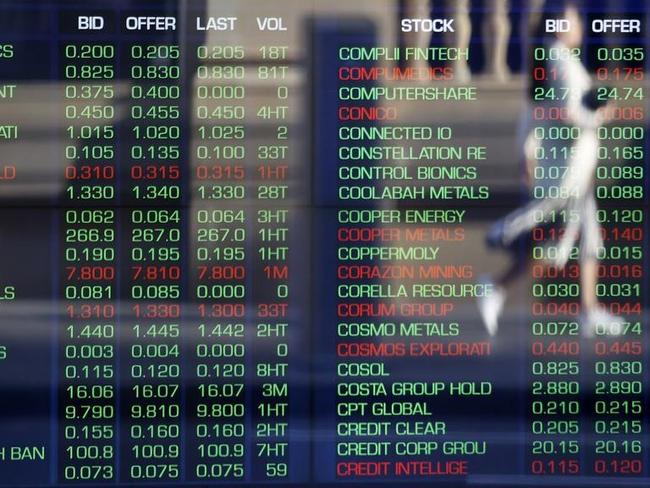

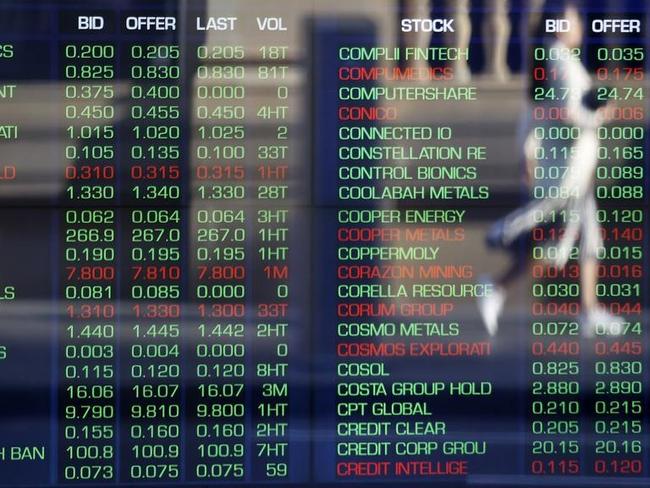

ASX ends flat; US tech stocks smashed

Seesaw day on the ASX following heavy falls across US tech stocks. Investors spooked following emergence of low-cost Chinese generative AI model DeepSeek. Goodman, NEXTDC, DigiCo, uranium stocks, Nuix fall hard.

Seesaw day on the ASX following heavy falls across US tech stocks. Investors spooked following emergence of low-cost Chinese generative AI model DeepSeek. Goodman, NEXTDC, DigiCo, uranium stocks, Nuix fall hard.

The ASX is poised to open marginally higher when trading resumes on Tuesday, though investors remain wary as they await data expected to shape Australia’s monetary policy.

The weak Australian dollar could deliver sharp misses from retailers and other importers this earnings season, but could underpin a financial windfall for some others.

As Donald Trump inflames the diversity, equity and inclusion debate in the US, super funds here reiterated their support for DEI reporting by ASX-listed companies.

Major retailers were responsible for the Aussie sharemarket closing just shy of a record high – with the dollar also climbing to a new peak.

US shares consistently beat ours for value and under newly installed President Donald Trump there are indications the pattern will accelerate.

Australian shares track US gains. Wesfarmers soars on upgrade. Goodman reverses intraday gain. Monadelphous, Synlait jump on updates but Kogan dives. Trump China comments lift stocks, $A. IGO creeps up despite hammer blow dealt to lithium plant.

The Aussie sharemarket has snapped a three-day winning streak as consumer-facing stocks and an “unloved” mining sector drag the index lower.

ASX is at risk of new enforcement action or further licence conditions over a damaging settlement outage caused by a decade-old systems error.

ASX down after most US stocks fell. Department store chain, Premier shareholders show huge support for merger. Bain boosts Insignia offer to $4.60 per share. Evolution drops on downgrades. Fortescue ships record amount of iron ore.

Australian sharemarket firmed on Wednesday, as Donald Trump helped the strong performance by Australia’s tech sector and uranium shares.

The secret behind the steady exit of local investors from the Australian sharemarket is not so much the attraction of Wall Street, but the poor value offered by the ASX.

Australia’s subdued market for new stock market listings faces an uncertain outlook, with the federal election potentially delaying new IP0s in the first half.

The ASX rises 0.3 per cent to a seven-week highs on positive US leads. Qantas shares soar on US peer gains. CBA, Goodman, NAB, Westpac, WiseTech top contributors. Paladin soars as operations improve. Iluka drops on estimates miss.

The Aussie sharemarket closed up on a strong day of trading, as investors factor in the new US President and how his proposed tariffs will impact the market.

ASX backs away from six-week high on Trump’s tariff threat against Canada, Mexico but still ends strong. Financials lead as Macquarie upgrades ANZ, NAB. Liontown, HUB24 soar on updates. Wesfarmers winds down Catch. Billions coming in insurance sector buybacks: MS.

The Aussie sharemarket started the week on a high in a broad market rally, largely due to Donald Trump being sworn in as the next US President.

Local bourse rides US gains after ‘very good’ talk between Donald Trump and Xi Jinping before US inauguration. Star warns of ‘material uncertainty’ over ability to continue as going concern after cash flow update. CC Capital gets edge over bidding rival Bain for Insignia.

The sharemarket is expected to rise on Monday but the rest of the week could be volatile as markets wait to see incoming president Donald Trump’s executive orders.

The ASX is set to finally provide aggrieved customers with an explanation for the damaging and chaotic outage that occurred in the days just prior to Christmas.

Original URL: https://www.theaustralian.com.au/topics/asx/page/2