Origin vote a close call but AusSuper in driver’s seat

Thursday’s vote on the $20bn takeover of Origin Energy by the Brookfield and EIG consortium is the culmination of one of the most contested bid battles in Australia for years.

Thursday’s vote on the $20bn takeover of Origin Energy by the Brookfield and EIG consortium is the culmination of one of the most contested bid battles in Australia for years.

Behind AustralianSuper’s aggressive positioning in the $20bn bid for Origin Energy is a change of strategy from a passive investor to an active player in the Australian sharemarket.

The future of Origin Energy has largely been decided after a deadline for proxy votes on Brookfield and EIG Partners’ almost $20bn bid for the group passed.

It’s not so happy holidays for US-based hedge funds looking to prosper on upside from a successful buyout of Australia’s largest energy retailer.

AustralianSuper has finalised how many votes it will be able to cast when Origin shareholders vote to support or reject a near-$20bn bid from Brookfield and EIG Partners.

Brookfield and EIG’s battle for Origin Energy is the most heavily scrutinised buyout in the Australian market this year and the stakes are high.

Berejiklian flags interest in Optus top job. Healius raising $187m to ‘reset’ balance sheet New ASX platform a ‘multi-year undertaking’. Rio Tinto cops $43m fine.

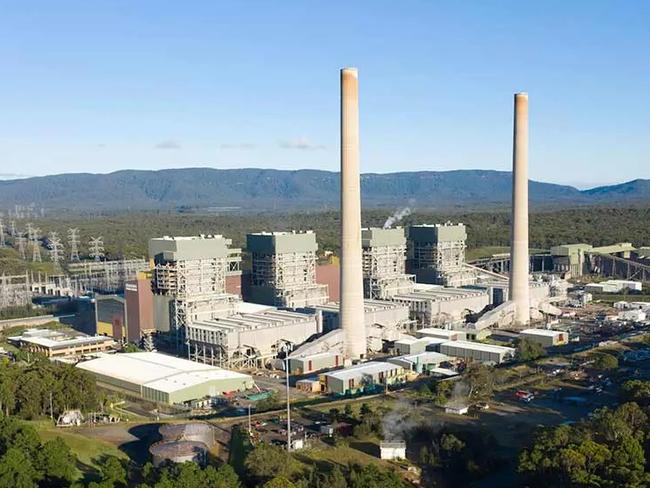

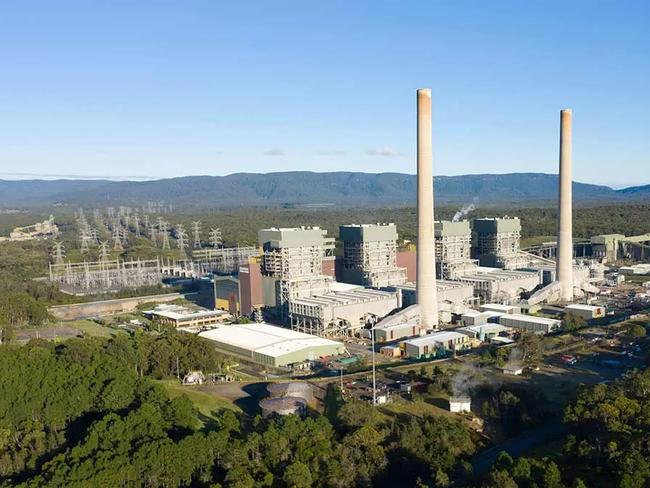

Origin Energy has declared it can still pull off an ambitious green pivot, even if a contested $20bn foreign takeover doesn’t proceed.

Just days out from a vote to determine the fate of the $20bn bid for Origin Energy, AustralianSuper has momentum in its efforts to spoil the party.

The Bermuda-based bidder Brookfield has waged a public campaign making out it is Australia’s environmental saviour, but price matters.

The plot thickens in the battle with Origin Energy with the latest development surrounding the trading of its shares.

Perpetual is the latest dissenting voice as the Brookfield-EIG consortium attempts to woo enough votes for its almost $20bn takeover of Origin Energy.

Only a small amount of the buying activity by Macquarie Capital in Origin Energy was linked to AustralianSuper on Tuesday night.

AusSuper’s broker is back in the market buying more Origin Energy shares, triggering suggestions the super fund is working hard to block a takeover deal.

The country’s largest superannuation fund looks almost certain to block Brookfield and EIG’s buyout proposal through a scheme of arrangement as it increases its holding.

The rejection will heighten market jitters about the prospects of the deal, widely seen as critical for Australia’s energy transition.

A clearer picture is emerging of the game plan for the suitors of Origin Energy, with the general view now that they will launch their takeover bid after the shareholder vote.

Canadian private equity giant Brookfield is seeking to sway Origin Energy shareholders with pledges to spend significant sums in creating renewable energy and storage.

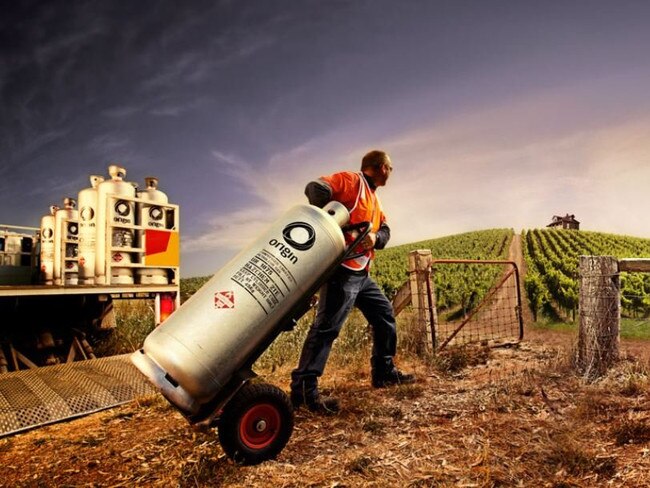

Australia’s largest energy retailer has partnered with Spanish company BlueFloat to develop an offshore wind project in NSW, as it moves to accelerate its renewable pipeline.

The recommendation from Glass Lewis is a boost to the bidding consortium which is likely going to need retail investors to support its almost $20bn offer for Origin Energy.

Origin Energy’s heavy trading on Thursday has some curious as to what could be behind the lift in activity.

There is a theory building that it makes sense for Brookfield and EIG to launch a takeover bid for Origin Energy before shareholders are due to vote on its $16bn buyout proposal.

The Nature Conservation Council of NSW has lobbed the inflammatory accusation saying AustralianSuper must support the Origin deal or add to Australia’s energy transition troubles.

Institutional Shareholder Services recommends Origin Energy investors back Brookfield and EIG’s near $20bn takeover bid, despite the energy player’s top shareholder snubbing the offer.

The battle for the country’s largest energy retailer is far from over.

The boss of EIG, which is trying to take over Origin Energy with Brookfield, says AustralianSuper should launch a counter bid for the energy major or move on.

Investment bankers working on the sale of Origin Energy are believed to be focusing on AustralianSuper, as they stand to lose about $50m in fees on the transaction if it fails.

In a fresh twist to one of the nation’s biggest corporate deals, it has emerged AustralianSuper made a late move to join the consortium bidding for Origin Energy.

AustralianSuper is amassing more shares in Origin Energy after rejecting a sweetened offer from Brookfield and EIG.

When AustralianSuper extracted more from the Brookfield-led consortium chasing Origin Energy, it rewrote the rule book about industry funds and their role in corporate influence.

Original URL: https://www.theaustralian.com.au/topics/origin-energy/page/4