Trading DayTrading DayFinancial regulator targets crypto giant over alleged customer fails. Insignia rejects Bain bid. Chalmers’ spending plans to challenge RBA fight. ANZ facing more regulatory scrutiny. Aus economy in ‘reasonable shape’: NAB CEO.

CEO SurveyFinancial ServicesMLC will be rebooted in 2025 under its owner, ASX-listed wealth management company Insignia Financial, which only weeks ago completed the brand’s separation from NAB.

Trading DayTrading DaySurprise inclusions in RBA’s new-look monetary policy board; new governance board members named. Data centres-focused DigiCo continues to decline. HSBC sued for alleged scam fails. China slump a blow to Treasurer’s mid-year budget update.

ceo survey 2025CompaniesAndrew Irvine says Australia needs more skilled migrants and to be more innovative on types of housing and construction methods, to address its crisis.

Andrew Irvine

Life insuranceFinancial ServicesThe MLC brand of life insurance in Australia will disappear after 130 years and a new one with almost two million customers will enter the local market as Japanese players chase profitable sectors.

BUSINESSBusiness Breaking NewsThe cost of doing business in Australia is too high to handle for many organisations, the latest business confidence survey has found.

Trading DayTrading DayMichele Bullock rejects commentary the RBA has misread the weakness in the economy and should have already moved to cut interest rates. ASX fell on tech, banks and property. But miners up on China stimulus hopes. 480 Mosaic jobs to go; Katies to shutter. Business confidence falls. Perpetual hit on ATO ruling on KKR deal.

EconomyBusinessNational Australia Bank expects the economy to grow in the coming year, with boss Andrew Irvine sounding a note of optimism for businesses.

BUSINESSBusiness Breaking NewsAs the cost of living crisis continues to impact small and medium Aussie businesses, thousands of owners have revealed their biggest fear which keeps them up at night.

Cameron Micallef

NewsNewsWireThousands of shoppers will be in the running to win up to $100 off their next shop as part of an instant win giveaway in the lead-up to the festive season.

Alexandra Feiam

Trading DayTrading DayFlurry of new partners at Barrenjoey. Northern Star down on $5bn buyout bid. Singapore Post locks in $1bn sale to Pacific Equity Partners. Metcash climbs as investors look past underlying profit drop. Retail sales, building approvals rise.

Financial ServicesThe corporate regulator has put banks on notice over financial hardship, launching court action alleging National Australia Bank took years in responding to borrowers in crisis.

newsBusiness Breaking NewsNational Australia Bank is facing federal court for allegedly failing 345 customers at their most vulnerable when they applied for hardship support.

Cameron Micallef

Trading DayTrading DaySites ‘held for strategic reasons’ Woolworths tells ACCC. SafetyCulture CEO to step down. Queensland coal ‘sugar hit’ won’t last: BHP. Elders in $475m buy after missing profit expectations, CEO extends stay. ASIC sues NAB.

BankingNewsWireOne of Australia’s big four banks has made a bold prediction about the future of interest rates, and it’s even worse than expected.

EconomyEconomicsNAB has become the first major lender to push back its forecast of an interest-rate cut to May, as Reserve Bank governor Michele Bullock issues a warning on the labour market.

BankingFinancial ServicesThe big four bank’s head of business banking Rachel Slade says there’s more pain ahead in the near-term, with arrears to push higher in the coming months.

BUSINESSBusiness Breaking NewsOne of Australia’s biggest financial institutions has reduced home loan interest rates, but there’s just one catch for potential customers.

Cameron Micallef

EXCLUSIVEFinancial ServicesNational Australia Bank is considering a scaled advice offering in its private wealth arm, as it chases a growth pipeline boosted by its move to link up its private and business bankers.

INVESTINGWealthNational Australia Bank and Domino’s Pizza Enterprises feature strongly in new share market buy, hold and sell recommendations.

BankingFinancial ServicesNAB’s so-called ‘watch loans’ climbed to its highest level since mid-2022 as CEO Andrew Irvine warned of a further increase in troubled business borrowers.

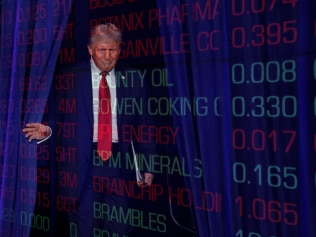

New NAB chief executive Andrew Irvine has seen the past benefits of a Trump bump, but this time the settings are much different.

NewsWireOne of Australia’s biggest banks has warned of a “challenging” time for customers as it releases its full-year results.

BankingFinancial ServicesThere will be negative implications to the global economy if Donald Trump goes ahead with his tariff agenda, NAB CEO Andrew Irvine says, after reporting a drop in annual cash profit.

Trading DayTrading DayACCC gives nod for Sigma’s multibillion dollar union with Chemist Warehouse. Regis launches legal action against Plibersek mine decision. Kerry Stokes starts swinging at AGM. Business leaders warn of Trump trade implications.

Trading DayTrading DayMinRes takeover/break-up not ruled out as billionaire boss Chris Ellison’s exit plan takes shape. AFP enter PwC Australia offices as part of confidential breach probe. Westpac down on dividend miss, high costs.

ExchangeMarketsAmid heightened focus on the US election, NAB’s economics team concludes there could well be more downside than upside risk to US economic growth from Donald Trump’s policies.

exclusivePropertyPremium office space by Sydney’s new Metro stations is getting harder to nab as more companies look for convenient buildings amid a race to keep talent.

BankingBusinessCBA and Westpac say current settings are appropriate as NAB and the ABA call for changes to the serviceability buffer.

BankingFinancial ServicesCEO Andrew Irvine has set a bold target for it to become the ‘most customer-centric company’ in Australia and New Zealand, as he lamented that improved momentum had not led to better customer advocacy.