch to PNG on Thursday afternoon.

“While not commenting on the specific aspects of the merger, Santos is committed to Oil Search’s unique social and community programs in PNG, and the ongoing economic and internationally competitive development of PNG’s resources,” a Santos spokesman said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout