How CBA stays ahead of the pack

The nation’s biggest bank beats up its rivals once more yet nobody likes the stock.

The nation’s biggest bank beats up its rivals once more yet nobody likes the stock.

Shayne Elliott says households are in ‘unbelievable good shape’ but Australia must be wary of resting on its ‘lucky country’ status.

After handing down a double-digit rise in annual profit, the kids products retailer plans to expand its exclusive label offering.

For the first time, Transurban’s Lindsay Maxsted and Scott Charlton speak about the March 2020 meeting that could have blown up the company’s business model.

The former Crown Resorts chairman says the record should reflect she stayed the course to line the casino giant up for success. But her former colleagues are divided on her image restoration plans.

Analysts say Resmed has an ‘uncontested sales opportunity’ of $US600m from rival Philips’s prolonged absence from the sleep apnoea device market.

The Australian chief executive of snack and drinks giant PepsiCo has called on the government to provide more certainty about its assistance plans for local manufacturing.

The owner of the Ladbrokes and Neds brands had a good first six months of 2022. It wants to win more market share in Australia and might be on the verge of some big deals.

Two factors underpin Mirvac’s robust results on Thursday, as rising interest rates bite and rising construction costs send some developers to the wall.

Santos has bought the Hunter Gas Pipeline as it seeks to develop a new $1.2bn route for its long stalled Narrabri project in NSW.

One of Australia’s most senior bankers has a clear message to smaller businesses as he warns of loan defaults, particularly in the construction and retail sectors.

Unusually for the telco, this is shaping up as another smooth CEO transition.

The Commonwealth Bank’s chief executive says some rivals are chasing riskier, unprofitable loans.

Commonwealth Bank CEO Matt Comyn says a potential ‘wage-price spiral’ poses real risks to the economy, as he also cautioned on the delayed transmission of rapid rate hikes.

The boss of online beauty retailer Adore Beauty has quit to join IDP Education and leaves behind her a company with a slumping share price and slowing sales growth.

A bumper crop combined with tight supply following Russia’s invasion of Ukraine has sparked GrainCorp’s second profit upgrade this year, sending its shares soaring.

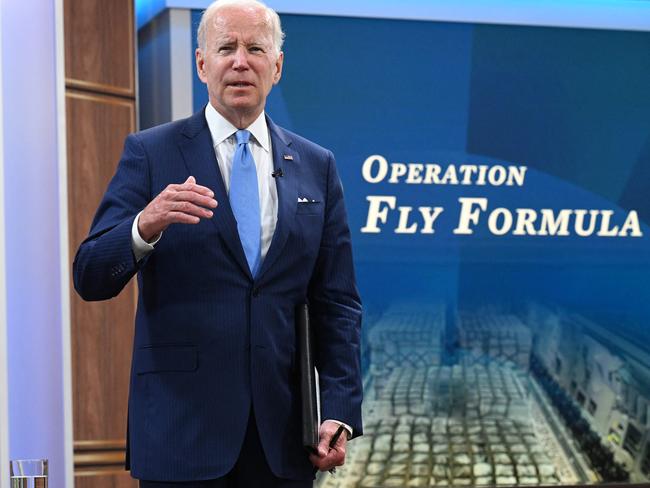

Plans by NZ suppliers to crack the mass US infant formula market and smash a decades-old oligopoly have been halted by yet more approval delays.

Treasury Wine Estates scores a win against Chinese-Australian company Rush Rich, which it alleges has been copycatting its Penfolds wine in China.

Despite some pullback in prices, property is rolling with economic hits. But it all depends on one key number.

NBN Co chief Stephen Rue says it was set up to bring social equality to Australia through digital access, but he knows it needs to make a profit.

Australian Dairy Nutritionals will shut its fresh milk processing plant in Victoria as inflation hits the small cap company.

The biotech says it will survive the costly path to producing its lead medicine as it once again secures capital from large shareholders.

The energy giant has also brought on APA Group and Jemena as it develops the Liddell and Bayswater power station sites alongside Fortescue Future Industries.

BHP is trying to draw a line under past habits of overspending but its own growth options in copper are limited.

The billionaire’s Premier Investments now owns 22.87 per cent, but will he launch a takeover or demand board seats?

It may be an embarrassing issue for the Victorian government, but investors in the diagnostics company have cheered its decision to no longer build a rapid antigen test factory in Melbourne.

The dairy producer has been in discussions with supermarkets for months as it seeks to recover a 30 per cent hike in its own costs.

The bank will book lumpy expenses in the latter half of the fiscal year that will be roughly offset by a gain on selling a stake, as it gears up to report an annual $9.3bn profit.

ASIC’s funding model, which raised $1.51bn last year, will be reviewed five years after it was rolled out.

The results are the latest from the big four firms to show impressive bounce back from the negative impact of the initial Covid-19 years.

Original URL: https://www.theaustralian.com.au/business/companies/page/198