Stick with tax cuts and budget surplus, John Howard and Peter Costello urge Albanese government

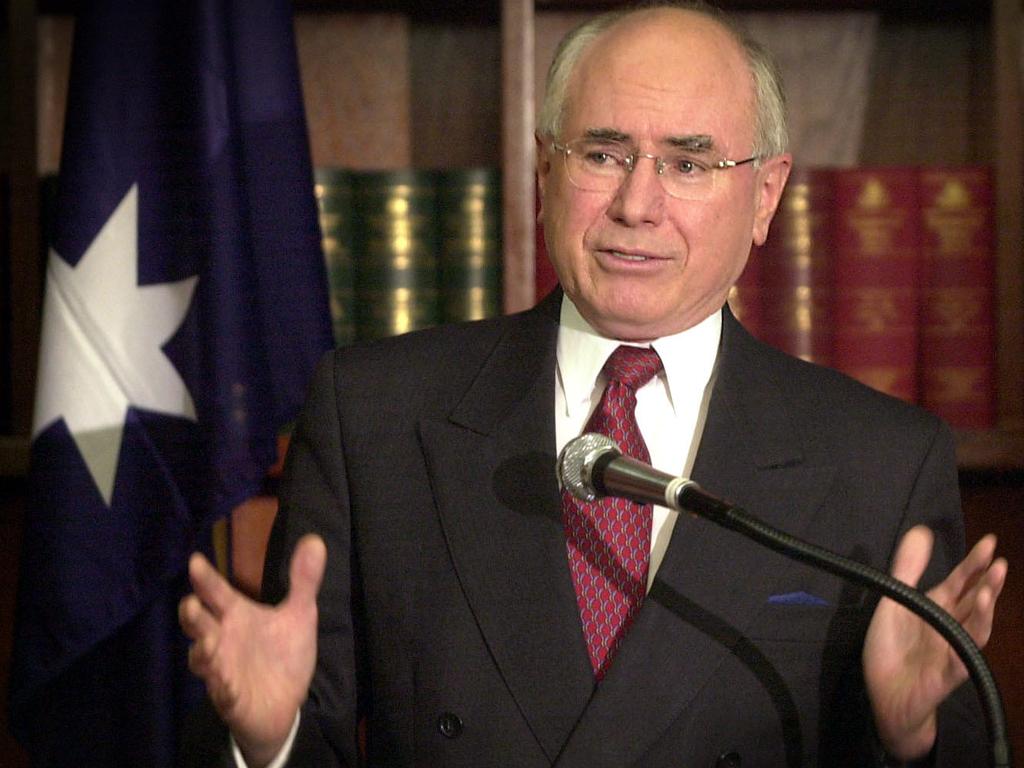

John Howard and Peter Costello have urged the Albanese government to ignore left-wing pressure on stage three tax cuts, warning taxpayers will be worse off than 20 years ago.

John Howard and Peter Costello have urged the Albanese government to ignore left-wing pressure to repeal or amend the stage three tax cuts, warning bracket creep has “stolen” income from an Australian middle class that will be worse off on July 1 than they were 20 years ago.

The exclusive interviews with the former prime minister and treasurer coincide with the release of cabinet papers from 2003 by the National Archives of Australia, with issues such as the Iraq war, climate change, trade with the US and China, taxation, immigration, Medicare and the resignation of governor-general Peter Hollingworth notable in the records.

Mr Howard and Mr Costello also told The Australian they would be open to increasing the GST if the revenue was used to reduce other inefficient taxes such as state payroll or stamp duties, or used to provide further income tax relief.

The Coalition elders, who in 2003 were seven years in to their almost 12 years in power, have also encouraged Labor to maintain the budget surplus to retire debt rather than spend it.

Mr Howard told The Australian that change to the stage three income tax cuts – due to come into effect in the middle of this year – following pressure from some Labor MPs, the Greens and left-wing unions and think tanks, could hurt many people who are not rich.

“We have a lot of people who aren’t in any sense, shape or form wealthy and paying a high rate of tax at the margin – and it will get worse if you get rid of stage three,” Mr Howard said.

“You still have to find a way of getting more money from indirect tax and give yourself greater freedom on the direct side. And the trade-off has to be lower income tax.”

Asked if he supported keeping the former Coalition’s stage three tax cuts, Mr Costello said: “Yes, I do, because bracket creep has stolen large additional taxation from the middle class. And even with the stage three, they are getting nowhere near back to the position they were in 20 years ago.”

The stage 3 tax cuts will abolish the 37 per cent marginal tax rate and lower the 32.5 per cent marginal tax rate to 30 per cent.

The taxable income threshold for the 45 per cent marginal rate will also be lifted from $180,000 to $200,000 – creating a flat 30 per cent rate on income between $45,000 and $200,000.

Under the changes, 94 per cent of taxpayers will face a marginal tax rate of 30 per cent or less. Australians are paying on average 30 per cent more income tax per person than a decade ago, even after accounting for inflation, confirming a long-term trend towards workers having to bear more of the burden to fund bigger government.

As the Prime Minister and Jim Chalmers grapple with the worst inflationary crisis in a generation, Mr Costello said income tax cuts would not be inflationary if coupled with continued fiscal consolidation and debt reduction in addition to tight monetary policy settings.

“My argument is we should be taking out inflationary impetus on the expenditure side and then we wouldn’t need as much tax,” the former treasurer said.

“If we do it on the tax side, it will heighten work incentives and enable productivity. If we just increase expenditure and therefore have taxes chasing them up, you’ll become a lower-productivity economy.”

Mr Howard said maintaining the budget surplus should be a continuing priority alongside an agenda for reform that included lower taxation and industrial relations that provided for flexibility rather than increasing union power, geared towards turbocharging declining productivity.

“There is a sense of artificiality about the bottom line because for the only occasion in my lifetime, the government intervened to contract the economy and then intervened to inflate it to save it from recession,” the former prime minister told The Australian.

“The government should, generally speaking, try and conserve the surplus because if it provides a little bit more ballast to the bottom line, that’s good. The best way to fight inflation is the orthodox way and that is to have a reasonably tight monetary policy working together with fiscal policy.”

Mr Costello, who delivered 10 budget surpluses and paid off $96bn in government debt, said successive governments had not made fiscal repair and debt reduction the priority they needed to, and the nation’s balance sheet should be much stronger given favourable terms of trade, noting the iron ore price was 10 times higher than it was in 2003.

“If the current government still had the policy of balancing the budget over the course of the economic cycle, it would be running very substantial surpluses now,” Mr Costello, the longest-serving treasurer, told The Australian. “Why? Because we’re in a terms of trade boom. Now is the time to run very substantial surpluses to try and pay back the borrowings of Covid and even the borrowings of the financial crisis. So, the fiscal objective now is much weaker than it used to be – and it’s been deliberately weakened.

“The surplus should be of such dimension now as would enable us to start paying back the accrued debt. It’s not enough to break even. In the greatest terms of trade Australia has ever had, we should be doing better than a balanced budget. We should be running surpluses of 2-3 per cent of GDP.”

The decision to join the US-led invasion of Iraq for the purposes of disarming it of weapons of mass destruction, even though no weapons were subsequently found, was the most significant issue handled by the Howard government in 2003. Mr Howard, however, stood by the decision to deploy the ADF.

“We were victims of the inevitable errors that will arise in any intelligence distillation,” the former prime minister reflected.

“I, like so many other people, was surprised, disappointed, and not a little angry when it transpired that there weren’t stockpiles. I just kept thinking as the months went by that we would find them. We didn’t.”

The Australian can reveal there was no written submission on the costs, benefits and implications presented to the full cabinet that authorised the deployment of forces, with key briefings and deliberations taking place in the national security committee.

However, no records from the NSC about the decision have been released.

Among the other issues on the government’s agenda in 2003 was a long-term climate change and energy policy, including a recommendation from Mr Costello, Alexander Downer, David Kemp and Joe Hockey to establish a mandatory emissions trading scheme that was rejected by cabinet after Mr Howard consulted with industry.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout