Bankers work on AusSuper block

Investment bankers working on the sale of Origin Energy are believed to be focusing on AustralianSuper, as they stand to lose about $50m in fees on the transaction if it fails.

Investment bankers working on the sale of Origin Energy are believed to be focusing on AustralianSuper, as they stand to lose about $50m in fees on the transaction if it fails.

In a fresh twist to one of the nation’s biggest corporate deals, it has emerged AustralianSuper made a late move to join the consortium bidding for Origin Energy.

AustralianSuper is amassing more shares in Origin Energy after rejecting a sweetened offer from Brookfield and EIG.

When AustralianSuper extracted more from the Brookfield-led consortium chasing Origin Energy, it rewrote the rule book about industry funds and their role in corporate influence.

Takeover bids are tougher to execute when it comes to ASX buyouts, but for Origin Energy and Azure Minerals suitors, they may not have a choice.

Origin Energy’s biggest shareholder AustralianSuper has rejected an increased takeover bid for the energy major, saying it ‘remains substantially below’ its long-term value estimate.

The $18.7bn bid for Australia’s largest energy retailer, Origin Energy, has become a finely balanced, high stakes game that could have very different outcomes for shareholders.

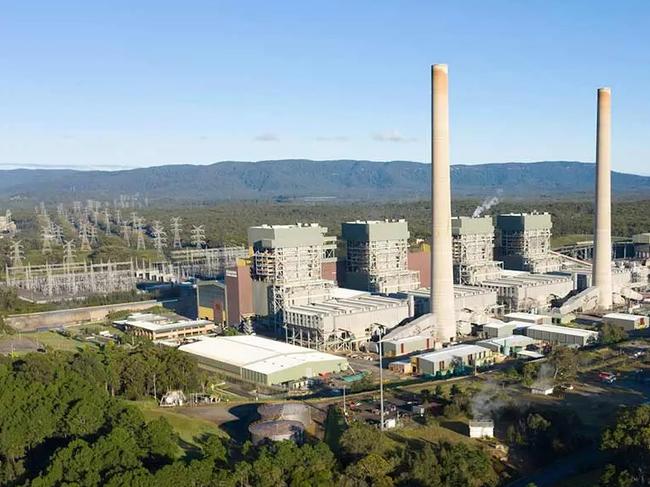

NSW Treasurer Daniel Mookhey has said he ‘wouldn’t use budget estimates’ to negotiate an Eraring extension, saying the government ‘had not made any commitments’

The super fund’s rejection will raise pressure on Brookfield and EIG to raise their offer price or risk defeat.

Billionaire’s mining giant’s profit falls. Argument breaks out on Endeavour AGM floor. Weak China data hits resources stocks. Treasury Wine’s $1.4bn DAOU Vineyards buy. AustSuper rejects Brookfield/EIG Origin bid.

The takeover target is turning to imports to help Australia’s east coast deal with its gas supply crunch as traditional sources run dry and permissions to dig new wells get harder.

The result is the latest in a string of disappointments, but the Kerry Stokes-backed company said Origin Energy was the primary driver for the underwhelming production figures.

AustralianSuper is believed to be drawing on the skills of some of the brightest minds in the infrastructure and energy sector to get a better price for its stake in the country’s largest energy retailer.

The real decision facing Origin Energy shareholders is whether to take the cash value now, or take the opportunity to participate and win big from the next chapter of the industrial revolution.

When AirTrunk’s sale process begins, it’s believed one keen to buy the data centre operator is New York-based private equity firm Blackstone.

Brookfield and EIG are struggling to woo sufficient numbers of shareholders for its $17.8bn deal for Origin Energy, with another investor going public with their opposition.

The Australian energy giant is set to be subject to a revised bid from Brookfield and EIG in the coming days.

Grant Samuel says the $18.7bn takeover bid for Origin Energy is fair for now, but shareholders could be short-changed if the energy company fires up.

Origin Energy’s bullish earnings guidance adds further pressure on international firms Brookfield and EIG to hike their $18.7bn takeover for the energy major.

Brookfield and EIG cleared a critical hurdle when they got the green light from the ACCC, but Origin Energy shareholders insist they expect a revised offer for the $18.7bn deal.

Original URL: https://www.theaustralian.com.au/topics/origin-energy/page/6